📚 Making Money Simple by Peter Lazaroff

🎯 Read This Book If

You want to simplify your finances by building a comprehensive foundation of how it all works, and what decisions you can make for an everlasting positive impact.

🔑 Key Points

- The most powerful tool you have as an investor is time – so start early and invest often.

- Investing is a complex topic that doesn't require a complex solution – history suggests that simplicity wins.

- Knowing what to expect as investors, can be reassuring and allow us to stay the course during the tough times – the goal is to invest for as long as possible.

🤔 Main Ideas

My first distinct memory of money was during a night out with my family at a local pizza shop. I don't remember how old I was, but I'd guess no older than six or seven. The restaurant had a jukebox and I asked my dad for money to pick out a song. Instead of handing over some change, my dad asked, "Is it worth your money?"

I told him no and he responded, "Then it's not worth mine."

The next time we went to that restaurant, I found myself eyeing the jukebox again. And again, I asked my dad for some money to pick songs on the jukebox. My dad asked the same question: "Is it worth your money?"

This time, thinking I was clever, I said yes. Then my dad said, "Great, then you can spend your own."

It often takes a lesson like this, to give us any sense of the importance of money growing up. Unfortunately we aren't taught about money throughout grade school, and our first chance to really learn doesn't come until college. Where it's unlikely to take a deep dive into topics like: retirement planning, buying a home, saving for a child's education, or other money management situations – topics that really impact all of us.

In school, you are given a lesson, then a test. In life, you are given a test and then you learn a lesson – and money lessons can be expensive.

The onus mostly falls on each of us individually to learn about money, unless we're lucky to have positive money influences around us. It might feel overwhelming, but it doesn't need to be. Starting early and keeping things simple can be an effective blueprint to our success.

Making Money Simple aims to do just that, by simplifying the tools in our financial toolbox we can make a complex topic simple. When we understand how our money works, we can focus on the things that actually matter, and it can help us make better decisions. Innovations will continue to shape the financial landscape, but good financial advice will never change.

Regardless of your specific situation, we all need to understand our money and what to do with it.

The Power of Time and Compounding

The most powerful tool in our Financial Toolbox is time. Compound interest allows you to not only earn a return on your contributions, but also on your past returns. This is an exponential relationship, and that power is the most under-appreciated component of a financial plan.

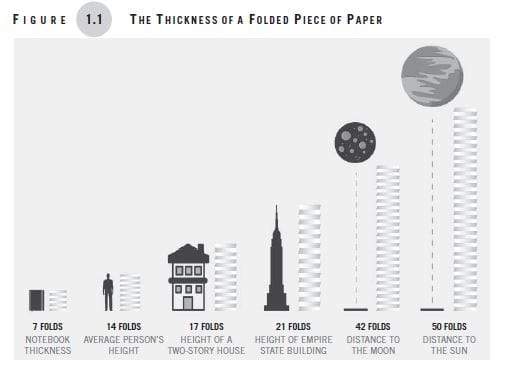

The issue with compound interest, is that our brain simply isn't good at visualizing exponential things. It's impossible to fold a piece of paper more than 8 times. But if it was possible to fold a piece of paper 50 times, doubling in thickness with each fold, how thick do you think it would become?

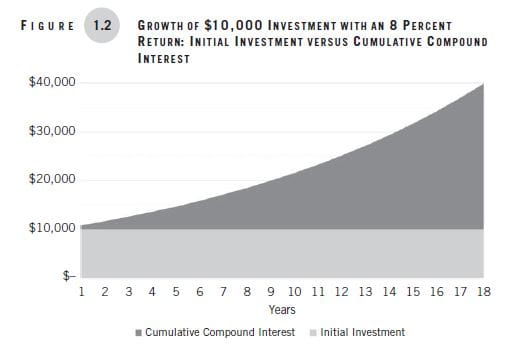

How many times you can double your money depends on your age and your rate of return. The rule of 72 states that if we divide 72 by your rate of return, the answer is the number of years it'll take your money to double. For example, 72/8% = 9 years. If you start with $10,000, after nine years it would double to $20,000. Another nine years, you'd have $40,000. After nine more, $80,000. With each period your money creates a new baseline, so you double that amount, not your original amount.

The more time you have, the more your wealth benefits from this compounding effect.

The most important rule for retirement planning is to save early and often. There's no such thing as too soon, because all it does is give you a longer time horizon. Warren Buffet says, "Life is like a snowball. The important thing is finding wet snow and a long hill." Compound interest works the same way, as it rolls, it collects more snow with each rotation, and the further it rolls the more mass it exponentially gains. Even while earning the same return percent each year, our dollar growth increases with each year: 8% of $10,000 is $800. 8% of $10,800 is $864.

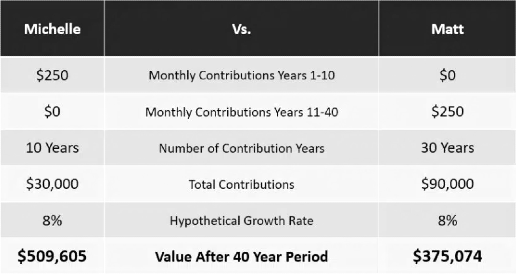

Time can also make a small amount of effort early on, add up to more than a large amount of effort later on.

Inflation is the increase of goods and services, which decreases buying power over time. If inflation rises at 3% annual, using the Rule of 72, our buying power gets cut in half every 24 years. Investment costs, fees and tax can also add up for a long period of time to slice into our growth. Bad debt, like credit cards with high interest and low minimum payments can add up to huge sums. A $2,500 purchase with a 16% interest rate, if only paying the minimum payment, would result in almost $4,000 of interest alone, over the nearly 22 years it would take to pay off.

Compound interest is a very powerful tool at our disposal. But it can work both for or against us. By understanding how it works, and what matters most, we can make better decisions. The trick is to use time to turn small habits into incredible results.

Where Do You Want to Go?

Achieving financial success can be challenging because it doesn't happen immediately, it's incremental. Especially if you're not sure where you're trying to go. We must start with the end in mind. Think about where you see yourself in 20 years, 30 years and beyond. What does your life look like, what milestones have you accomplished along the way? Allow yourself to dream, there are no wrong answers.

All too often, people make money decisions without considering the impact on their future. In fact, research shows that our brains think of saving as a choice between spending money on ourselves versus giving it to a complete stranger.

By feeling more connected to our future self, we can more easily make decisions that prioritizes them. The trick is defining our end destination, and creating a financial plan to get there. Similar to how a pilot prepares a flight plan. Only by knowing where they are going, can a pilot create a plan of action to take them to their intended destination safely.

Writing down your goals and ranking them are an effective way to make them a priority. Because goals change over time, they should be something that you revisit regularly to accommodate for life's inevitable changes. Although retirement might be decades away, it should always be a top priority in order to take advantage of compound interest.

Your other priority is your emergency fund. We often overlook our emergency fund because we tend to believe that bad things only happen to others. An emergency fund helps cover life's unexpected surprises, things that can happen to anyone. The size of your emergency fund depends on things like: expenses, job stability, and income volatility, but a general goal is about six to 12 months' worth of living expenses. Your emergency fund should be kept in an account that is accessible when you need it, but creates friction from using it for everyday expenses.

Personal preference can play a big influence (for example: the desire to be debt free), but here's how I believe it makes sense to prioritize investing and debt from a math perspective:

- Make contributions to your employer-sponsored plan to get a match.

- Pay down high interest debt (at least 8%) that is not tax deductible.

- Maximum contributions to tax-advantaged accounts like employer-sponsored plan and registered accounts.

- Pay down your mortgage if it requires you to pay private mortgage insurance (PMI).

- Pay down high interest debt (at least 8%) that is tax deductible.

- Contribute to investment accounts with no tax benefits where you expect to earn returns greater than the interest rate on remaining outstanding debt.

- Pay down debt with interest rates that are less than 8%.

The quality of the journey is just as important as the destination. That's why it's important to make sure we spend our money in a way that gives us the most value. Research suggests that experiences, not material items, are more likely to give us lasting happiness. Another way to create happiness with spending is to focus on purchases that create time – spending more of our time in a way that's ideal to us, can be more than worth the cost.

Where Are You Today?

Before getting to where you want to be, you need to understand where you are today. Your net worth represents where you are, and moving forward you'll want to ask yourself two questions when facing personal finance decisions:

- How does this affect my net worth?

- How does this impact my ability to reach my goals?

Good financial decisions should increase your net worth, and move you closer to your goals. Running a decision by these two questions can help you make better decisions and minimize regret. You will have times where a decision goes against both questions, but in that case, it should be for something you highly value.

Spending money is not a bad thing. The key is to make intentional choices with your saving and spending so that you get the most value out of your money.

An essential part of determining where you are today, is understanding your cash flow – what money comes in, and where it goes. Looking through statements or using a tracking app, can be an easy way to assess your spending. The longer you use it, the more insightful the information should be.

Once you have an idea of your cash flow, you can see how much cash is left over to work towards your goals. Dividing up your leftover cash flow between your priorities can help determine if you have enough cash to make them work, if they're realistic, or if you need to restructure your priorities. Start with your retirement savings and emergency fund, and then work through the rest by what's most important to you.

When evaluating your budget, don't view it as a tragic event, view it as a way to have more money for what you really want. Find ways to cut down on impulse shopping by sticking to a list of what you really need. You can also look for ways to reduce spending by downsizing on what you don't need. Increase insurance deductibles to reduce payments, get a cash back credit card instead of points, downgrade your subscriptions, or make big purchases (like a car) less often. It may seem small, but just like compound interest, a little bit adds up to a lot over time.

Creating a System for Financial Success

Distractions are all around us. Advertisements, social media marketing, Wall Street, or gamified stock trading. They are all ways we can easily be tempted away from what matters most. Precommitment is a system of self control that we can establish to help us stay on course.

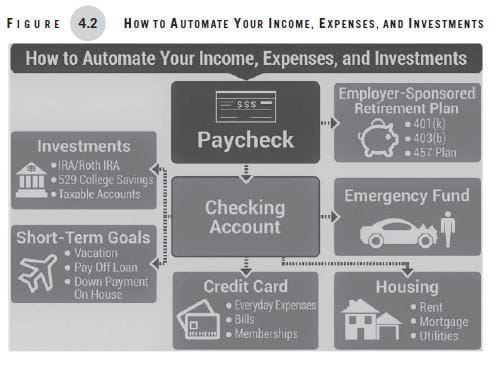

Reverse budgeting simply figures out how much you need to save, makes those savings automatic, and then allows you to spend the remaining money as you please.

Reverse budgeting is the idea of paying yourself first. Instead of waiting until your paycheque is gone to think about your future, make it the first thing. It requires almost no ongoing time commitment, so it's much easier to stick to.

More than 40% of the actions people perform each day are driven by habit rather than actual decisions. Habits allow us to do the things we need to do without much thought or energy. So it's no surprise that putting our finances on autopilot can have a huge impact. Here's how to start:

- Open the appropriate accounts for your automated system.

- Pay yourself first.

- Set up payments for your bills and expenses.

- Automate your contributions to your investment accounts.

- Increase your automated savings over time.

Setting your finances up for success not only helps lead to success, but it makes it so much easier. We can't spend money that goes straight to our priorities, so it enforces what we want most, while eliminating what we don't. By making intentional decisions, we can ensure that we are getting the most value out of each dollar we earn.

Your Introduction to Investing

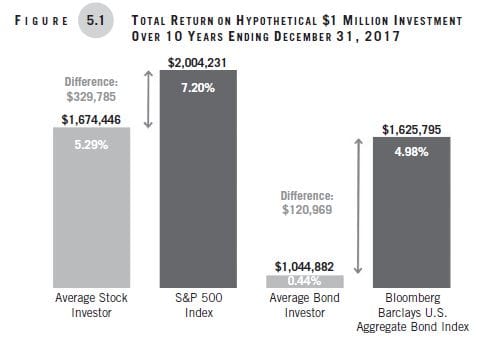

Investing is an overall complex subject, but it doesn't require a complex solution. A key ingredient to investing success goes against our intuition, it's simplicity. Many investors get in their own way of getting good returns, and it boils down to two critical factors: bad behavioural tendencies, and investment fees.

Good investing isn't necessarily about earning the highest returns. It's about doing the same thing for decades on end.

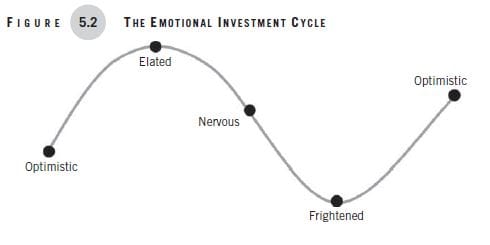

Our natural intuition often goes against what the correct investment decision is. This is because we tend to feel the pain of a loss twice as much as the pleasure of the same sized gain. If instead of showing share price, markets showed emotion, it would look something like this:

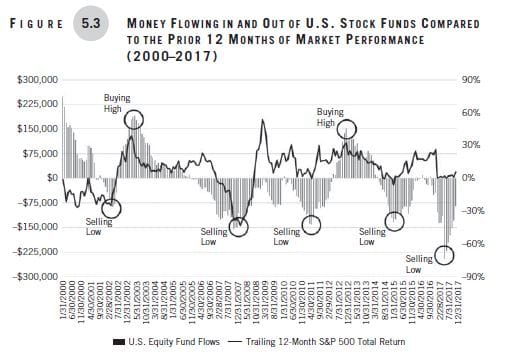

We've all heard the phrase "buy low, sell high" but quite often, we do the opposite. When markets drop, our fear kicks in and makes us feel like we have to do something, and sell. When markets are highest, we see never ending wealth, and buy. This is "buy high, sell low", the opposite of what we know we should do. We see the biggest inflows of money at highs, and the biggest outflows of money at lows.

Chasing performance is another bad behavioural tendency. Past performance offers no indication of future results. We overconfidently put importance on short term trends, pouring money into a stock we think that will do well (recency bias), or that others believe will do well (herding bias). On a year to year basis, there's no pattern in the best or worst performing asset classes. The best approach is to have a healthy mix of it all.

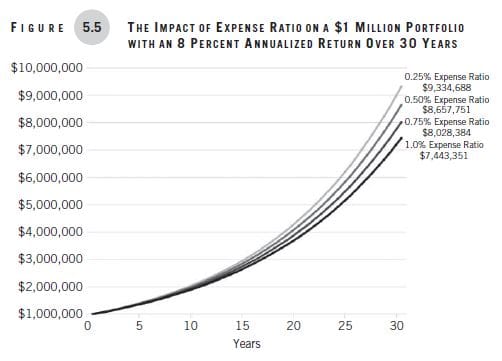

It's important to know what you're paying for. A lot of funds have fees that aren't necessarily hidden, but not transparent either. Just like with anything else, you can overpay for something you could get much cheaper. Over your lifetime, small fees can make a big difference in your overall returns, and therefore retirement income.

Harnessing the Power of Markets

Markets operate under a simple force, supply and demand. When demand is high, prices rise. When supply is high, prices drop. We tend to respect supply and demand in many areas of our day to day, like produce at the grocery store. But that respect stops with financial markets. We try to outsmart the market by taking big bets, we overestimate the opportunity for above-average returns.

In 2017, the global stock market averaged 76.5 million trades per day, valued about $441 billion. There is so much information available and people participating in markets. The collective information is incredible. By the time we see a headline, it's likely already old news that markets have already priced in.

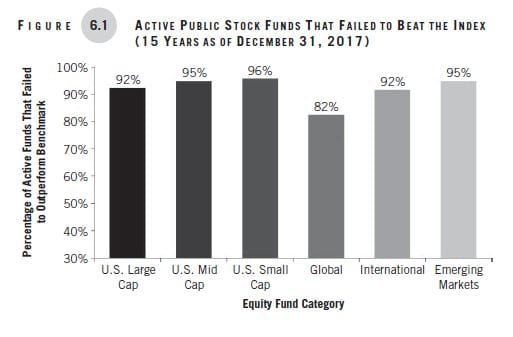

Research shows that actively managed funds, largely underperform their benchmark. Beating the market is hard, the odds are stacked against you. Accounting for higher operating fees, and human error makes it even tougher.

Investing is one of the rare activities in which greater effort and talent doesn't automatically translate to superior results.

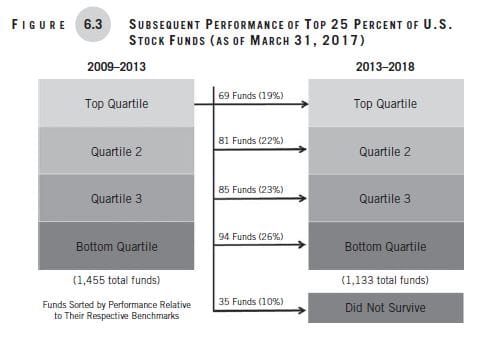

The data also shows that managers who have outperformed over a short period of time, are more likely to underperform moving forward. There are always outliers, but it's impossible to know who they will be before they happen. Betting on the markets, leverages the knowledge they contain automatically.

There's a lot of evidence that shows simple, is best. A rules based approach takes forecasting out of the equation, and makes decisions based on predetermined set of rules and methodology. The other simple fact is that fees come out of performance, the more you pay, the less you keep.

Building a Portfolio to Meet Your Goals

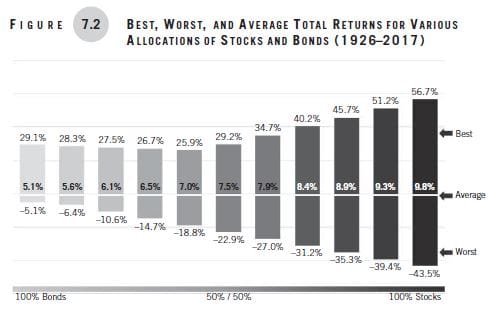

Investing is all about risk and reward. You're able to earn a return in exchange for accepting volatility, uncertainty, and potential for permanent loss. Your portfolio should follow overall market trends, but your outcome is dependent on your specific mix of stocks and bonds.

More stocks = more risk, more reward, less stability. More bonds = less risk, less reward, more stability. Stocks represent a share of ownership in a company, and a share in future profits. Bonds represent loans to be repaid, and a share in future repayments and return on principal.

In order to maximize performance over the long term, stocks are essential. The day to day experience of owning stocks can be more stressful, but it's the price you pay as an investor, and over the long term, it's more than worth it.

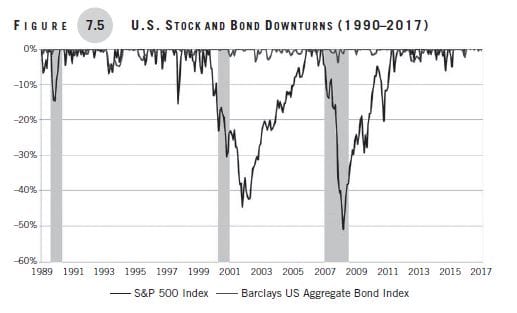

Even though the expected return is less than stocks, bonds play a key role with our investments. Bonds greatly reduce the volatility we feel during market declines, making them more tolerable. The key is to invest smartly for as long as possible, it's critical that your portfolio behaves in a way that's aligned with your appetite for risk.

Your ability to tolerate risk depends on your time horizon, liquidity needs, size of human capital, and goal flexibility. Your willingness to tolerate risk is more subjective, and will usually depend on your investing experience. Aligning your ability and willingness is important to: maximize growth and efficiency towards your goals, while protecting your investments when you need to rely on them.

A properly diversified portfolio not only holds many different companies, but holds companies from different industries and countries all over the world. You also want to be careful that you're not owning different funds with a lot of overlap, it gives a false sense of diversification. We never know what will perform best year to year, and different classes will be driven by different factors. Owning a diversified mix gives us the best chance to consistently do well.

When it comes to investing, you'll want to have several baskets. And you'll want more than just eggs in them.

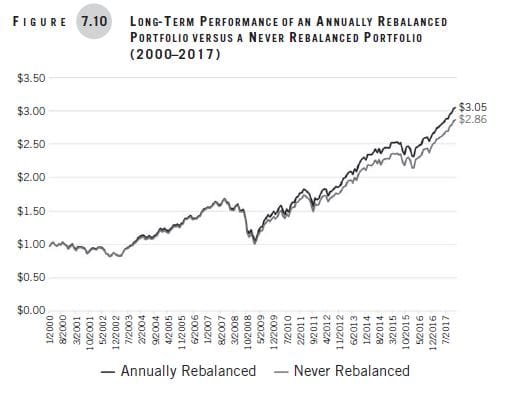

Establishing a proper asset allocation is the first step, next is properly diversifying, and finally the ongoing maintenance of rebalancing is last. Over time, asset classes will perform differently than others, which can shift our asset allocation outside of our design (shifting a 50/50 split to 60/40, for example). Rebalancing takes us back to where it should be, it's not guaranteed it'll help with performance, but it'll keep your risk exposure in line with your risk tolerance.

How and Where to Invest Your Savings

Dollar cost averaging is the act of making set, regular, contributions towards your goals. It takes the thought or timing out of it, allowing you to regularly invest no matter what's happening with the markets. If you accumulate cash or come into money you want to invest, don't overthink it, just get it invested. Time in the market, is more important than timing the market.

A Peter Lynch study looked at investing $1,000 annually from 1965 to 1995 in three scenarios: best timing, worst timing, no timing (just invest on the first day of the year). Here's the average annual returns in each case:

- Perfect timing = 11.7%

- Worst timing = 10.6%

- No timing = 11.0%

Perfect timing only did 1.1% better than worse timing, and only 0.7% better than no timing at all. All three returns are incredibly good, the fact that they are so close in performance shows the power of time, and the lack of power timing plays in the long term.

It's time and the power of compounding that act as the biggest drivers of building wealth in markets.

A secret key of investing that is entirely within your control, is your savings rate, which is more important than your rate of return. How much you invest dictates your end result. By saving more, you could also be in a position of taking less risk, because, although returns are important, your plan doesn't hang in the balance of performance. Increasing your savings rate, increases your success.

There are a lot of different accounts you could use for a broad goal like retirement planning, or specific accounts used for education – accounts generally will have different taxation rules that make one more advantageous than another. Since we all have different time horizons and goals, it's important to assess your unique situation, rather than do the same thing someone else does. Your financial plan, should be unique to you.

Facing the Realities of Market Downturns

It's important to establish the realities with investing, and have a good understanding of the process. You don't need to be an expert by any means, but you should at least understand what you're looking at.

One of the first things to accept as an investor is that you'll occasionally lose money – sometimes a lot of money – on the way to earning a decent return.

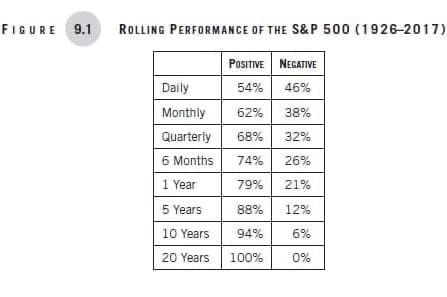

On a daily basis, the market has a coin flip whether it'll be a gain or a loss for the day. But as our timeline becomes longer, the odds shift to a heavily positive outcome. Research shows that the more infrequent an investor checks their investments, the more likely they are to see that it's up, and not change a thing.

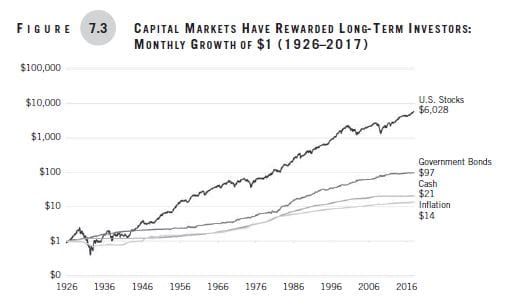

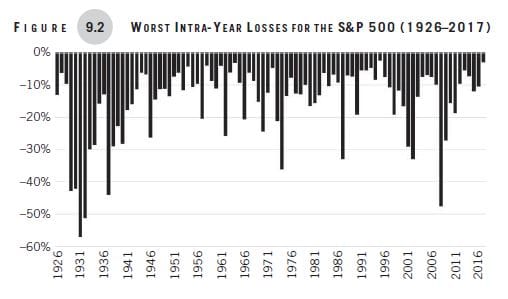

If we look back historically, we know the stock market is down quite often. Double-digit losses happen in 65% of calendar years, even if the market ends up being positive overall. Nearly 25% of the time, a calendar year experiences a loss of 20% or more. Despite these frequent losses, the S&P 500 averaged an annual return of 10.16% over this time.

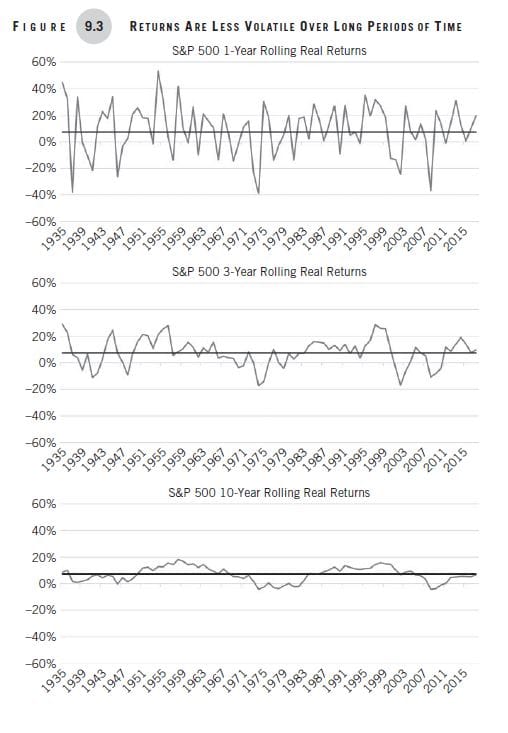

When we look at a short time horizon, our results are less predictable, and more volatile. As we extend our view we see softer and smoother lines form, the volatility becomes less. Instead of trying to time the market and predict downturns, we should expect them to happen with a regular frequency, and focus on what we can control: continuing to invest. If we can set realistic expectations, then we won't be tempted to change our approach at the slightest negative movement.

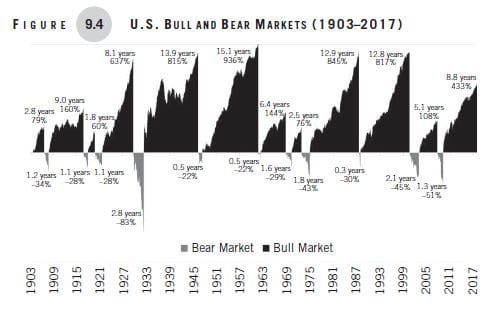

We should also understand that in spite of the reality of market losses, markets are up far more than they are down. Even the historically worse crashes of all time, don't even look noteworthy compared to the positive gains that surround them. Losses are short in duration, and nowhere near the magnitude of gains.

It's always important to keep in mind why you're investing, what goals you're working towards, and whether or not it's still on track. Financial success isn't magic, it's engineered. It should take into account the good years and bad years, and be based on a realistic expected return. Even through the downs, a good financial plan will still be on track.

Family Finances

Whether or not you combine finances and accounts with your spouse, it's important to have a honest conversation and make sure that both opinions and views are taken into account. You could combine all accounts, keep things separated, or use a hybrid approach that combines income for shared expenses. Money is often one of the biggest strains on a marriage, so honesty, communication, and a mutually agreed solution goes along way to reducing stress.

Saving for a child's education can really help ensure they have every opportunity, but don't feel 100% responsible. If you want to help them out, it's important to know what accounts you have access to, as the government can help, and to start early so you can let the growth of your investments do the heavy lifting.

Buying a home is an emotional process, but we shouldn't let our emotions control the decision making process. When it comes to buying a house, ask yourself the following questions to make an informed decision:

- Do you plan to live in the same place for at least 5 years?

- Is owning less expensive than renting?

- What are your current and future career prospects?

- Can you afford the down payment and upfront costs associated with buying a home?

The biggest mistake people make when purchasing a home is not living there long enough for the finances to work out in their favour.

It's important not to overextend yourself with your house budget. Just because you could get approved for a specific amount, doesn't mean you have to spend that amount. You still want to be able to afford and enjoy the other aspects of your life.

Historically speaking, a home is not a good long term investment. The annualized returns are poor compared to the stock market, and even more so if we consider all of the ongoing costs of home ownership (taxes, repairs, maintenance, etc). Don't look at your home as an investment, but instead as what it is, your home. Buy because it makes sense, not because you have the urge to.

Big Financial Decisions at Critical Junctions in Life

Having a plan in place to manage your estate can have significant advantages over the flow of your assets. You're never too young to have a plan in place, but a trigger point should be when you get married. This should be a plan that's reviewed every few years, or when there are big life changes.

Life insurance is a priority as soon as you have someone that depends on you financially, or if your spouse would incur a large expense without you (like a stay at home parent). The amount of life insurance you need depends on a lot of different factors, so sitting down with a professional is a good idea, but remember to take your employee coverage into consideration. There are two main types of life insurance: term and permanent.

Term insurance can be thought of at renting, an example would be having insurance in place to cover your mortgage balance. Permanent insurance is designed to last for a lifetime, it's more expensive because as long as premiums are paid it's almost guaranteed to pay out. Insurance is not an investment, and it shouldn't be viewed as one, even if it has an investment related component. Insurance is an inefficient investment at best.

Your biggest asset over your life is your ability to earn an income. We tend to believe bad things only happen to other people, but disability is more common than we think. Unlike life insurance, that pays someone else, disability pays you when you're still expected to pay your bills.

The amount of coverage you need can be complex, talking to a professional, or analyzing your cash flow can help determine what you'd need. During your career, you're more likely to become disabled than you are to die. Accidents and illness can strike anyone, so it shouldn't be overlooked in your financial plan.

How to Create Your Own Team of Professionals to Help You Succeed

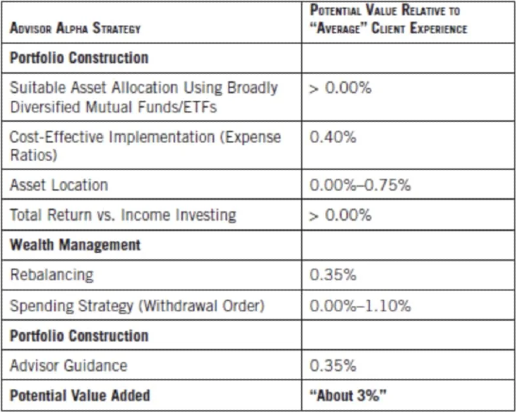

So far we've covered a lot of information, and even if it all makes sense, it still can be overwhelming. Hiring a financial professional can make the process easier and more effective. Although you pay for a financial planner, a Vanguard study suggests that working with one can add a lot of value to your performance.

Just like any other profession, not all financial planners are created equal. Taking the time to selecting the right person, is an important investment. Things like: standard of care, credentials, and compensation are all things that should be considered. Here is a list of questions you can ask a prospective advisor (or even your current one):

- How do you get paid?

- Does your firm earn revenue from anyone other than me?

- What services do you provide? Would you consider charging a retainer or by the hour instead of a percentage fee based on my assets?

- How are you personally (not the firm) paid?

- Do you always act as a fiduciary, and will you state that in writing?

- Do you have experience working with clients like me?

- What experience, education, and credentials do you have?

- What is your investment philosophy?

- What is the all-in cost of working with you?

Then, ask yourself "what is your overall impression of the advisor?" Try not to overthink it, but take everything into consideration. The advisor-client relationship should be one that lasts decades, that you could refer your friends, family, and children to one day. It might feel like a lot of work, but it is a very important decision.

You could also round out your team of professionals with an estate attorney, accountant, insurance broker and banker. You may not need them often, but having someone to turn to when you do need them, can make a high-stake situation a little bit easier.

Building a System for Financial Success

Financial success is not magic. The key, is to minimize mistakes and leverage the power of compounding over your financial life. Define your goals, optimize your savings, and automate as much of your financial plan as possible. The earlier you start, the easier it'll be to reach your goals.

For worksheets to help you get your financial house in order, visit https://peterlazaroff.com/resources/.

🧠 Final Thoughts

I often find that finance books can either be too simple, or too complex. Too simple leaves the reader wanting more, and wondering where to go from here. Too complex requires the reader to have an existing foundation of understanding to apply the lessons. Making Money Simple is neither, it's a book that lays out the foundation of understanding while having actionable steps the entire way.

On top of that, there's the perfect amount of historical data and visuals to support the perspective taken, without making it feel like you're reading a text book. That's what really puts this book on another level. Peter has a gift of turning complex topics into easy to understand lessons that doesn't leave you guessing.

It's a complete practical guide for someone looking to better understand how finances work. It also provides the data that someone familiar with finances can learn a whole new appreciation for. There's a lot to learn for every reader, regardless of their financial literacy. If you're looking to learn about finances, and take action to improve yours, look no further.

❤️ Liked This? Check These Out

I Will Teach You To Be Rich by Remit Sethi

Simple Wealth, Inevitable Wealth by Nick Murray

Think & Grow Rich by Napoleon Hill

All ideas, quotes, and illustrations are borrowed or based on Making Money Simple by Peter Lazaroff. To learn more, visit www.peterlazaroff.com.

Member discussion