Avoiding Mistakes Matters More Than Making Great Shots

If you follow golf, there's a couple of names you're hearing more than ever lately: Nelly Korda and Scottie Scheffler. Nelly has been dominating the LPGA for years, but she's turned up the heat by winning the last five tournaments she's played in. Scottie has won four of his last five tournaments, finishing top-10 in nine of his ten tournaments this year. Both players are ranked #1, favoured in every tournament, and seem to be unstoppable.

Golf is a highly skilled sport. At the top end, it requires hundreds of hours of dedication to get a fraction of a percent better. We can look at Nelly and Scottie and point to dozens of things that they do exceptionally well, but the thing that really sets them apart is their ability to avoid mistakes.

In order to win golf tournaments, you need to score very well. In order to score very well, you need to get birdies (or better) and avoid bogeys (or worse). Both golfers rank at the top of average birdies per round.

Scottie is the only player on the PGA to rank in the top 10 for: most birdies and least bogeys per round (he's ranked #1 for each). For most players they need to take risks in order to score birdies, which leads to more bogeys. Or they play safe enough to avoid bogeys, but the conservative play doesn't lead to a high amount of birdies.

Every one of his 40 rounds of tournament golf this year have been under par. He avoids having a bad hole and a bad round. It's the reason why his scoring average is a full stroke better than second place (at which point the difference between places becomes about 0.1 strokes or less).

They're able to play their game, not worrying about anyone else, and play to their strengths. Knowing that if they do, they are likely to get the result they're working towards, victory. Looking at PGA major tournaments between 2000 and 2019, only 17.5% of day one leaders went on to win. You can't win a tournament in one day, but you certainly can lose it.

Instead of finding success by avoiding mistakes, which works great for Nelly and Scottie, investors try to find success by taking on unimaginable financial risk in areas they are completely unfamiliar with. How many investors during the meme-stock era could tell you anything of importance about a company they were investing in? My guess, almost none.

Exceptional results don't come from getting lucky. They come from doing the little things right for a very long time. When it comes to golf, and long-term investing, avoiding mistakes matters more than making great shots.

Key Takeaways:

- Without a financial plan and the discipline to stick to it, investors can quickly become their own worst enemy.

- Long-term success doesn't come from capitalizing on high risk moves, but instead from avoiding making mistakes.

- Investing is an endurance sport, what the investor is doing is always more important than what the markets are doing.

Golf is the ultimate sport of risk and reward, and the driver is the highest risk/reward club in the bag. It goes the furthest, but it has the highest degree of dispersion. If you're hitting it long and straight, it gives you an incredible advantage. But if your accuracy is off, it can be the difference between making birdies and bogeys (or worse).

During the 2006 Open Championship at Royal Liverpool, Tiger Woods only used his driver once on his way to victory (a club that's typically used around 50 times per tournament). The course played tough and weather conditions made it tougher, to the point where Tiger said "You can't control that.", referring to a driver. Having a good second shot, one from the fairway rather than the rough or a bunker, was more important than squeezing out every last yard of distance.

During the 2019 Masters, the door to victory swung wide open for Tiger when a number of players found water on the short par-3 12th, including his two playing partners in the final pairing. Tiger knew he didn't need to aim anywhere near the flag, instead deciding to play a safe shot to the middle of the green. He two putted for par, was tied for the lead, and had every bit of momentum on his side. He went on the win the tournament, in one of the most improbable victories in golf.

In both cases, Tiger leaned on his experience, course planning, and what he believed would give him the best chance to win. Even as it went against the modern belief that distance is king and you should go for every pin. And it worked. Tiger didn't win either tournament because of his tolerance for risk, he won because he was able to identify the risks he faced and avoided making a big mistake.

Whether we're taking a look at the great golfers back in the day, or the great golfers of today, their ability to identify and avoid making a big mistake is a critical part of their success. Something that gives us a lot to think about as investors.

Why This Should Matter to Investors

Golf, like investing, is an endurance sport. You can't win a tournament in one day, but you certainly can lose it. You can't amass your retirement savings in one day, but you certainly make mistakes that can jeopardize all of it.

We know that compounding can have exponential influence on our finances. For the sake of simplicity, let's say we expect someone's investments to double every ten years. That means that a $10,000 mistake today, is equivalent to $160,000 in 40 years. If we put it at risk, we don't just lose that money from our accounts today, we lose what that money has the potential to become.

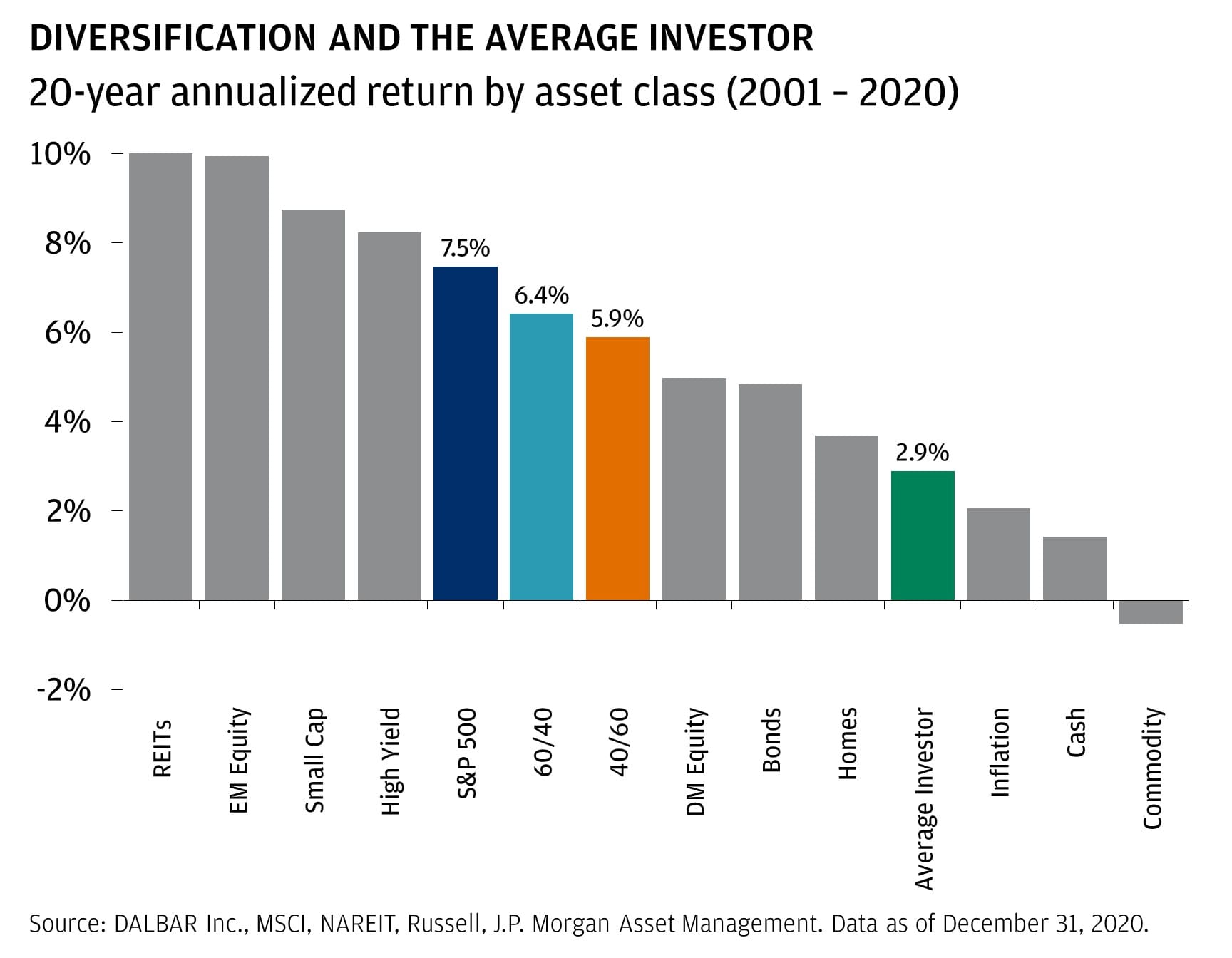

As investors, there's an unnecessary emphasis put on chasing returns. Getting into the hot stock at the 'right time' or figuring out the next big trend – things that don't actually lead to the results we hope. In fact, they lead to the opposite. Studies show that the majority of investors underperform the fund they're in, and not by a little, but by upwards of 60%.

"One often meets his destiny on the road he takes to avoid it." – Master Oogway, Kung Fu Panda

Investors make decisions with the hope that they will result in riches, but it's actually more likely to take them further from it. Often, investors become their own worst enemy. In order to get extraordinary results, we don't have to look for complex solutions. It sounds boring, but instead, we should focus on being patient, sticking to our financial plan, and ignoring the background noise. The variable that matters the most, is us.

"If patience is tolerance and restraint in the face of provocation—the decision not to do something wrong—discipline is more properly the decision to keep doing the right things"

- Nick Murray

When a golfer misses winning a tournament by a stroke or two, they don't reflect on how they played and say "Well I would've lost by more if I didn't make the incredible shots I made." They reflect on the mistakes they made, their bad decisions or a short putt they missed. The difference between winning and losing, comes back to a handful of mistakes they made, not the shots they made.

Similarly, and contrary to popular belief, investing success doesn't come down to our incredible wins, but instead to specific points in time where we did the right thing, when we didn't make a mistake.

Keep doing things your future self will thank you for (on and off the course).

Member discussion