Managing Financial Risk

Our primary objective as investors isn't to try to earn the highest return each and every year, but instead to earn a very good return for as long as possible.

At first glance, this might seem like a one task solution: to earn a very good return, we just need to invest well. But there's a second part to the equation: for as long as possible, which comes with its own challenges outside of the investment philosophy we implement. It relies on our ability to manage financial risk.

Jesse Livermore was a pioneer of day trading, and amassed a huge fortune during The Great Depression by betting against the market, reportedly making the equivalent of $1.5 billion today. Taking risks lead to his wealth, but it also lead to his demise. Continuously over-leveraging his investments, he lost everything he ever made and more, going bankrupt four different times. He ultimately took his own life, without a penny to his name.

Livermore was regarded as one of the best traders of his time, but because of his inability to manage risk, he lost everything – every single time. Returns are worthless if they are short lived. Despite his achievements and how we was regarded, someone who simply saved and never invested at all ended up with more than Livermore in the end.

Driving is a risky activity, we know its negative potential. But, we also know that we can do things to make it safer. Like: obeying speed limits, following traffic laws, using signals, overall being a cautious driver. We go even further to prepare for the unexpected by wearing seatbelts, addressing warning lights, buying based on safety ratings, and maintaining our cars to be safe. By taking the right actions, we make a risky necessary activity safe 99.9% of the time.

Many people mistakenly view investing as an unavoidably risky activity. But it doesn't have to be. We could put ourselves in a position like Livermore, where we're constantly taking on too much risk, leading to disaster. Or similarly to driving, we can take the time to understand the associated risks and create an easy to implement plan to make investing more successful.

Key Takeaways:

- Properly constructing our investing portfolios can ensure that they are exposed to the right amount of risk for our tolerance and goals.

- Playing defence through setting up an emergency fund and insurance, can help us prepare for the unexpected and protect what matters most.

- Establishing good spending habits that reflect our values and our future self, can make saving easier, while helping us avoid debt and paying interest.

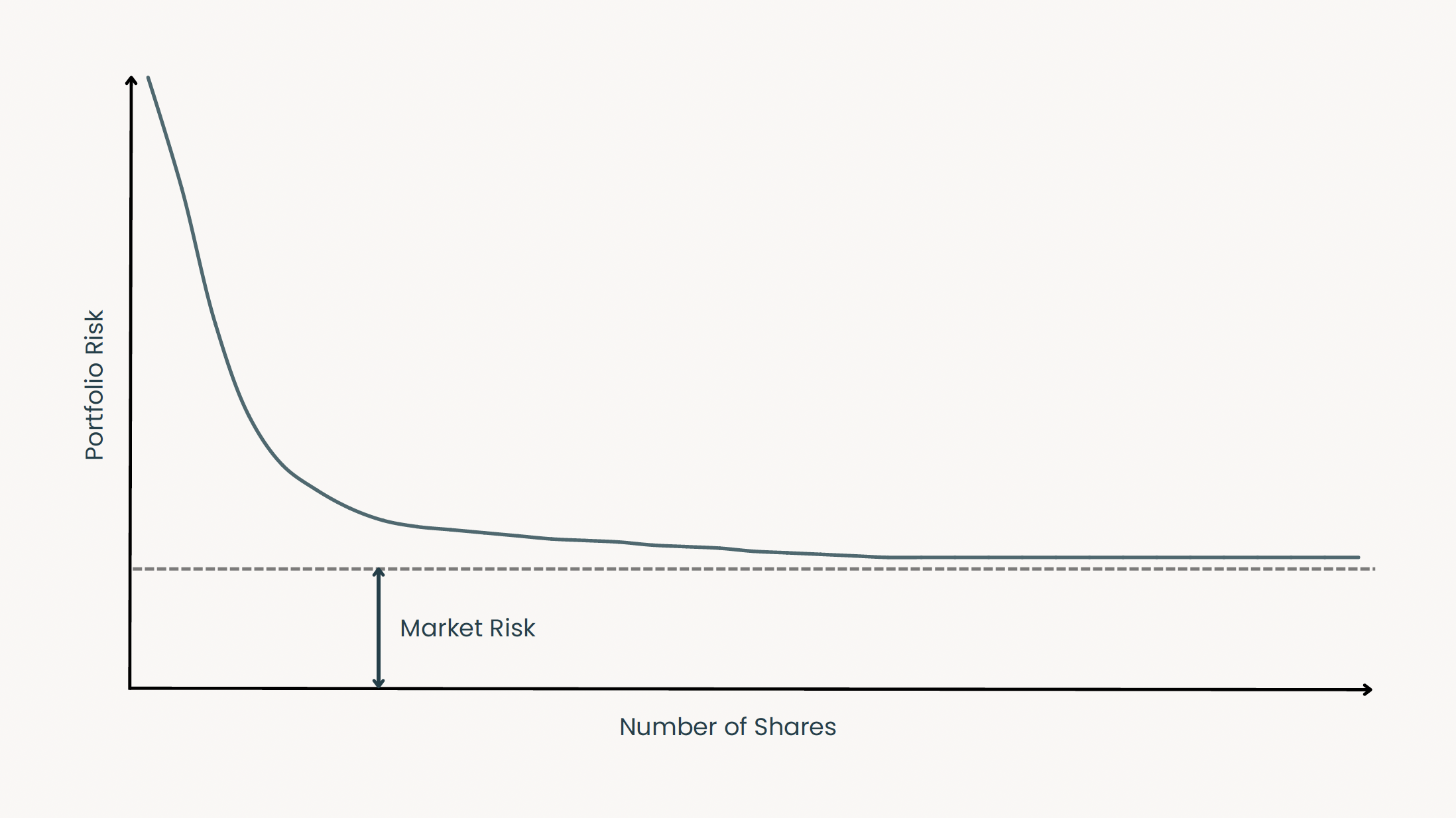

Let's first discuss what risk related to investing means. Commonly, what is perceived as risk is really just volatility. When we invest, we expose our money to two types of risk:

- Market Risk (Systematic)

- Decision Risk (Unsystematic)

Systematic risks are unavoidable, they are embedded in the action itself – like how there's always the risk of an accident when you drive. Unsystematic risks can be avoidable, depending on how you approach a thing – like how driving cautiously lowers risk of an accident over driving aggressively. How we approach something, can either increase or decrease the risk we face with it.

Markets naturally move up and down, but over long periods of time, they consistently move up. Volatility is the short term movements we see in markets, and often when markets drop, it's seen as risk instead of natural movements. Risk should be seen as the chance of complete loss of capital, rather than a downtrend from last week. Markets drop at least 10% in about 60% of years. In 2022, the S&P 500 dropped at least 10% four different times.

Being able to differentiate between risk and volatility is important in setting our expectations and avoiding panic at the slightest downturn. Remember, we want to stay invested for as long as possible. Understanding how the market behaves, is important because it allows us to respond accordingly.

Portfolio Selection

There's a big difference between investing and gambling. Investing is when we're building a logical portfolio based on investing fundamentals that will be able to survive any market condition. Gambling is taking undue risk with the hopes of riches, with no fundamentals behind it. Going all in on one company, chasing a hot stock or the latest investing trend, all resemble actions that are closer related to gambling. Gambling is risky, investing is volatile.

Portfolio Construction

The most effective way to reduce risk, depends on our portfolio construction. It's not only important to have as appropriate allocation of stocks and bonds, but to have diversification within each.

Stocks offer more reward, and are more volatile. Stocks are what leads to long term growth, but can pull us through short term growing pains. Bonds offer less reward, and are less volatile. They still offer growth, but provide our portfolios with stability through the ups and downs. Depending on your goals, risk tolerance, and timeline, a portfolio that's more focused towards growth or preservation might be more appropriate for you.

Although someone going 100% in one stock would have the same asset allocation as a diversified mix of an 100% equity portfolio, they carry dramatically different risk levels. That's why diversification within each asset is very important. By diversifying our portfolio across many companies, industries, and counties, we eliminate our dependency on any single characteristic needing to do well, and spread out our risk.

Investment Style

There are plenty of different styles to manage a portfolio, based on different philosophies. Strategies generally fall under one of two categories: active or passive.

Active strategies involve a Portfolio Manager monitoring their investments, and making decisions that are aligned with the portfolios design. Depending on the Managers philosophy, active management could make a portfolio more aggressive or more conservative. A strategy focused on growth might take more chances, choosing to invest in smaller companies or higher risk counties. Whereas, a strategy focused on preservation which might prefer more stable companies to invest in.

An example that always comes into mind is the ARK Innovation ETF and Berkshire Hathaway. ARKK focuses on growth, momentum, higher risk picks. BRK-B focuses on larger, stable, everyday companies. Both could have the same asset allocation between stocks and bonds, but as you can see, the required appetite for risk is drastically different.

Passive strategies put your faith in the markets ability to provide good returns. Which historically, they have. Although no one escapes the full volatility of the markets, without a Manager making timely decisions that help during down periods, you feel the full swings through passive strategies. But with lower fees than active strategies, passive strategies certainly pull their weight, providing investors with great returns.

By paying attention to our investments, we can make sure they are aligned with our risk tolerance and appropriate for our goals. Having a correct asset allocation provides volatility that we can handle, diversification allows our portfolios to endure, and an investment style that we believe in can provide confidence during downtrends. These all help ensure that our investments survive, regardless of what's happening in markets.

Playing Defence

I like to look at investing (building a plan, contributing, investing money, etc) as playing offence. It's something that we are actively putting time and effort towards. If we look at a financial plan as a sports team, then we know defence plays a crucial role.

Emergency Fund

Having an emergency fund can sometimes feel like a waste, because it's designed to primarily be accessible, not profitable. It's money that we're not likely investing, but even if we are, very conservatively. We aren't expecting our emergency fund to grow at extraordinary rates.

What's often overlooked is what emergency funds allow us to do: keep our investments where they are. By having funds already set aside, it helps us avoid having to withdraw from our investments (which could be really costly, especially if markets are down at the time). The value of an emergency fund shouldn't be weighed by the interest it earns, but by the investments it allows to stay in place to earn interest.

Insurance

Our other primary defender comes in the form of insurance. Over our lifetime, our most valuable asset is our ability to earn an income. If you average earning $100,000 over a 40 year career, that's $4,000,000. It doesn't always feel like that amount of money, but it's pretty incredible to think about. Ensuring that income is protected is essential for a couple of reasons.

First, we don't want to interrupt our income. Even missing a pay cheque or two can send a lot of us into a tough financial position of having to borrow or load up our credit cards just to get by. This can end up costing us a lot in interest, while missing contributions towards our investments.

Second, similar to an emergency fund, insurance can help us avoid having to withdraw from our investments. If a disability lasts more than 90 days, chances are that it lasts three years. Without insurance, it could put us in a position of having to withdraw from our investments. Which, not only means we're losing that dollar amount from our investments, but we lose its compounding potential.

Someone earning 7% annually, can expect their invests to double about every 10 years. For every $10,000 someone withdraws today, they'll have $80,000 less in 30 years ($10,000 to $20,000 [1], $20,000 to $40,000 [2], $40,000 to $80,000 [3]).

Playing good defence, allows our offence to continue doing what it does best. It's not exciting, or flashy, but it's essential to ensuring that we can stay invested for as long as possible. Depending on your employment, an emergency fund could be anywhere from 3 to 12 months of essential expenses. In most healthy cases, 1% of your income going towards insurance could be enough to protect 100% of your income.

Our Spending

If we go back to Jesse Livermore, or think of any athlete, or celebrity going bankrupt after making more money than we can imagine. It usually comes back to uncontrolled spending. As soon as the money is started to be made, lifestyle and expectations skyrocket, resulting in a constantly unstable cycle of spending.

We could have an ideal mix of investments, the perfect investment strategy, an adequate emergency fund, and the right amount of insurance coverage to protect our income. But if we spend like there's no tomorrow, racking up debt, draining our accounts, and putting ourself in a financially vulnerable position, it's asking for something bad to happen.

Living Within Your Means

The modern world is a consumer economy. It has never been more impossible to avoid seeing ads, and it's never been easier to buy unnecessarily. We can open an app, see an ad, and complete the purchase using facial recognition, all in under a minute from the comfort of our couch. The way we buy feels like a different world than even 20 years ago.

It's also never been easier to compare ourselves to others. Before social media, it was difficult to compare ourselves to anyone other than those immediately around us, family and friends, people who were likely very similar to us anyways. Now we are constantly comparing ourselves to others, often people we don't know.

Seeing the highlight reel of others, and new products constantly being pushed at us, can lead us to consume and spend with no means to an end. But study after study shows us that there isn't happiness in material items. When our expectation is buying this will make me that, it always falls short, leading to another purchase to fill the void left by the previous purchase. The higher our expectations become, the more unlikely we are to be happy.

"The first rule of a happy life is low expectations. If you have unrealistic expectations you're going to be miserable your whole life. You want to have reasonable expectations and take life's results, good and bad, as they happen with a certain amount to stoicism.", Charlie Munger

The Future You

The best investments or financial plan, won't be able to offset the negatives created by a mismanaged cashflow and uncontrolled spending. It's important to live a lifestyle you enjoy, but it shouldn't come at the expense of your future self. Balance between the present and the future is important. The best way to establish that balance, is to have a clear idea of who you want to be.

It isn't easy to think about who you want to be in 20, 30, or 40 years. That's why our future self often feels like a stranger, making it easier for our present self to prioritize spending now. But by thinking about how you want your life to look, what your core values are, what you expect to be most important to you, you can begin to make a stranger feel more familiar.

Balance doesn't require a 50/50 split of spending, but more of an 90/10 or 80/20. That's because of compounding. If we allow our money to work for us, a small amount of money can grow into something incredible. Someone contributing $200/biweekly paycheque, and earning 7% annually, would end up with over $1.1 million after 40 years, even though they only would have contributed $208,000.

Having more control over our spending, by establishing good habits and expectations, along with finding better balance by becoming more familiar with who we want to be, can put us in a better financial position. We can stay out of debt, while making it easier to prioritize saving and investing. It isn't as complex as investing, or reducing financial risk through insurance, but it's just as vital over the long term.

Conclusion

It's important to realize that the climb is greater than the fall. A 50% loss, requires a 100% gain just to break even. Taking unnecessary risks can be disastrous to our investments because it can easily wipe out years of effort, putting us further back from where we need to be.

But there are many things that we can do to lower our risk exposure. We can focus on investing fundamentals: portfolio construction, asset allocation, diversification, and our investment strategy. We can play defence: building an emergency fund, and ensuring our income is properly protected through insurance. Finally, we can focus on our spending: living within our means, setting realistic expectations, and making saving easier by becoming more familiar with our future selves.

They are all things that require effort and energy, but the benefits far outweigh the cost. Investing is the best way to grow your money, and allow it to work for you. There's no sure thing that exists that has produced the results that simply investing for a long period of time has. What we want most, is too important to leave up to chance.

Keep doing things your future self will thank you for.

Member discussion