📚 Simple Wealth, Inevitable Wealth by Nick Murray

🎯 Read This Book If

You want to understand what makes investors successful over the long-term, and how a Financial Advisor can play a pivotal role in that success.

🔑 Key Points

Investing is equities is the only solution to building and preserving wealth, over a long enough period, it becomes simple and inevitable.

Investor behaviour is much more important than investment returns when building wealth.

A Financial Advisor can play a huge role in setting you up for success, and reinforcing behaviour that will benefit your success.

🤔 Main Ideas

This is a book for seekers of wealth, so they may learn everything I know without having to make my mistakes. Simplicity, is the ultimate sophistication. I believe that:

If wealth is your goal, stocks are the only answer because they're the only financial asset that has any net return.

Most investors will get much better returns from owning portfolios of stocks rather than selecting individual stocks on their own.

Most investors will achieve far superior lifetime results working with a caring, competent and trusted financial advisor.

The key to "outperforming" most other people is simply behaving more appropriately than they do. To an extend that may astonish you, exceptional results in investing proceed from avoiding a few awful, but common, mistakes.

Take a moment to look the cover of this book. It's a tree. You plant it in the earth, and a wonderful force of nature causes it to take root, and grow. You don't have to do much with it: the air, water, and nutrients are all around the tree, and it knows how to use them.

You don't dig it up every 90 days to check on its progress. You don't uproot the tree and store it in your garage over the winter, to protect it from what you regard as "bad weather".

Give the tree enough room, light and time. Then leave it alone. It will give you back air and shade and beauty as it grows – and will go on doing so for your children, after you're gone.

That's what investing is like – if you let it be.

Foreward

Wealth is freedom.

When your investments provide you sufficient income to live a full and joyful life, then you are truly wealthy – because you are truly free.

It is simple to accumulate wealth through patient, discipline investment in equity funds – those which invest primarily if not exclusively in common stocks. If history is any guide – and it's the only guide we have – provided that you will give your equity investment plan both enough time and enough money, wealth is ultimately inevitable.

Wealth is much less a function of what you know than of what you do. There is no miracle cure, no shortcut to wealth in equities. Knowing what to do, starts which having a financial plan.

In the great scheme of things, fund selection just isn't that important. No one is ever going to achieve wealth, or fail to achieve it, because of which particular equity fund they owned. One can buy top-rated funds, and yet lose money if one's own behaviour is sufficiently inappropriate. The opposite is also true.

A huge percentage of your total lifetime return will be attributable to the simple decision to be an owner and not a loaner – to be a stock investor rather than a bond investor. Most of the rest of your real-life return will depend not on how your stock funds perform versus their peers, but on how you behave yourself.

Wealth isn't primarily determined by investment performance, but by investor behaviour.

Investors who correctly realize that their own behaviour is the decisive variable in their long-term results feel very much in control of their own destinies.

The stakes are too high; the road is too long and often very dark. Remember: it's simple, but it sure isn't easy.

What Your Financial Advisor Can Do For You, and What He Can't

I know two truths, and believe that they're decisive. First, there is a qualified, caring, committed financial advisor for you. Second, the value of that advisor to you and your family, will greatly exceed the cost of the advice.

There are three key areas in which a professional advisor can add significant value to your probable do-it-yourself outcome:

They may increase your return by more than 1% a year by creating a portfolio which is better suited to your long-term goals than the one you'd select, left to your own resources.

They may save you the equivalent of 1% a year in time, energy and worry that go into managing your own investments.

They may save you some multiple of 1% a year, by coaching you out of making the great behavioural mistakes.

Now, for what an advisor can't do:

An advisor cannot, with any consistency or precision, forecast the economy. No one can.

They cannot, with any consistency or precision, forecast the markets, much less time them. No one can.

They cannot, based on their past relative performance, forecast the future relative performance of similar mutual funds or other equity portfolios. No one can.

The great advisors deal not in prediction and "performance", but in planning, perspective and behavioural coaching.

They will assure you that the dominant determinant of long-term, real life investment outcomes is not the performance of investments but the behaviour of investors.

They will begin by learning everything they can about your hopes, dream, goals and financial situation. Then and only then, they will build a portfolio, based not on an economic or market outlook – which they won't have – but on the dictates of the plan.

What your advisor owes you is their full attention when they're dealing with you, a keen interest in helping you reach your financial goals, a proper respect for your fears and concerns, and the patience to explain solutions to you in language you can understand. What you owe your advisor is faith in their judgement – particularly when their faith in the future seems so at odds with current events.

Of just such mutual respect and trust is enduring wealth built.

An Owner, Not a Loaner

Nearly everyone you've ever known about who achieved lasting financial independence owned a business, or was a manager and/or stockholder in a business.

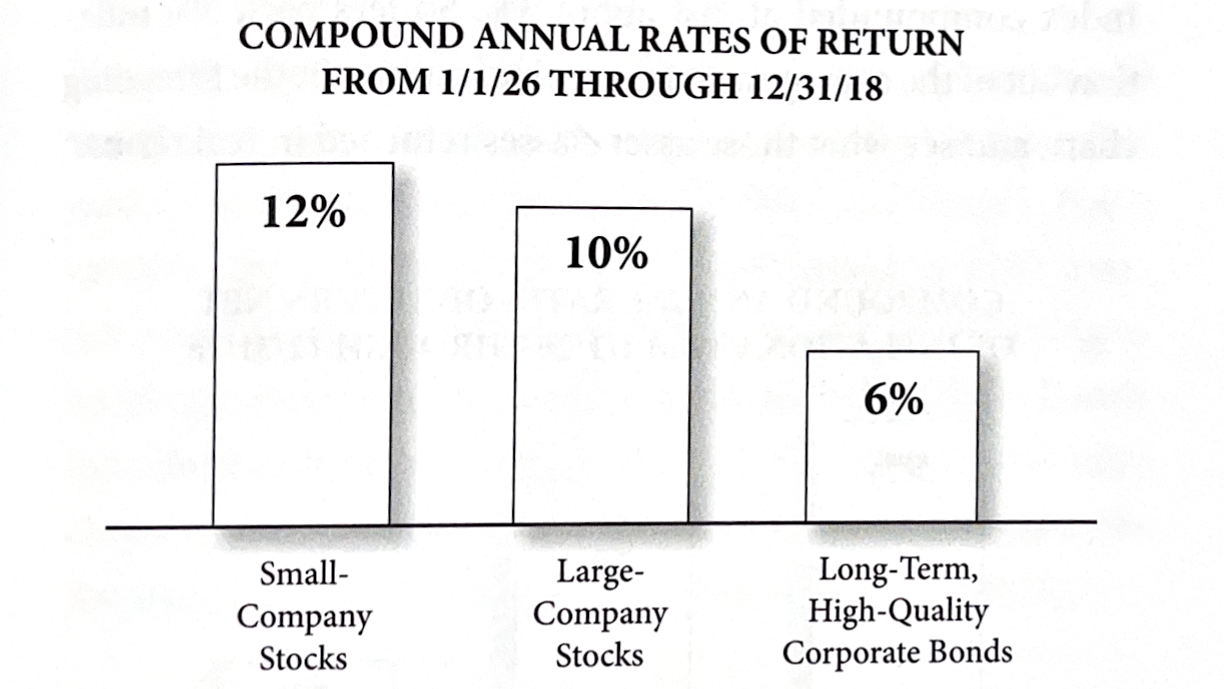

We know in concept that the lender to a business – the bondholder – doesn't take much risk and doesn't get much return. We know, too, that the owner of the business – the stockholder – takes more risk than the lender and gets more return.

Think of owning a house. The lender (bondholder) of a mortgage takes their profit through interest on the loan. Whereas the homeowner (stockholder) captures all of the appreciation of their home. The lender may make a good loan and earn a good amount of profit, but they homeowners profit can be many multiples of the lender.

This matters. We can see that historically, being an owner results in returns just less than double that of being a loaner.

But when we factor in inflation, that difference grows to more than double. When you start compounding that equity premium for long periods of time, the dollar difference it makes quickly becomes pretty staggering.

Whatever the equity premium turns out to be in the future, to the extent that logic and history tell me that the stockholder will continue to earn some multiple of the bondholder's real return.

What the Real Risk Isn't

The single biggest reason that people fail to achieve wealth in equities is that they never really understand risk.

Misperception of risk actually takes two distinct forms. First, people greatly overestimate the long-term risk of owning stocks. Second, people seriously underestimate the long-term risk of not owning stocks.

While stocks are much more volatile than bonds – sometimes horrifically so – the passage of time leaches the risk out of stocks. Moreover, volatility isn't risk, and volatility passes away, while the premium returns of stocks remain.

In this book, "long-term" really means five years and longer. Stocks are too volatile over shorter periods for you to be certain of reaching near-term goals. This is not to say you can't earn superior returns in stocks over periods less than five years. It's simply that you can't rely on such a favourable outcome. The more important your under-five-year goal is, the less you want to put the achievement of that goal at risk.

Timelines mean when you'll need a majority of your funds in your portfolio. A recent retiree could still have a timeline of decades.

The fewer stocks you own, the greater are your opportunities to outperform – and to underperform – the market as a whole. Stocks as an asset class can't go to zero, but an individual stock can, and occasionally does. The principal risk of equities has historically declined, and ultimately disappeared, with the passage of time.

The natural law of a free economy is one of permanent advance punctuated cyclically by temporary decline. A line drawn between the peaks and the valleys of our economic life always has a relentless upward bias. The advance is permanent; the declines are temporary.

It's not what the market is doing, but how you are reacting to what the market is doing.

People who have years and years of investing yet to do – who should welcome a bear market as a sort of fire sale on the quality investments they need to own more of – instead liquidate their equity holdings at panic prices – prices which will never be seen again when the permanent uptrend reasserts itself.

When it comes to investing in general, the intellect isn't in the driver's seat. The emotions are. Specifically, the driving emotion is fear. It is fundamental to human nature that we fear loss much more than we hope for gain.

"Losing money feels twice as bad as making money feels good." – Richard Thaler

Part of the problem, too, is that people have a hard time making the critical distinction between volatility and loss. When markets drop, if the capital isn't going to be withdrawn for at least five years, and if five-year holding periods with dividends reinvested have shown a positive return 87% of the time for well over 90 years, wouldn't you be advised to just ride it out?

The ability to distinguish between temporary volatility and permanent loss is the first casualty of a bear market.

Only people themselves can create permanent loss, that's by selling, of course.

"Fear has a greater grasp on human action than does the impressive weight go historical evidence." – Jeremy J. Siegel

If you do not give in to fear, you probably won't sell. Failing to sell, you will remain fully invested in your equity portfolio for the long run. History teaches that by holding a diversified, high-quality equity portfolio for the long run, you will – simply, inevitably – build real wealth.

The trick isn't to not feel fear, it's simply to have to refuse to act on the feeling. If wealth is the product of successful long-term investing, and if giving in to fear is by far the greatest obstacle to that success, then the highest, best and most valuable function of an advisor is simply in prevailing upon you not to lose faith – not to sell.

Victory over fear in one bear market may strengthen you for the next, but it certainly doesn't vaccinate you to the point of immunity – especially if, next time out, you encounter a bigger bear.

What really happens when fear takes over is that it immediately dragoons the intellect into ginning up a rationalization for the crazy decision that it – fear – dictates.

Time in the market, as opposed to timing the market, is the only practicable way of capturing the long-term return of equities. You have to stay in it to win it.

Buy, and hold, and hold, and hold. That's the only path to wealth for you and for the generations of the family you love.

What the Real Risk Is

The real long-term risk of equities is not owning them. Not owning equities will provide fatal to the achievement of wealth.

The Consumer Price Index, which tracks the change in costs of goods, has risen about 3% annually over the past 90 years. Meaning, that over a 30 year period, the cost of something should increase by nearly 2.5 times. You'll need about $2.45 to purchase what one dollar will buy today.

We don't know how much prices will increase, but our experience and common sense would tells us that things are increasing in price, and over long periods of time, they go up by a lot. A big risk for retirees is running out of money, either by: things becoming more expenses than they thought, or living longer than they thought. Life expectancy increases with each generation, but often people assume a life expectancy closer to their parents than their own.

Culture, is always more psychologically powerful than fact. Words have tremendous power to shape our perception of the world, particularly when everyone around us assigns the same meaning to those words.

On which end of your investing lifetime do you want your insecurity, so that you can have security on the other end?

If your goal is to become wealthy, to increase our purchasing power, then you need growth. In this context, bonds are risky because we expect little growth, and stocks provide safety because over a long period of time it preserves and enhances our purchasing power. This goes against conventional wisdom, and it should. If what everyone believes works, everyone would be wealthy and only get more so.

Although stocks are volatile, they can be viewed as conservative because they most reliably and consistently maintain (and enhance) purchasing power through growth. Bonds, on the other hand can be viewed as aggressive because in order to maintain purchasing power, we'd need to see zero inflation or even deflation. Things that history tells us are highly unlikely.

Yield isn't a good measure of an investments income producing potential, only total return is. Once you start withdrawing from your investments, you want growth to counteract your withdraws. It's better to withdraw from assets whose long-term return is 10% than one whose is 6%.

Behaving Your Way to Wealth

Equities neither make you wealthy or keep you wealthy, that is up to you. Which is good news, because in the end, your own behaviour is the only thing you can really control.

The single most important variable in the quest for equity investment success is also the only variable you ultimately control: your own behaviour.

The four behavioural tactics are:

Setting goals in dollar-specific, date-specific terms.

Establishing a plan for achieving those goals, assuming a specific rate (or rates) of return.

Investing the same dollar amounts at regular intervals, so as to harness the power of dollar-cost-averaging.

Meeting your retirement income needs via systematic withdrawal from your equity fund portfolio.

These behaviours are simple, but they are far from easy. If they were easy, we'd all be wealthy. It's okay to feel fear, it's just not okay to act on the feeling.

It is irrational in the extreme for someone who is not finished buying yet to want the market to go up.

The right time to buy equities is always when you have the money. The right time to sell them is when (and if) you need the money. Otherwise. . . just let them grow. Put your time and energy into the variables you can control, and you will – simply, inevitably – achieve and preserve wealth.

Getting Diversified, Staying Diversified, and Steering Clear of the Big Mistake

Three essential ideas to building wealth are: faith (in the future, and in equities), patience, and discipline. A postcard summary up to this point would say:

Dalbar's Quantitative Analysis of Investor Behaviour studies consistently find that the average fund investor's return lagged that of the average fund by upwards of 40%. "Bad" portfolio selection didn't create this gap; "good" portfolio selection won't solve it.

The gap if from the investor making The Big Mistake: a critical behavioural error from which their returns can never recover. If you can achieve wealth in equities by behaving appropriately, you can build on that to achieve extraordinary returns by failing to behave inappropriately.

Funds work so well because most people are somewhat less likely to get their egos and identities tangled up in them, than a particular stock.

Since we don't know the winners of investing, you maximize your chances of accumulating a significant position in them by: diversifying across a number of different sectors, and dollar-cost averaging by investing the same amount in each sector every month.

Broad equity diversification can capture the long-term returns of different sectors. And it will usually suppress to some extent the overall volatility of your portfolio, since all your sectors won't normally be soaring or cratering in unison.

The battle of passive vs active management, is irrelevant because it cannot possible matter. 90% of your lifetime returns will be governed by the beliefs and behaviours already discussed.

Putting a lot of energy into the issue of passive vs action management will be akin to rearranging the deck chairs on the Titanic.

What's important is to be appropriately investing for your goals and risk tolerance. To not chase hot short-term performing stocks or funds. And to behave in alignment with a long-term view. Nothing will be the rarest and the most valuable thing you can do.

"All of us would be better investor, if we just made fewer decisions." – Daniel Kahneman

Here are the Eight Great Mistakes you'll need to avoid:

Overdiversification: owning nothing by owning bits and pieces of everything.

Underdiversification: the fatal narrowing of a portfolio down to essentially one idea.

Euphoria: the loss of an adult sense of principal risk, out of fear that everyone else is getting richer than you.

Panic: the failure of faith in the face of the apocalypse du jour.

Speculating when you think you're still investing: the siren song of a "new era," and of chasing hot price trends instead of digging to find intrinsic value.

Investing for yield instead of for total return: suicide on the instalment plan, by fixing one's retirement income in contemplation of three decades of rising living costs.

Letting your cost basis dictate your investment decisions: asking your investments to behave differently just because of what you paid for them.

Leverage: mortgaging the ranch to buy the wrong idea at the wrong time.

🧠 Final Thoughts

Through his own experience as a Financial Advisor, and the decades of experience that came along with it, Nick Murray has been able to capture what he believes leads to investor success, and captures it in Simple Wealth, Inevitable Wealth.

Success comes down to redefining foundational terms like: risk, safety, conservative and aggressive. Reevaluating the relationship stocks and bonds have with those terms. Investing in a way that sets yourself up for the most long-term success. And that success is much more about investor behaviour than investment performance.

He also believes that the biggest value add from a Financial Advisor comes in the form of behavioural coaching. Establishing good habits, avoiding The Big Mistake, and maintaining a position that ultimately leads to wealth for not only yourself, but for generations to come.

❤️ Liked This? Check These Out

Making Money Simple by Peter Lazaroff, the complete guide to getting your financial house in order and keeping it that way forever

The Psychology of Money by Morgan Housel, timeless lessons of wealth, greed, and happiness

Same As Ever by Morgan Housel, a guide to what never changes

All ideas, quotes, and illustrations are borrowed or based on Simple Wealth, Inevitable Wealth by Nick Murray. To learn more, visit nickmurray.com.