Everything You Need to Know About Mortgages

When I bought my house in 2015, I was like most people when it came to my mortgage: I was looking for the lowest interest rate. That’s all I thought was important about mortgages. But having gone through the process of buying a house, renewing my mortgage, and now a licensed Mortgage Broker and Certified Financial Planner, I know that there’s a lot more to mortgages than just the rate. It’s amazing to realize how little you know, once you start to learn about it.

My hope of this article is to combine the best of what I know and have experienced, into an easy to read and informative article. Whether you’re thinking of buying a home, or are currently a home owner, I believe there’s value here for you.

Key Takeaways:

- A mortgage is a loan specifically for a property, and can have a variety of features – no two mortgages are exactly the same.

- Your ability to get a mortgage depends on things within your control, your: income, debt, savings, credit score, and spending habits.

- Paying off your mortgage early comes down to personal preference, which do you value more: eliminating debt, or building wealth?

Mortgage Fundamentals

Sometimes the most difficult part of the financial world is just understanding the language. Most banks or lender will advertise something like a ‘5 Year Fixed Closed High-Ratio’ mortgage. That might sound like gibberish right now, but let’s break it down and see what it actually means.

Mortgage, Amortization, and Term

A mortgage is just a fancy word for a loan, used specifically to buy a house. Most people don’t have the cash needed to buy a house outright, so we have to borrow. An amortization is the total length of the mortgage loan. In Canada it is typically 25 years, but can be longer (the longer a loan, the more interest you pay). Throughout an amortization, you can lock in rates for a term (specified amount of time), the most common term is 5 years, but can range anywhere from 6 months to 10 years.

So a mortgage is a loan for a house, which is made up of many terms to form its overall length, the amortization.

Interest Rates

The interest rate is the cost of borrowing, it’s what you pay the lender. A fixed rate locks in an interest rate for a term, if interest rates go up or down, it doesn’t impact you. Fixed rates are great for people who don’t like risk, or want stability with their mortgage payments. Variable rates are suited for someone who is willing to take a chance that mortgage rates are going to decrease over the term. Rates fluctuate, and although you want rates to go down when you have a variable rate mortgage, it can also do the opposite.

Open vs Closed

An open mortgage has no early repayment restrictions, meaning you can completely pay off your mortgage anytime. A closed mortgage has restrictions on early repayment, but typically still allows the borrower to repay a percentage of the loan (10% to 20% per year). Closed mortgages usually have slightly lower rates, while still providing early repayment options. For most of us, it would take winning the lottery to even think about paying off our mortgage, and if that's the case, a small penalty will be easy to swallow.

High-Ratio vs Conventional

A high-ratio mortgage means that you’re borrowing more than 80% of the property value, that your downpayment is less than 20%. A conventional mortgage means you’re putting down 20% or more, that you’re borrowing less than 80% of the property value. High-ratio mortgages are slightly more risky for a lender, because the amount you’re borrowing is more.

Because of the extra risk, high-ratio mortgages are required to have CMHC (Canadian Mortgage and Housing Corporation) or an equivalent. The CMHC fee ranges from 2.80% to 4.00% of the loan value, depending on your downpayment. This fee is typically added to the mortgage and paid off over time.

Other Features

A portable mortgage allows you to take that mortgage to a new property. This can be good because lenders will charge penalties if you break a mortgage. An assumable mortgage allows someone else to take it over. This can be advantageous if the interest rate on an existing mortgage is a lot lower than anything available now.

Sometimes a really low rate has the most restrictions, which makes it not worth it. Especially if you can get a much friendlier mortgage for a 0.1% higher rate. Look beyond the rate to understand the features of a mortgage, it could save you a lot of money and headaches down the road.

Preparing to Get Your Mortgage

When you apply for a mortgage, you’re asking a lender to give you a lot of money. A lender will only be willing to do so if they're confident you’ll pay them back. These are things you should be mindful of to help improve your chances of getting a mortgage.

Saving Your Downpayment

As you’re starting to get serious about buying a house, something to really think about is how much you want to spend on a house. Typically borrowers can get approved for around 4 times their annual income, but you don’t have to borrow your maximum amount. It’s not only an important thing to think about because it impacts your budget, but it also sets the mark for your downpayment. In order to buy a house in Canada, you need at least a 5% downpayment.

The way you save for your downpayment can also make a big difference. There are three main ways I see people save for a downpayment: savings account, HBP, and the new FHSA. A savings account offers low returns, but no risk. This is ideal if you're looking to buy sooner than later, and are counting on each dollar you have saved.

The Home Buyers Plan (HBP) lets you take funds out of an RRSP and use them towards the purchase of a home. You can withdraw up to $35,000 per homeowner (up to $70,000), and you have to pay back what you took out over a 15 year period, starting in the second year after you bought your home (or earlier). Since RRSP contributions are tax-deductible, it's a great way to get the most out of your savings.

The new First Home Savings Account (FHSA), is similar to the HBP with a couple of major differences: you gain $8,000 of contribution room each year the account is open (up to $40,000), and you don't have to repay it into an RRSP.

Debt Levels

Lenders look at your debt to income, to help them determine what you can comfortably afford for a mortgage. Having monthly debt payments can limit the amount you can borrow. Paying off debt and freeing up cash flow aren’t just good financial habits, but can make you look more attractive to a lender.

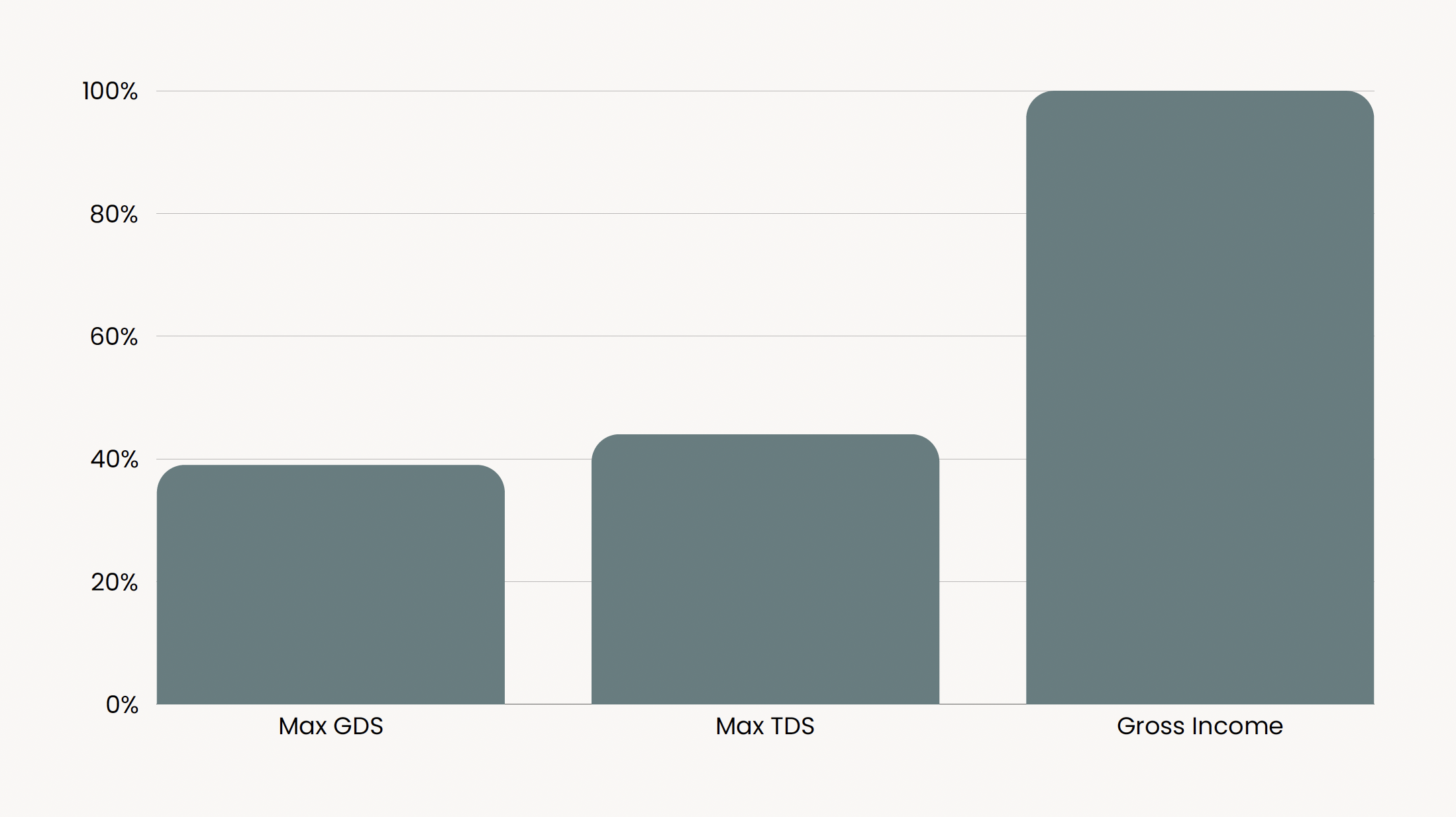

There are two main ratios lenders will look at: Gross Debt Service (GDS) and Total Debt Service (TDS). GDS looks at all bills and debts that are associated with housing, such as: mortgage payment, property taxes, heating, and 50% of condo fees (if applicable). TDS includes GDS plus any other loan payments (credit card, student loans, car payments, other outstanding loans), alimony and child support.

Typically an acceptable GDS is 39% or lower, and TDS is 44% or lower. The debt is compared to your Gross Income (before taxes and deductions).

Credit Score

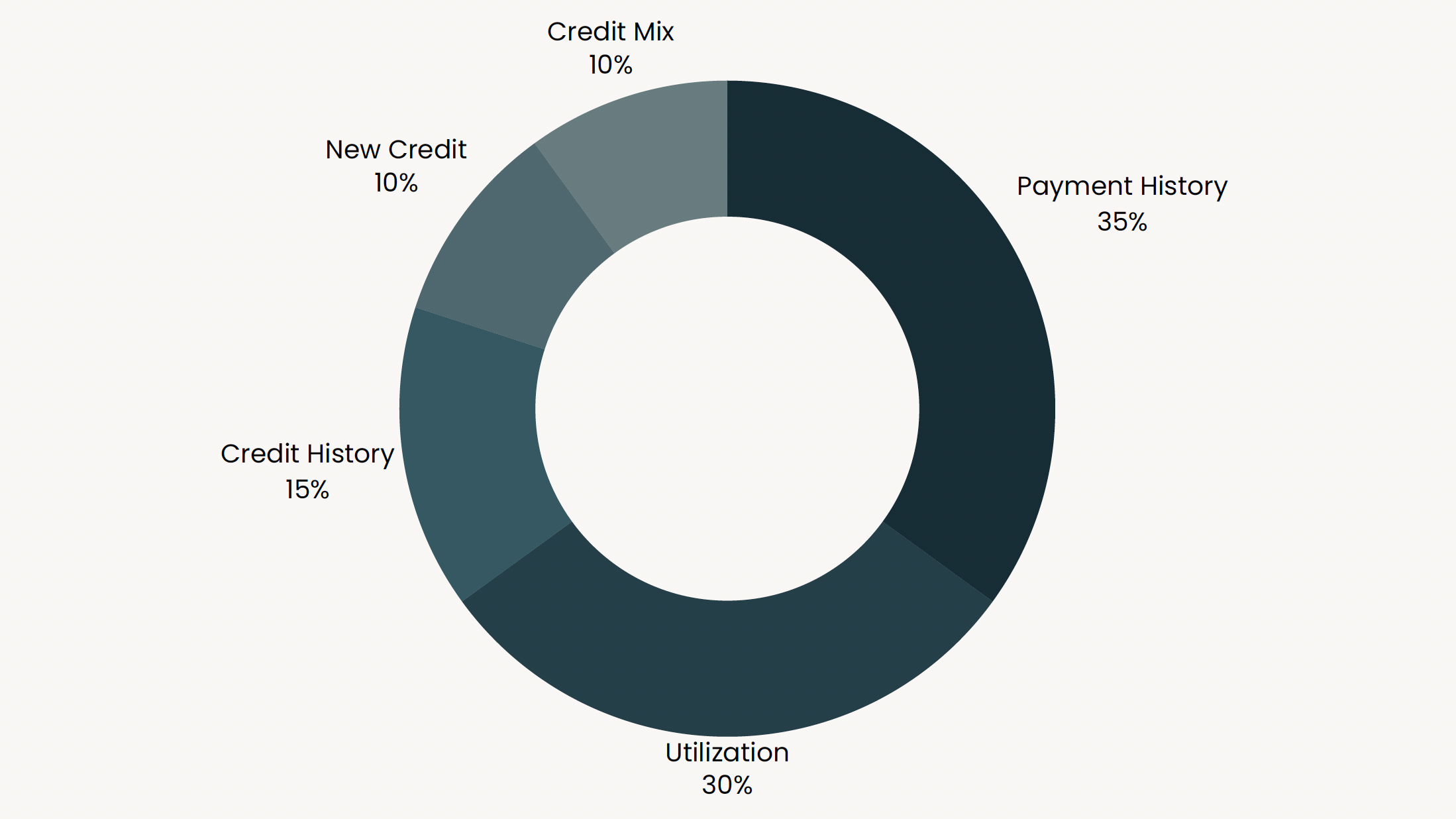

Lenders also look at your credit score, to examine your payment history and identify any red flags. Paying bills on time, utilizing only a portion of the total credit available to you, establishing credit early (even if not used), and having a variety of credit history can help improve your credit score.

If you don’t know your credit score, that’s okay, most people don’t know their exact number. When you get a pre-approval, credit score is something that will be checked. A lower credit score may result in a higher interest rate, or a lower borrowing amount. Good credit is helpful in a lot of scenarios, not just getting a mortgage, so once you do know your credit score, look for a way to improve it.

Closing Fees

In a real estate transaction, the seller pays their realtor and yours. If you’re buying a home, a realtor technically works for you for free. But even though that’s the case, there still are closing costs you have to keep in mind. Things like: appraisal fee, home inspection, land transfer tax, real estate lawyer fees, among other things. A good approach to closing fees is to set aside 1.5% - 3% of the total purchase price to put towards closing costs.

Getting Your Mortgage

Now you know what a mortgage is, and you’re serious about buying a house. You’ve spent some time and hard work saving up your downpayment, paying off debt and improving your credit score. It’s time to get your mortgage.

Documents Required

Even though you’re confident you’re ready for a mortgage, you still have to prove it to possible lenders. Here are some of the more standard documents you’ll need to get approved for your mortgage:

- Photo ID — Drivers license, or passport.

- Letter of Employment — Stating your job title, length of employment and income.

- Recent Pay Stub — Lenders typically only include OT after two years of employment. Otherwise they'll base the income on guaranteed hours.

- Bank Statement — This helps the lender see income and expenses, and the possible source of your downpayment.

- Supporting Tax Documents — Notice of Assessment, T1, and T4/T4A.

These documents are standard, but in some cases more documents or information may be required. It’s important to start your mortgage conversation early, to ensure you have the time to get everything together. Even though the documents are pretty personal, the mortgage industry has a lot of regulations in place to help keep the information of potential borrowers safe, private, and secure from anyone who doesn’t need to see it. If that’s ever a concern, just ask your mortgage professional what they do to keep your information safe.

Pre-Approval and Approval

With mortgages, everyone wants to know one thing: how much house they can buy. As a rough idea for most people, it’s generally 4 times your annual income. But in order to get an exact number and get something official, you need to get pre-approved.

A pre-approval gives you most of the information you’re looking for when it’s time to buy a house. You’ll find out how much a lender will let you borrow, what interest rate you could get, and from there you can get an estimate of what your mortgage payments would be.

If you need a mortgage your pre-approval will be subject to the Bank of Canada’s stress test rate. This rate right now sits at 5.25% or the current rate +2% (whichever is higher). The stress test provides a margin of safety. It tests your ability to continue to make mortgage payments if you have to renew at a higher rate, or if you come into financial difficulty. It might seem like a bad thing, but it’s really meant to help your future self out.

Once you’ve made an offer on a property and it’s been accepted, now it’s time to get your mortgage approval. The approval will contain all of the terms, conditions and features, for a specific property. All of your information, as well as the properties information is reviewed by the lender and your mortgage gets approved.

Broker Over Bank

It’s good to shop around. If you walk into a bank and say “I’d like a mortgage” they'll offer you a mortgage, but it most likely won’t really be the best they can offer, and it might not be the best option you could get if you had looked around.

Mortgage brokers have access to dozens of different lenders. When you go to a mortgage broker, it’s like walking into all the lenders they have access to. It saves you time, and puts you in a position of power. Instead of one lender, you have dozens of lenders competing for your business by offering their very best. If you’re most comfortable working with your bank, I would still shop around and know what the best deals are. It’ll only strengthen your position.

Start Sooner Rather Than Later

House hunting is very exciting. It’s fun to look at houses and imagine yourself living there, the changes you’d make to make it your own, and the life you could have while living there. It’s living your favourite HGTV show.

The last thing you want to be doing while house hunting is scrambling last minute trying to put together documents. Something I would suggest, is starting your pre-approval process sooner than later. It’s common for pre-approvals to last for 120 days (it doesn’t cost you anything, it’s not contractual, so there’s no risk), and if it’s about to expire you can easily renew it. It’s like studying and knowing the material for a test way ahead of time versus only studying the night before. The more preparation you do early, the easier (and less stressful) it will be later on.

You Have A Mortgage — Congrats!

At this point we’ve gone through some fundamentals, preparing to get a mortgage, getting your mortgage, and now you’ve successfully moved into your home.

Other Bills to Consider

Along with your mortgage payments, here are some other bills that might be new to you to keep in mind:

- Property Taxes

- House Insurance

- Life Insurance

- Heating

- Water

- Discretionary Bills (internet, TV, alarm, etc.)

Reviewing your overall budget is a good idea before buying a house. It can give you an idea of how your mortgage payments will work with everything else. If you’re unsure, ask a friend, family member, or a professional, to help give you a better idea of what it might cost.

Renewing and Refinancing

Earlier we talked about mortgage terms and amortization, and we know that an amortization is made up of several mortgage terms.

Near the end of each term your lender will reach out to you about renewing your mortgage. The trick with renewing is being proactive. Humans are naturally a little lazy, and when we get a letter about our mortgage renewal three months, we might ignore it. Then before we know it, our mortgage has to be renewed before the end of the week and we sign whatever is offered to us — even if it isn’t the best deal.

Refinancing/switching is when you’re looking for a new mortgage deal. Maybe interest rates have dropped significantly compared to the rate you have, or you'd like to consolidate debt into your mortgage. Breaking a mortgage will always come with costs, but if the money you’ll save is greater than the penalty, it’s worth taking a closer look and weighing your options.

When going into a renewal or refinancing, know what competitive rates are to make sure you’re getting your best offer. It'd also be good to review the features of your mortgage. Make sure your new mortgage has a great rate, and makes sense for what you imagine you life looking like for that term.

How Mortgage Payments Are Structured

Paying off a mortgage can seem like a pretty daunting task. Not just because the amount of money, but also the length of time it takes to pay it off.

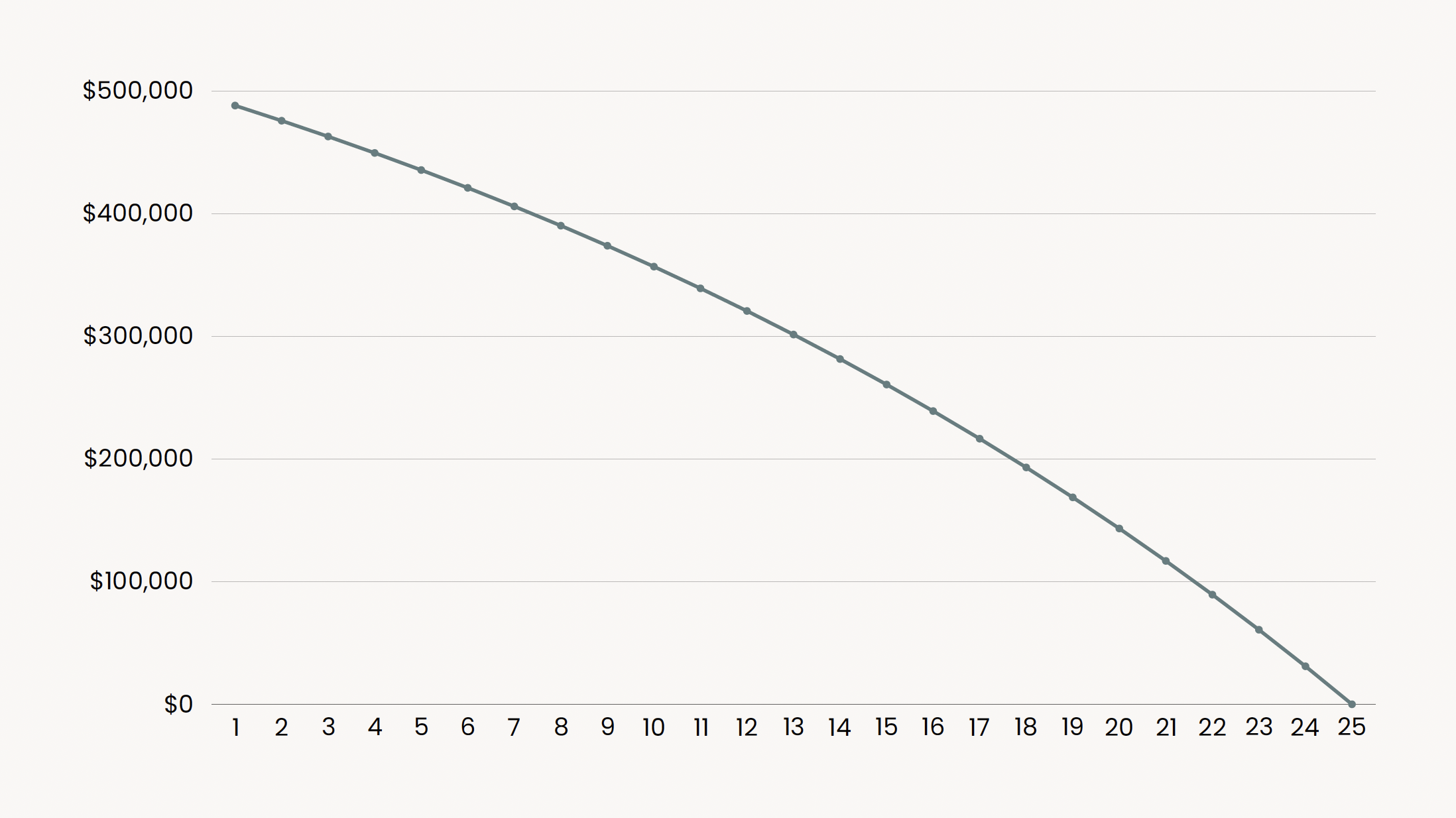

Each mortgage payment is a blend of interest and principal. The interest portion is the cost of borrowing, the principal portion is what you owe.

In the beginning, the payment is weighted more towards interest, and with each payment the weighting shifts ever so slightly towards the principal. So even though your payments don’t change, the amount you pay towards your principal increases over time. Looking at the chart above, in the first year you would pay $11,887 towards the principal, and by the last year it’s $30,997.

Paying Off Your Mortgage Early

The easiest way to pay off your mortgage early, is to round up your mortgage payments. It’s easier to think of expenses as nice round numbers. Instead of viewing your monthly mortgage payment as let’s say $1,273.85, you might just call it $1,300. If you round up and feel like you still have extra money each money, you could look at increasing your regular mortgage payments more, or look at making a lump sum payment.

Those extra payments go straight towards the mortgage principal, and will shorten your amortization period. A shortened amortization saves you money because you have less principal to pay interest on, and it also eventually frees up cashflow because you don’t have a mortgage payment anymore.

Should You Pay Off Your Mortgage Early?

Being debt free is a great feeling, but paying off your mortgage early might not be the best use of your money.

The Case For Paying Off Your Mortgage

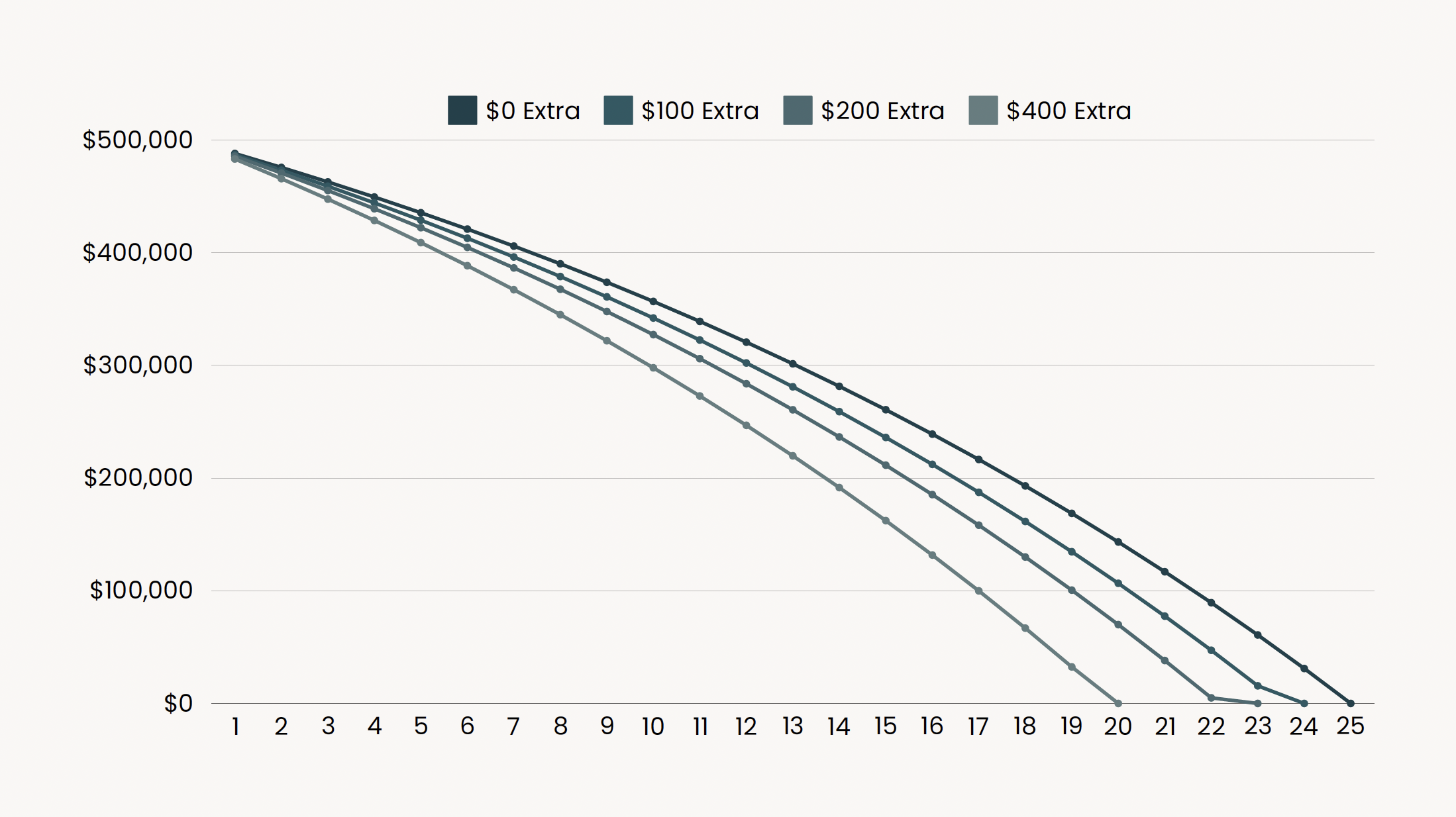

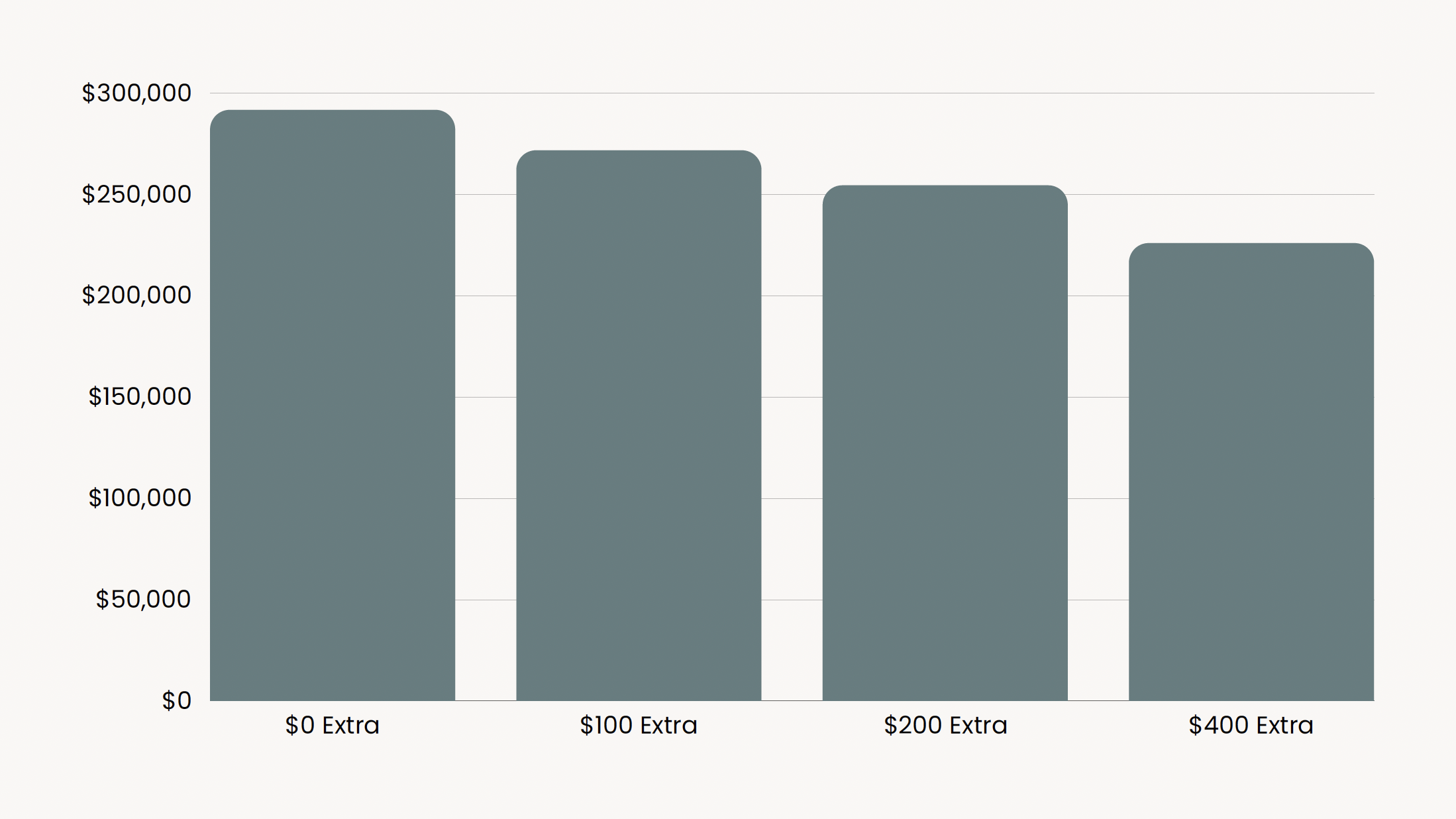

Let’s use the same example we did above, a $500,000 at 4% 25 Year Amortization (for simplicity we’ll assume an interest rate of 4% throughout the amortization). Monthly mortgage payments would be $2,639. Let's look at four scenarios: making the monthly payment, and paying $100, $200 and $400 extra each payment.

Paying the minimum doesn’t change anything. But paying extra shortens the amortization period in every case: $100 = 1.5 years sooner, $200 = 2.8 years sooner, and $400 = 5.1 years sooner. This has two big advantages.

Firstly, it gets you out of mortgage debt sooner. Every month $2,639 goes towards your mortgage, that’s a total of $31,668 a year going towards your mortgage. Once you have it paid off, that money stays in your pocket.

Secondly, it saves you paying interest. Extra payments go straight towards the mortgage principal, resulting in you paying less interest. In our example, extra payments of $100 saves you $19,952 in interest, extra payments of $200 saves you $37,239 in interest, and extra payments of $400 saves you $65,756 in interest.

These extra payments can make a huge difference. Let’s look at extra payments of $400, our most extreme example. By paying off the mortgage sooner, we are freeing up $161,507 (monthly payments of $2,639 X 12 payments a year X 5.1 years). We are also saving ourselves $65,756 in interest payments. For a total of $227,263.

What If You Instead Invest The Money

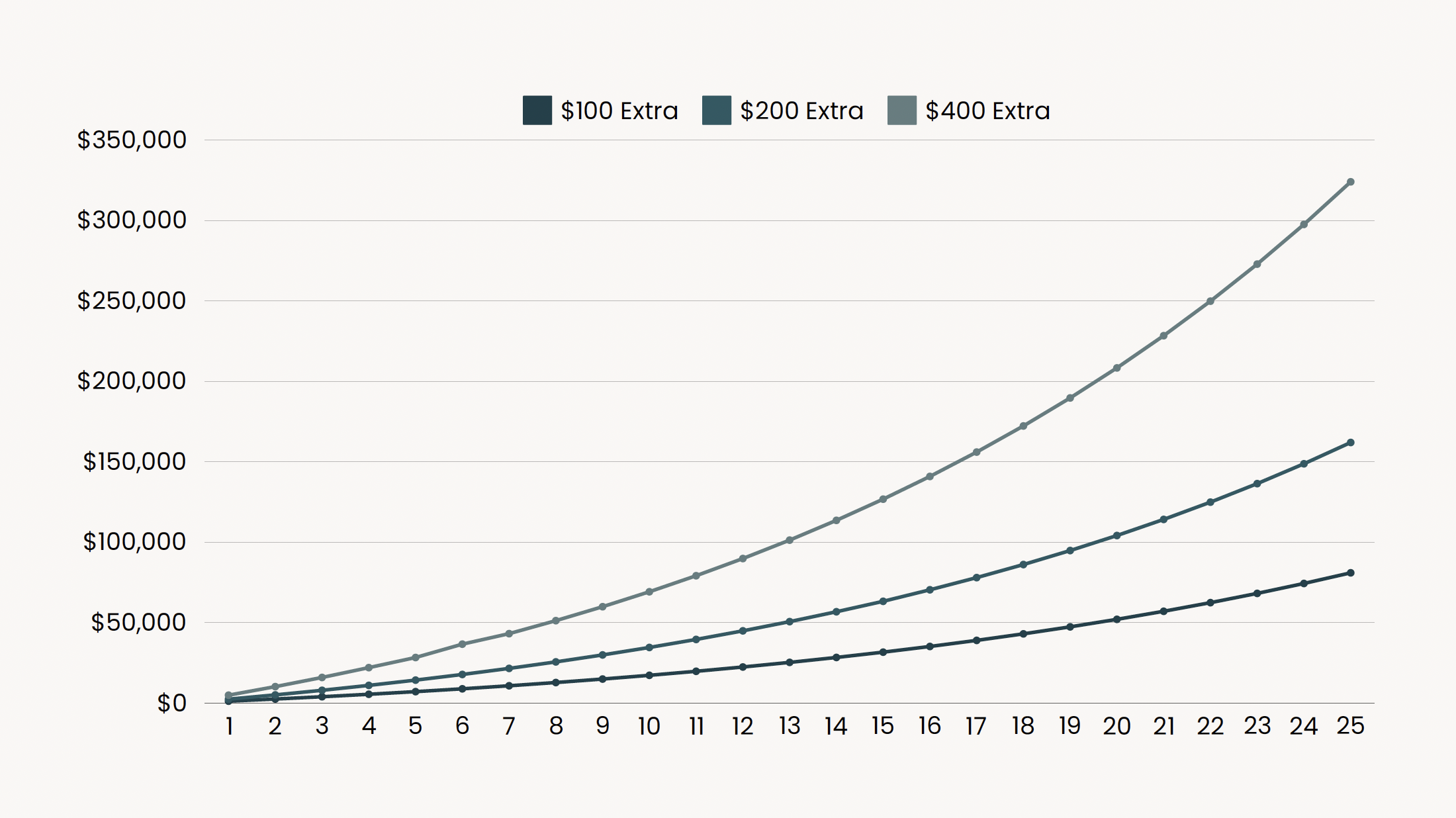

We saw above that by making extra monthly payments of $400, we can save and free up $227,263. That’s a lot of money, almost 1/2 of the total mortgage in the example. But what happens if we invest that money instead?

If you were to invest $400 every month and earn a 7% return, after 25 years your balance should be $324,029. A difference of $96,766. In each case, investing gives us more money after the 25 year period, than paying off our mortgage early would.

What Is Best For You?

Paying off your mortgage early, or investing, is picking between two good things. Both will help increase your net worth, and bring you closer to financial freedom. Looking at the numbers, investing pays off more. If interest rates are higher, than you would end up paying more interest, therefore, paying off your mortgage would have an increased benefit. It comes down to a case by case basis, looking at rates, historical returns for your expected risk tolerance, and your timeline.

Another factor, is personal preference. Some people hate debt, and would rather eliminate it. If you have a time horizon of only a few years, your investments won’t grow substantially. If someone wants to buy an additional property, then focusing on eliminating debt to get their debt-ratios in order makes sense. Others may want to take on risk and keep mortgage debt for the future larger investing return. Taking on debt to then invest with is a pretty popular strategy.

Ultimately, either choice, is a choice in the right direction.

Hopefully now a 5 Year Fixed Closed High-Ratio Mortgage sounds like english, you understand what it means, and can even explain it to someone else. Because this information is very general, it is always recommended to speak to a professional regarding your specific situation, in order to identify and plan for unique circumstances that may impact your experience.

Keep doing things your future self will thank you for.

Member discussion