📚 Same As Ever by Morgan Housel

🎯 Read This Book If

You want to better understand why we make the decisions that we do when it comes to our money. Full of timeless stories about risk, opportunity, living a good life, and what people have always done and will always do.

🔑 Key Points

- We experience a lot of firsts over our lives, but history shows us that something similar has happened before, often countless times.

- Advances in technology changes how our world looks – it always has, but the constant that remains is how we behave – it always will.

- Success comes down to differentiating between what does and does not matter, and focusing on what's in our control – which tends to be what never changes.

🤔 Detailed Summary

The Little Laws of Life

I once had lunch with a guy who's close to Warren Buffett.

This guy – we'll call him Jim (not his real name) – was driving around Omaha, Nebraska, with Buffett in late 2009. The global economy was crippled at this point, and Omaha was no exception. Stores were closed, businesses were boarded up.

Jim said to Warren "It's so bad right now. How does the economy ever bounce back from this?"

Warren said, "Jim, do you know what the bestselling candy bar was in 1962?"

"No," Jim said.

"Snickers," said Warren. "And do you know what the bestselling candy bar is today?"

"No," said Jim.

"Snickers," Warren said.

Then silence. That was the end of the conversation.

Change captivates our imaginations because it's surprising and exciting. Underlying change, are timeless human behaviours that never change, and those are history's most powerful lessons. It's impossible to know what change will happen next, but we can be confident in how we will behave to change. We don't know what the stock market will do, but we can be confident that people will respond in greed or fear.

In a world that is forever changing, we could find more success by focusing on the things that don't change. That's what this book is all about. It's about the things that never change, in a constantly changing world. It's about how we can put ourselves in a position to be more successful more often. And all we have to do, is shift our focus.

"In 1,000 parallel universes, you want to be wealthy in 999 of them. You don't want to be wealthy in the fifty of them where you got lucky, so we want to factor luck out of it. . . . I want to live in a way that if my life played out 1,000 times, Naval is successful 999 times.", Naval Ravikant

If you travelled in time to five hundred years ago or five hundred years from now, there'd be a lot that would look foreign. Technology, medicine, politics, and language, to name a few.

But after that initial shock, you'd see things that are familiar. People falling for greed and fear. People persuaded by risk, jealousy and tribal affiliations. People's overconfidence and shortsightedness. People looking for the secret to a happy life and certainty where none exist. Even when everything looks different, the way people behave is, has always been, and will always be, the same.

When transported to an unfamiliar world, you'd spend a few minutes watching people behave and say, "Ah. I've seen this before. Same as ever."

Hanging by a Thread

If you know where you've been, you realize we have no idea where we're going.

During the Revolutionary War of 1776, defeat looked guaranteed for George Washington. The British had him and his troops cornered, all they had to do was sail up the East River and the war would be over. But Washington had a bit of luck on his side, the wind made sailing in that direction impossible for the British. Historians believe that if not for the wind, the United States of America may have never happened.

Our world is shaped by big stories that went one way, but could've gone the other way if things were even just slightly different. By studying history, we often know where a story ends, but have no idea where it began. Every event has a family tree, a series of events that lead to itself. Viewing events in isolation, without considering how they came to be or where they're going, explains why we are often so wrong. We only think of a fraction of the situation by skipping to ask "and then what?".

Two things to keep in mind:

- Base predictions on how people behave rather than on specific events.

Predicting what the world will look like in fifty years from now is impossible. But predicting that people will still respond to greed, fear, opportunity, exploitation, risk, uncertainty, tribal affiliations, and social persuasion in the same way is a bet I'd take.

- Have a wider imagination.

Events, like money, compound. And the central feature of compounding is that it's never as intuitive how big something can grow from a small beginning.

Risk Is What You Don't See

We are very good at predicting the future, except for the surprises – which tend to be all that matter.

In the 1920's, it was believed the stock market would continue increasing forever, no one forecasted anything that resembled The Great Depression. A year into it, members of the National Economic League ranked unemployment as the 18th biggest problem in the USA, the next year it was fourth.

"Risk is what's left over after you think you've thought of everything.", Carl Richards

Past events that moved the needle the most are the ones no one predicted: the Great Depression, Pearl Harbour, 9/11, COVID-19, etc. Each year The Economist forecasts the year ahead, and rarely predicts what matters most. It's like predicting what you'd be most surprised about, but if you can think of it, you wouldn't be as surprised by it.

There is rarely more or less economic uncertainty; just changes in how ignorant people are to potential risks.

History knows three things:

- What's been photographed

- What someone wrote down or recorded

- The words recorded by people whom historians and journalists wanted to interview and who agreed to be interviewed

How much of the important stuff that has ever happened falls into those three categories? Probably not very much. They all suffer from misinterpretation, incompleteness, embellishment, lying and selective memory. When we don't have a complete view, it's easy to underestimate what we don't know, what else could be happening, and what could go wrong.

Two things to keep in mind:

- Prepare for what we know will happen, even if we don't know when, where, or of what magnitude.

- If we only prepare for the risks we can envision, we'll be unprepared for the risks we can't see every single time.

Expectations and Reality

The first rule of happiness is low expectations.

An important skill is getting the goalpost to stop moving. Our happiness is primarily driven by our expectations. Even though our world continues to improve, our expectations increase with it. We have a new goal in mind before we even reach our current one, so by the time we get there, we don't find the happiness we thought it'd bring. In a constantly improving world, happiness remains unchanged. As Charlie Munger once noted, the world isn't driven by greed; it's driven by envy.

"If you only wished to be happy, this could be easily accomplished; but we wish to be happier than other people, and this is always difficult, for we believe others to be happier than they are.", Montesquieu

The 1950's is considered one of the best eras of America. Wages were set that created smaller gaps between low and high-income workers. Wealth is relative, and more than ever, everyone was in the same boat. There wasn't large differences between how classes of people lived. There wasn't a lot of social pressure to live beyond your means. Economic growth accrued straight to happiness.

We should try to recognize two things:

- One is the constant reminder that wealth and happiness is a two part equation: what you have and what you expect/need.

- The other is to understand how the expectation game is played.

"The first rule of a happy life is low expectations. If you have unrealistic expectations you're going to be miserable your whole life. You want to have reasonable expectations and take life's results, good and bad, as they happen with a certain amount to stoicism.", Charlie Munger

Wild Minds

People who think about the world in unique ways you like also think about the world in unique ways you won't like.

History is littered with incredible thinkers, but those minds also produce precarious results. Sir Isaac Newton might be the smartest person to ever live, but topics like alchemy, sorcery, and searching for eternal life, took up a considerable amount of his time. Did his scientific mind spark his curiosity of magic? Or was it the pursuit of things that seemed impossible, that lead to his success?

Something that we do know, is people are complex. We can look at someone and wish we were more like them, usually at something specific. But we forget to take everything about that person into account. We might be drawn to an aspect of good, but would we really want everything else? Probably not. We could all benefit from gaining a better insight into who we want to become.

Part of this idea is realizing that people who are capable of achieving incredible things often take risks that can backfire just as powerfully.

Wild Numbers

People don't want accuracy. They want certainty.

You might feel like miracles are happening more often, it's true. 8 billion people on earth means that a one-in-a-million event happens 8,000 times a day, or 2.9 million times a year. One-in-a-billion events could happen hundreds of thousands of times over our lives. With modern media, it's impossible not to hear about them. When something has low probability, but high opportunity, it can happen with regular frequency.

Something can be likely and not happen, or unlikely and still happen, is one of the world's most important tricks.

Bad things don't often happen directly to us. With the spread of our reach, the chance of something bad happening at anytime, is 100%. Bad news gets attention because pessimism is seductive and feels urgent. Usually, it's just math at work: something is bound to go wrong. Since we are so connected, we are more likely than ever to hear about it. A few things to keep in mind:

- People don't want accuracy. They want certainty.

- It often takes too long for a sufficient sample size to play out. So everyone is left guessing.

- Distinguishing between unfortunate odds and recklessness is hard when risk has painful consequences. It's easier to see black and white even when the odds are apparent.

The inability to forecast the past has no impact on our desire to forecast the future. Certainty is so valuable that we'll never give up the quest for it, and most people couldn't get out of bed in the morning if they were honest about how uncertain the future is.

Best Story Wins

Stories are always more powerful than statistics.

The story that catches people's attention is what wins, not the best or most rational idea. The ability to take existing information and spin it in a new way, has made people incredibly successful. Good story telling can down to a few words, people don't remember books; they remember sentences. We all want complicated things distilled into easy-to-grasp scenes. Every company valuation is just a number from today multiplied by a story about tomorrow.

"The common stories are one plus one equals two. We get it, they make sense. But the good stories are about one plus one equals three.", Ken Burns

A few things worth remembering:

- When a topic is complex, stories are like leverage.

- The most persuasive stories are about what you want to believe is true, or are an extension of what you've experienced firsthand.

- Stories get diverse people to focus attention on a single point.

- Good stories create so much hidden opportunity among things you assume can't be improved.

- Some of the most important questions to ask yourself are: Who has the right answer, but I ignore because they're inarticulate? And what do I believe is true but is actually just good marketing?

If you're honest with yourself you'll see how many people, and how many beliefs, fall into these buckets. And then you'll see the truth – that the best story wins.

Does Not Compute

The world is driven by forces that cannot be measured.

Rational thinking is only always true in a rational world, one that does not exist. Some of the things that matter the most in decisions, are things that are impossible to measure and predict. 20th century economist, John Maynards Keynes, discovered that economies are not machines, but instead have souls, emotions and feelings, what he'd refer to as "animal spirits".

"The thing I have noticed is when the anecdotes and the data disagree, the anecdotes are usually right. There's something wrong with the way you are measuring it.", Jeff Bezos

Whether it's Lehman Brothers going bankrupt in 2008, or GameStop going to the moon in 2021, the most important variable was the stories people told themselves. Which were often a reflection of what they wanted to be true.

If you've relied on data and logic alone to make sense of the economy, you'd have been confused for a hundred years straight.

Making sense of the world requires admitting a few things:

- It would be great if the world worked in predictable, rational ways, but it doesn't.

- Accepting that what's rational to one person can be crazy to another.

- Understanding the power of incentives.

- Understanding the power of stories over statistics.

Calm Plants the Seeds of Crazy

Crazy doesn't mean broken. Crazy is normal; beyond the point of crazy is normal.

Economist Hyman Minsky's financial instability hypothesis, proposed that economic stability is actually destabilizing. A belief that things will be okay, actually pushes us towards something not okay. It looks something like this:

- When an economy is stable, people get optimistic.

- When people get optimistic, they go into debt.

- When they go into debt, the economy becomes unstable.

The irony of good times is that they breed complacency and skepticism of warnings.

Stock market prices are driven by what someone is willing to pay. As long as someone believes an investment has potential to go higher, it can. We can't know the top of anything until we've pushed past it. Not only pushing beyond where the numbers stop making sense, but also beyond where the stories people believe about those numbers go.

That's why markets don't stay within the limits of sanity, and why they always overdose on pessimism and optimism. They have to.

Two things we can do:

- Accepting that crazy doesn't mean broken. Crazy is normal; beyond the point of crazy is normal.

- Realizing the power of enough. Maybe there's potential out there, but it's fine to say enough.

Too Much, Too Soon, Too Fast

A good idea on steroids quickly becomes a terrible idea.

Warren Buffett once joked that you can't make a baby in one month by getting nine women pregnant. When we discover something great, we have a tendency to want it faster, and want more of it, instead of accepting it for the already great thing that it is. It's a natural thing to think, but it has a dangerous track record.

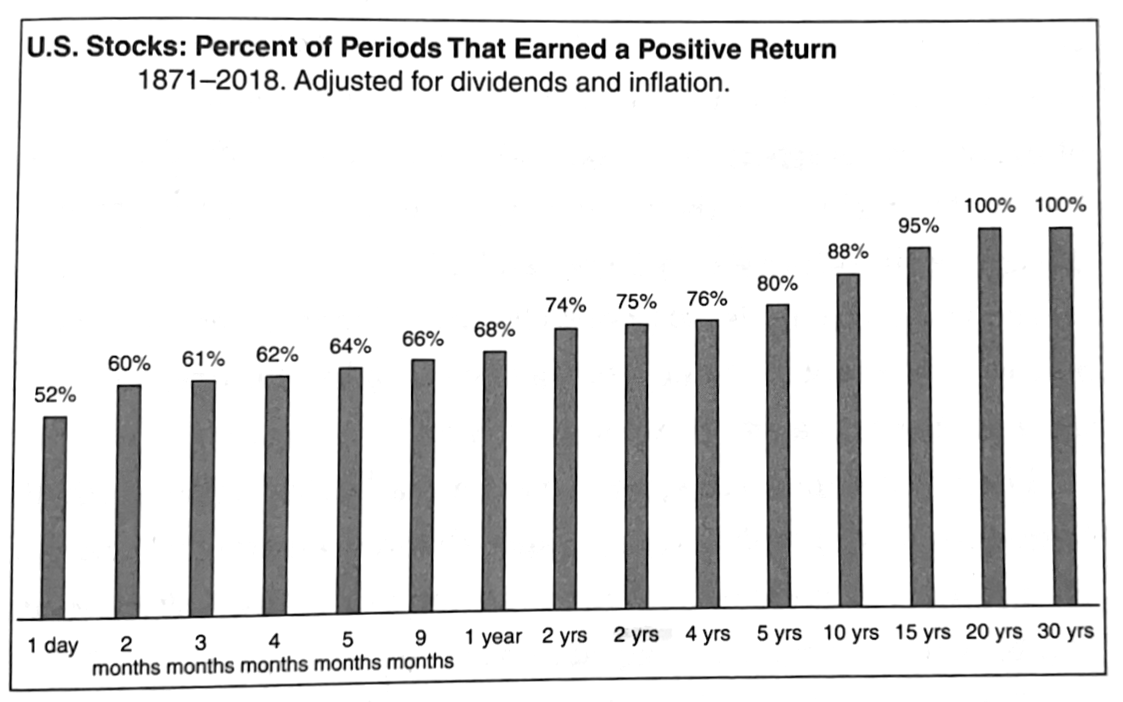

History shows us that when we're patient, stocks pay a fortune in the long run. As our time line becomes shorter, the odds are less in our favour. With investing, there is a most convenient time horizon, say 10 years or more gives us a great chance for the results we're looking for.

An important thing about this topic is that most great things in life – from love to careers to investing – gain their value from two things: patience and scarcity. Patience to let something grow, and scarcity to admire what it grows into.

When the Magic Happens

Stress forces your attention in ways that good time can't.

The biggest changes and most important innovations, don't happen when everyone is happy and things are going well. They tend to happen during, and after, terrible events.

The 1930's are know for the Great Depression, one of the darkest periods in American history. 1/4 of Americans were unemployed in 1932, the stock market fell 89%. These two stories dominated headlines for a decade. But as the problems grew, so did the number of solutions. What doesn't get talked about enough, is the amount of innovation that came out of the decade. Cars, technology, electricity, infrastructure, manufacturing, education, all shaw incredible growth unseen ever before.

It's doubtful that business owners and entrepreneurs would so urgently have found new efficiencies without the record threat of business failure.

There's a delicate balance between helpful stress and crippling disaster. But a stress-free life sounds wonderful until you see the motivation and progress it fails to produce. Hardship is the most potent fuel of problem-solving, for both at the time and of the future.

Overnight Tragedies and Long-Term Miracles

Good news comes from compounding, which always takes time, but bad news comes from a loss in confidence or a catastrophic error that can occur in a blink of an eye.

Warren Buffett says it takes twenty years to build a reputation and five minutes to destroy one. The idea of "complex to make, simple to break". Life requires countless things to go right, death only requires one thing to go wrong. Construction requires engineers, demolition only requires a sledgehammer.

"To enjoy peace, we need almost everyone to make good choices. By contrast, a poor choice by just one side can lead to war.", Noah Yuval Harari

Two things to remember:

- A lot of progress and good news concerns things that didn't happen, whereas virtually all bad news is about what did occur.

- It is so easy to discount how much progress is achievable.

Tiny and Magnificent

When little things compound into extraordinary things.

The most powerful force in the universe, is evolution. The thing that has turned single-cell organisms into everything we know today. Over our lives, we barely see the evidence of evolution, because of its incredibly small changes. But with enough time, those changes compound. Given that evolution has been at work for 3.8 billion years, it's no wonder that what we see today is indistinguishable from magic.

The key to evolution is time, not change. Evolution relies on little changes over a very long time, to create something special. Just like with investing. In order to get incredible growth, we don't need the highest returns, we need good returns for a very long time. An investor with average, unremarkable returns over their life, can outperform the investor who takes big swings chasing performance.

If you understand the math behind compounding, you realize the most important question is not "How can I earn the highest returns?" It's "What are the best returns I can sustain for the longest period of time?"

Elation and Despair

Progress requires optimism and pessimism to coexist.

The best financial plan is to save like a pessimist and invest like an optimist. Bill Gates ran Microsoft for decades having enough cash in the bank to keep the company alive for 12 months with no revenue coming in. He understood that in order to be a long-term optimist, you have to be pessimistic enough to survive the short-term. Survive short-term problems to get long-term growth.

The belief that things can be, and will be, better even when the evidence is murky is one of the most essential parts of everything from maintaining a sound relationship to making a long-term investment.

There's a sweet spot between an optimist and a pessimist, a rational optimist. Where they understand that history is a series of problems, disappointments and setbacks, but can remain optimistic because they can see past to the eventual progress. They aren't stuck on the negative short-term, they are looking further ahead than most other people.

Casualties of Perfection

There is a huge advantage to being a little imperfect.

In nature, when a species evolves to be perfect at anything, it's at the expense of something else. Striving towards perfection, creates vulnerability. We often try to be as efficient as possible, but it's time away from being efficient that can provide the answers we're looking for. Coming back from a break, a vacation, or a long weekend with friends, we can feel an energy and subconsciously solve the problem we couldn't at our desk.

"I take time to go for long walks on the beach so that I can listen to what is going on inside my head. If my work isn't going well, I lie down in the middle of a workday and gaze at the ceiling while I listen and visualize what goes on in my imagination.", Albert Einstein

When people have "thought jobs", jobs that rely on thinking rather than a physical skill, taking a step away from our thoughts can help us. Creating inefficiency and imperfection, can help us find what we're looking for. We could spend countless hours trying to bring something from 90% to 100%, but at the cost of what we'd rather be doing instead. Settling for good enough, can keep balance and close off our own vulnerabilities.

It's less about admitting that we can't forecast, and more about acknowledging that if your forecast is merely good enough, you can invest your time and resources more efficiently elsewhere.

It's Supposed to Be Hard

Everything worth pursuing comes with a little pain. The trick is not minding that it hurts.

There's a big difference between finding a better way than we know, and pursuing a shortcut that's bound to blowup in our face. Things that are worth it, are supposed to be tough, they are supposed to require effort. If they didn't it wouldn't mean anything. If everyone was as good at basketball as Michael Jordan was, there'd be nothing special about him.

"The safest way to try to get what you want is to try to deserve what you want. It's such a simple idea. It's the golden rule. You want to deliver to the world what you would buy if you were on the other end.", Charlie Munger

No matter what we love, and what we do, there will be aspects of that thing that we're not crazy about. It's part of it. Whether it's a job, hobby or relationship. It's something we have to deal with. Having a zero tolerance for what we don't like, won't allow us to do anything. Whereas fully accepting everything, will eat us alive.

The trick is being able to put a non-monetary price tag on things in our lives, and be willing to pay it. When something doesn't have a price tag, the price is usually paid by putting up with an optimal amount of hassle.

Keep Running

Most competitive advantages eventually die.

The bigger they are, the harder they fall. Whether we look at companies, or animals, no one stays at the top for very long. Both have many examples that looked to stand on the top forever: Sears, Lehman Brothers or dinosaurs. Sometimes it takes an extraordinary event, or just the course of time. In a world of constant change, adapting to change is essential to survive.

Five big things tend to eat away at competitive advantages:

- Being right installs confidence that you can't be wrong.

- Success tends to lead to growth, which is a different animal.

- The irony of working hard to gain a competitive advantage with the purpose of not having to work hard in the future.

- A skill that's valuable in one era may not extend to the next.

- Some success is owed to being in the right place at the right time.

Another takeaway is to keep running. No competitive advantage is so powerful that it can let you rest on your laurels – and in fact the ones that appear to do so tend to seed their own demise.

The Wonders of the Future

It always feels like we're falling behind, and it's easy to discount the potential of new technology.

New innovation and technology take time before they're widely accepted. At first it's met with skepticism, until it's impossible to imagine life without it. ARPANET was developed in the 1960's as a way for the Department of Defence to manage Cold War secrets. Decades later, it became the foundation for the idea of the internet. Today, almost every aspect of our day relies on the internet. When we first hear of something new, it's entirely too early to even fathom its full potential.

And that's why all innovation is hard to predict and easy to underestimate. The path from A to Z can be so complex and end up at such a strange point that it's nearly impossible to look at today's tools and extrapolate what they might become.

Fisher's Fundamental Theorem of Natural Selection, suggests that variance equals strength. The more diverse a population is, the more different the perspectives and ideas are, which should lead to new innovations. It's easy to underestimate how two small things can compound into something enormous. We have both: more people and more communication than ever. Sometimes it can feel like we're standing still, but that's because things can take decades to develop, there's no guessing what the innovation of today will lead to.

Harder Than It Looks and Not as Fun as It Seems

"The grass is always greener on the side that's fertilized with bullshit."

It's important to understand that the things that we think make us unique, are the things that connect us to people the most. We all suffer, go through hardship, and try to hide things that define us. We constantly see people selling us a perfect version of their lives, but that isn't the reality. Just like us, people have highs and lows, and live for the most part somewhere in between.

What most of us see most of the time is a fraction of what has actually happened, or what's going on inside people's heads. And it's stripped of all the hard parts.

Something that connects us, is we are all good at something and bad at a lot more things. At best, we can be an expert at one thing, and inept others. If you can keep that in mind, you can be more forgiving to yourself, and others.

Incentives: The Most Powerful Force in the World

When the incentives are crazy, the behaviour is crazy. People can be led to justify and defend nearly anything.

People aren't crazy, well not a lot of them. If you were asked what percentage of the population is crazy, the number would be low, maybe 3% to 5%. But if you were asked what percentage of the population would do something crazy if their incentives were right, it would be the majority. People follow incentives, not advice.

No matter how much information and context you have, nothing is more persuasive than what you desperately want or need to be true.

Three things stick out here:

- When good and honest people can be incentivized into crazy behaviour, it's easy to underestimate the odds of the world going off the rails.

- Unsustainable things can last longer than you anticipate.

- A good question to ask is, "Which of my current views would change if my incentives were different?"

Now You Get It

Nothing is more persuasive than what you've experienced firsthand.

Something that history shows us, is how fast we're willing to change our minds during a change of circumstance. Some of the most dramatic changes come out of tough times. We may have ideals built on beliefs, but until we have those experiences first hand, it's impossible to know what we'll do. Our first hand experience, more than anything, influences our behaviour.

In investing, saying "I will be greedy when others are fearful" is easier said than done, because people underestimate how much their views and goals can change when markets break.

This goes all directions. We have ideals of what we'd do given a situation, but we also have ideals that we strive towards. Ideals that end up, being not everything we made them out to be. We might think we know how we'll feel given a certain situation, but until we are living it in the moment, we won't actually know. And chances are, we'll realize it's a lot more complicated than we thought.

Time Horizons

Saying "I'm in it for the long run" is a bit like standing at the base of Mount Everest, pointing to the top, and saying, "That's where I'm heading." Well, that's nice. Now comes the rest.

To do long-term effectively you have to understand a few points:

- The long run is just a collection of short runs you have to put up with.

- Your belief in the long run isn't enough. Your partners, coworkers, spouses, and friends have to sign up for the ride.

- Patience is often stubbornness is disguise.

- Long-term is less about time horizon and more about flexibility.

"The purpose of the margin of safety is to render the forecast unnecessary.", Benjamin Graham

There's two types of information: permanent and expiring. Permanent information matters years and decades later, it matters. Expiring information is stuff you forget the next day, it doesn't matter. You wouldn't remember and keep a newspaper you read a decade ago, but you'd remember and keep a book you read during that time, and how it changed the way you think. Knowing the difference will help you understand what you should pay attention to.

Saying you have a ten-year time horizon doesn't exempt you from all the nonsense that happens in the next ten years.

Trying Too Hard

There are no points awarded for difficulty.

We often get caught up thinking simple can't be correct, that we need a complex solution for every problem. Evolution fused many bones into one, and decreased body parts by increasing their usefulness, simplicity wins. The truth is there are no fields where points are awarded for difficulty. It's possible to try too hard, to overcomplicate, and to have it backfire spectacularly.

In finance, spending less than you make, saving the difference, and being patient is perhaps 90% of what you need to know to do well.

Why are complexity and length so appealing when simplicity will do? A few reasons:

- Complexity gives a comforting impression of control, while simplicity is hard to distinguish from cluelessness.

- Things you don't understand create a mystique around people who do.

- Length is often the only thing that can signal effort and thoughtfulness.

- Simplicity feels like an easy walk. Complexity feels like a mental marathon.

Richard Feynman and Stephen Hawking could teach math with simple language that didn't hurt your head, not because they dumbed down the topics but because they know how to get from A to Z in as few steps as possible.

Wounds Heal, Scars Last

What have you experienced that I haven't that makes you believe what you do? And would I think about the world like you do if I experienced what you have?

The world heals from war, recessions, and market crashes, but the scars of those events remain. They not only change the world, but also change our behaviour. They influence what we do, and why we do them. The reality is that mindsets are harder to repair than buildings and cashflows.

We can see and measure just about everything in the world except people's moods, fears, hopes, grudges, goals, triggers, and expectations. That's partly why history is such a continuous chain of baffling events, and will always be.

Two things tend to happen after you get hit with something big and unexpected:

- You assume what just happened will keep happening, but with greater force and consequence.

- You forecast with great conviction, despite the original event being improbable and something few, if anyone, predicted.

Disagreement has less to do with what people know and more to do with what they've experienced.

Same as it's ever been.

Same as it will always be.

Same as it ever was.

🧠 Final Thoughts

Same As Ever is a wonderful blend of finance, history, and psychology. It doubles down on the brilliant storytelling from Psychology of Money, creating a book of incredible stories that happen to be about finance, rather than a finance book that happens to contain stories. It transports you to different places and times, where the value to be taken away is more about how the stories make you feel, than teaching you a hard lesson.

Exploring the psychological side of money, it's less of a numbers driven book. Although I like a good chart, the more I think about it, the more I appreciate it. It appeals more to the non-traditional investor, or the person who feels like they wouldn't read a finance book (even if they know they should). Someone who doesn't care to dive into the deep end, but wants to ensure they're doing everything they can to make better decisions for their future self.

It lives in the space between a non-finance book, and a traditional finance book. A book that financial professionals would love because it provides a fresh take on ideas they thought they knew. And a book maybe even more important for the person trying to figure out where to begin their financial journey. It's a rare type of book where the more time you spend with it, the more you love it.

A decade ago I made a goal to read more history and fewer forecasts. It was one of the most enlightening changes of my life. And the irony is that the more history I read, the more comfortable I became with the future. When you focus on what never changes, you stop trying to predict uncertain events and spend more time understanding timeless behaviour.

❤️ Liked This? Check These Out

The Psychology of Money by Morgan Housel, timeless lessons of wealth, greed, and happiness

A Random Walk Down Wall Street by Burton Malkiel, the time tested strategy for successful investing

Principles for Dealing with the Changing World Order by Ray Dalio, why nations succeed and fail

All ideas, quotes, and illustrations are borrowed or based on Same As Ever by Morgan Housel. To learn more, visit www.morganhousel.com.

Member discussion