My Favourite Lessons from Visualize Value

Visualize Value, by Jack Butcher, creates simple but powerful visuals. With over one-million followers across social media accounts, his work is only getting more popular and engaging. Jack has also collaborated with Eric Jorgenson on two books: The Almanack of Naval Ravikant, and The Anthology of Balaji. Both books are must reads, as they dive into the thoughts of incredible thinkers.

Simplicity can leave more room for creativity and self interpretation, being able to see your own values or what you need to see. Although the images are created in a finance focused mindset, I'm sure that everyone could take different lessons away from them. They're specific but relatable in unique ways. Let me know how you interpret the images, or if you have other favourites.

Here are five of my favourite visuals from Visualize Value, in no particular order.

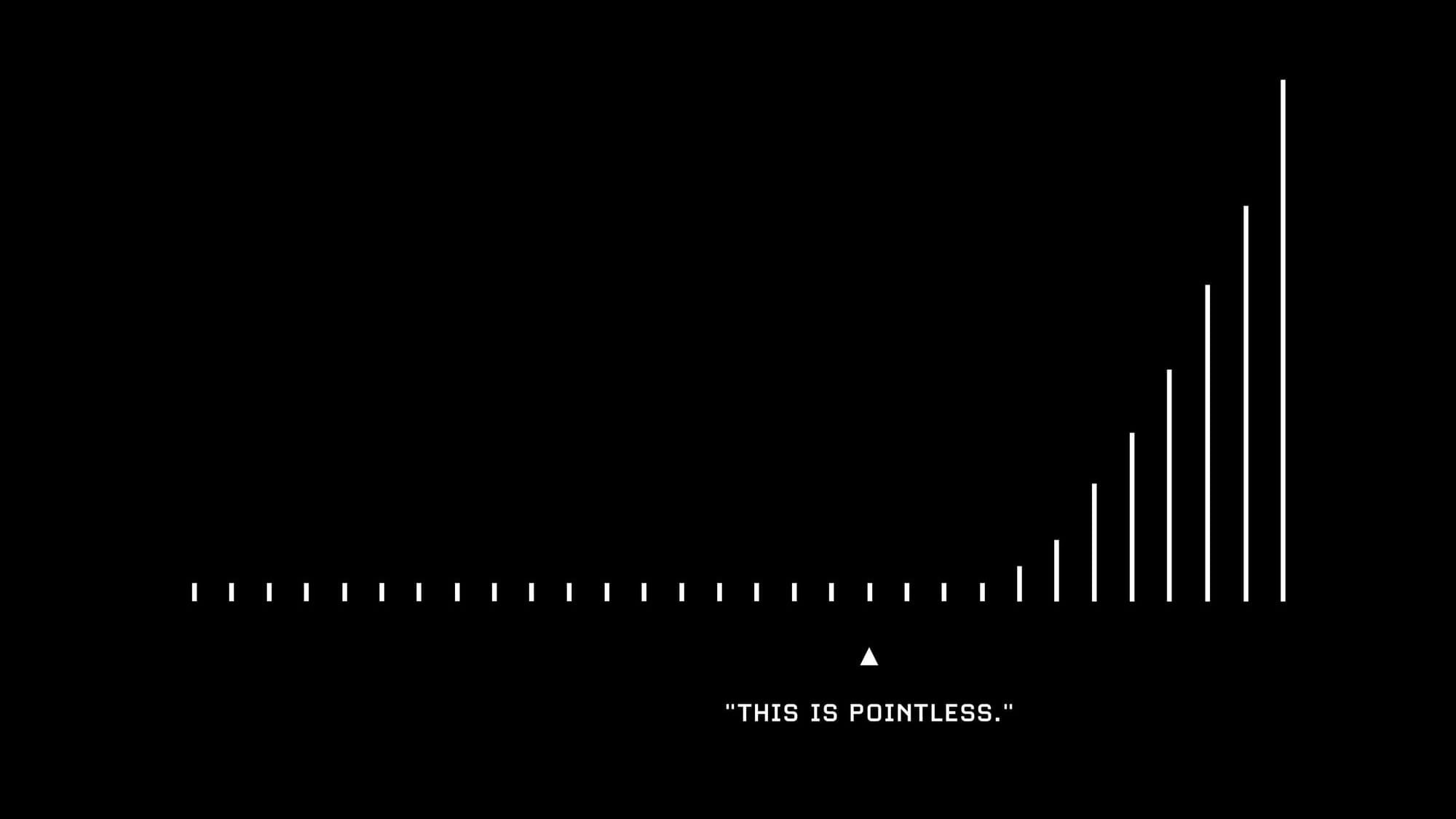

Investing, like so many other things, compound. It's the idea of continuously building on itself. Think about rolling a snowball, with each single rotation, the snowball increases in size. But it doesn't increase at the same rate. Each roll increases what the snowball builds on top of. Even though you're still only doing one roll, the snowball compounds to give you more and more each time.

The secret to compounding is really quite simple, it's time. The longer you allow compounding to work for you, the bigger and better the results become. Nearly 99% of Warren Buffet's net worth has come after his 60th birthday. If instead of continuing to invest, he simply called it quits, to retire at age 60 and live a comfortable life, it's likely no one would really know who he is.

Building something great, takes a long time. But you know what, it's supposed to. If it was easy, there wouldn't really be anything special about it. Compounding works like evolution, they both depend on small changes over a really long time, adding up to something great. Whether it's investing, a habit, or learning, doing it properly requires you to make progress and build on that progress. If you feel stuck or like you're not going anywhere, the progress you're looking for might be right around the corner.

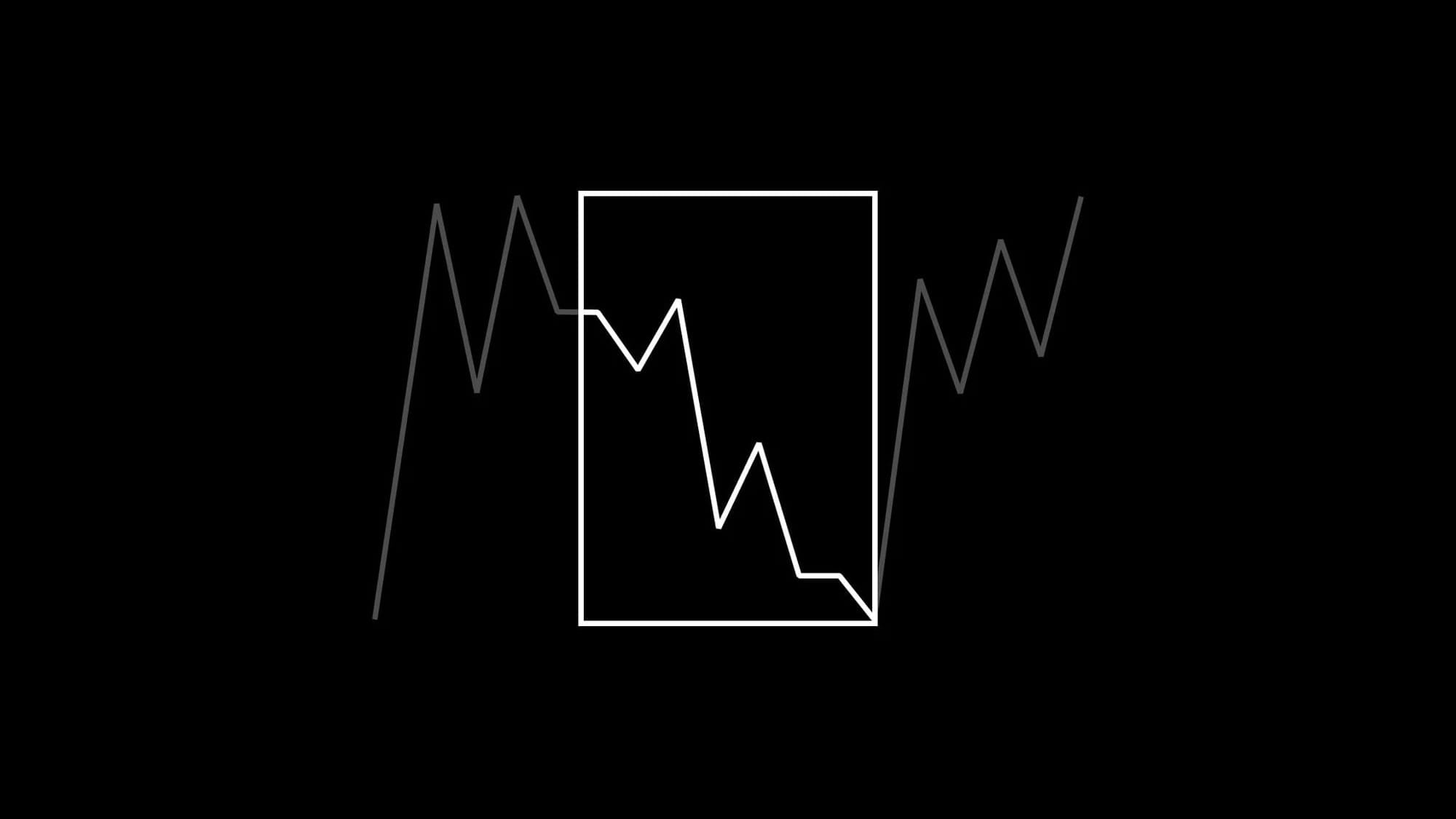

Not only is what we see important, but how we perceive, or frame it. It's easy to get caught up in the moment, and make something happening right now, a bigger deal than it is. Throughout each of our lives, we've been in situations that felt like the end of the world. But look, we're still here.

Taking a step back from what we are experiencing, to assess it in the right size frame, is important. Being too focused on the present or short term, might leave us feeling down. Even if we've made significant progress along the way. One bad day or event isn't enough to wipe out weeks, or months, or years worth of positive progress. If you're viewing something as a negative, take a step back to increase your frame size until it looks like a positive.

Stock markets are down in the short term almost as much as they are up, but the longer our timeline, and the further we stretch our frame, the better the results look. Historically speaking, investing in the S&P 500 for longer than 15 years, has only produced positive returns. That's over a period of time that includes: depressions, world wars, recessions, pandemics, some of the worst of the worst that humanity has faced. Remember to zoom out, take in the big picture, not just a small sliver of time.

One of the easiest ways to prioritize investing, is becoming more connected to your future self. The future you can often feel like a stranger to the current you. It makes sense, think about how much you've changed over the past five years. The past versions of ourselves can look like different people altogether. Now project that same magnitude of change over decades moving forward.

Our day to day is filled with decisions between our current and future self. With your finances, it mostly comes down to spending or saving. Part of what is so difficult, is our brains are wired for the short-term. Something that helped us when we were primitive and threats were everywhere, but now it's something that harms our long term thinking. Everyday we make decisions between what we want now, and what we want most.

Without feeling connected to our future self: what we'll look like, what we'll do, what'll be important to them, it's impossible to set priorities for them. It's guessing priorities for a stranger. If you can take the time to better understand who you want to be and what it will require of you to get there, you will have a better understanding of what you need to prioritize. And when you have a decision between what you want now and what you want most, you can make a more balanced decision.

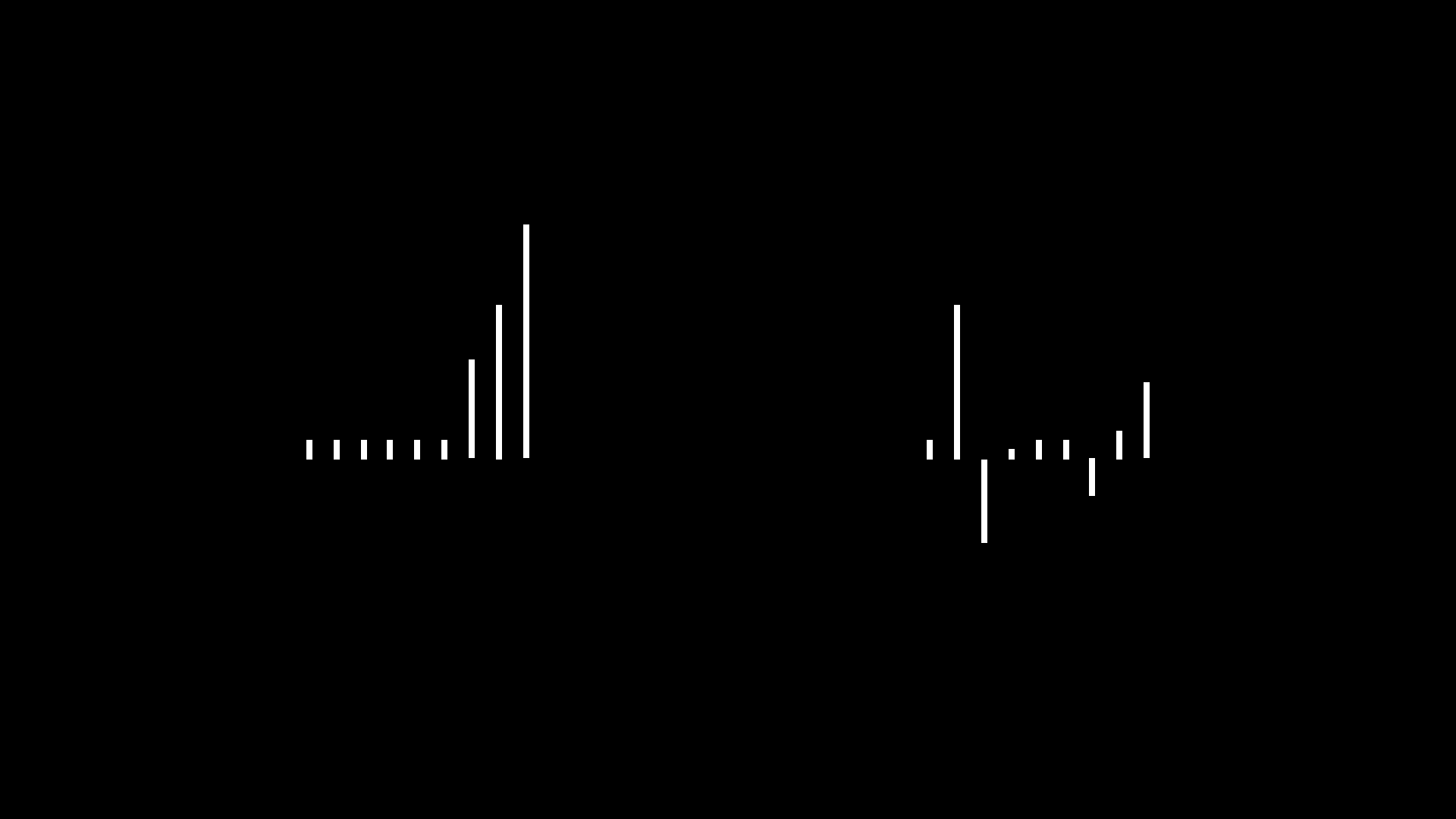

Building a habit can take months, and reaping the benefits of that habit could take even longer. Sometimes, even a lifetime isn't long enough. The same is true with our money. Building requires consistency, discipline, and most importantly: patience. It often takes longer than we think to build. Each day, building on the day before. Comparing day by day the progress looks negligible, but compare months, years or decades, the progress is impossible to ignore.

Betting can offer a shortcut to what we want. A way to take a big risk in order to get a big reward. But the issue is betting is inconsistent. If someone is successful on a bet, was it because: they were right or because they got lucky? In each case there's so many variables, most of which are outside of our control. It's impossible to consistently replicate success through betting, and creates a false sense of success when you win because you could lose it all next time.

Investing success is about doing the little things right, for a very long time. When we talk about doing the little things, focusing on what's within our control, that we can replicate over the longterm, we're talking about building. Calculated effort within our control, that builds towards our goals, the things that we want most. Don't put yourself in the position where you're risking what you have and need, for what you don't have and don't need.

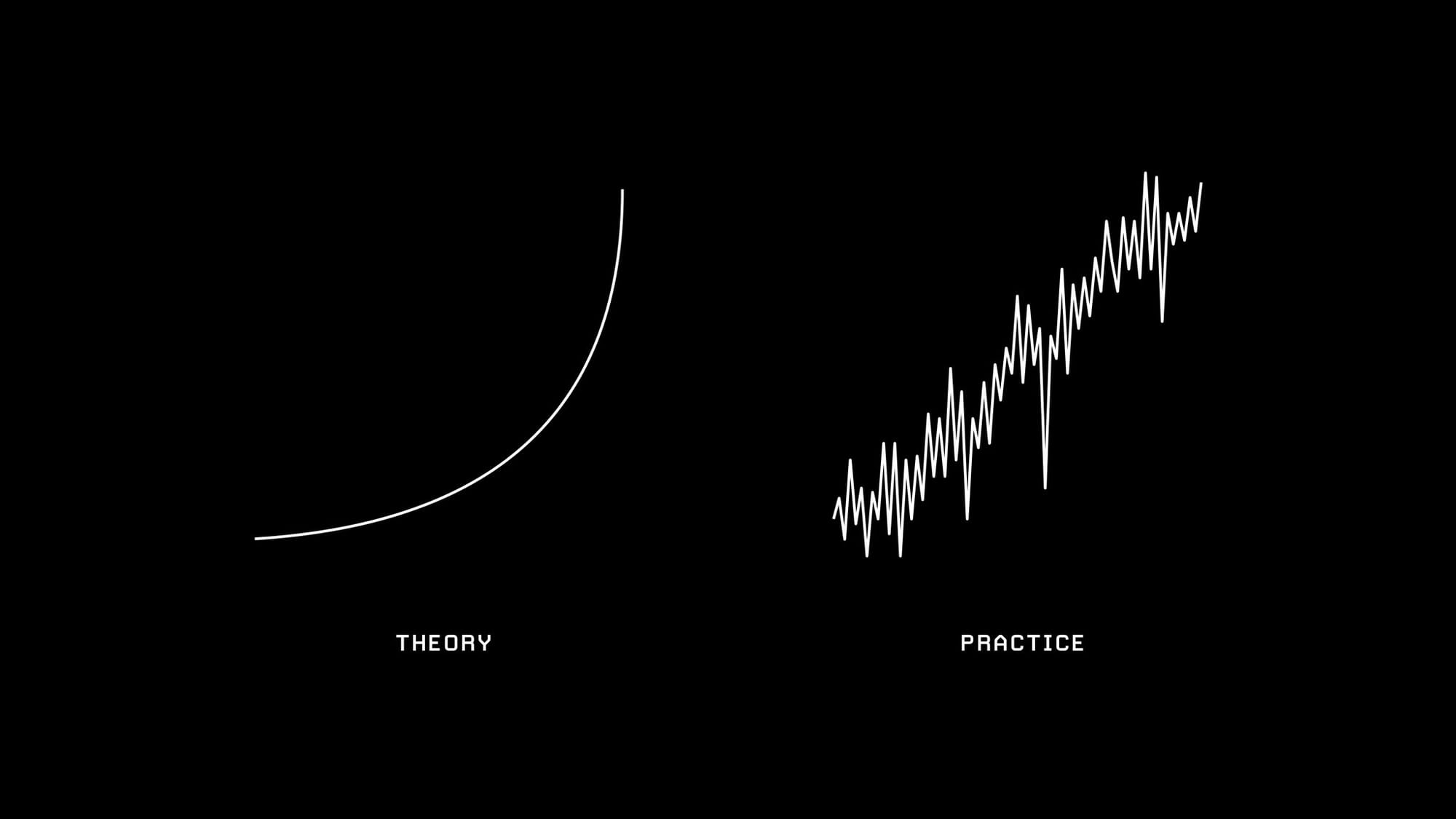

When we map out a financial plan, we use slightly conservative historical averages for a portfolio. We generally assume a constant rate of return, and make adjustments along the way. In reality, markets never behave like that. Performance for the exact same portfolio can vary, drastically. The difference between the S&P 500's best and worst year is nearly 100%.

It's important to have realistic expectations because it establishes what we perceive as normal. The S&P experiences a drop of at least 10% in about 2/3 of years, it's very normal, even in years that experience a huge gain. If someone only has experience in savings accounts, or GICs, where the expectation is small growth with no chance of a loss, as soon as they see a negative return in their investments, they might freak out. To their experience, it's abnormal. But if their expectation aligns with reality, they'd see that it's normal.

Our success as investors doesn't come down to our highest return in a year, but how long we are able to get a modest return for. We'll each experience multiple recessions over our lifetime, plenty of bear markets, and dozens of times where the market drops more than 10%. The trick is to understand that those things are all normal. They don't require any corrective or drastic change. When we know what to expect, we won't be surprised when it actually happens.

Keep doing things your future self will thank you for.

All ideas, quotes, and illustrations are borrowed or based on Visualize Value by Jack Butcher. To learn more, visit https://visualizevalue.com.

Member discussion