You Should Have A Financial Planner Before You're 'Rich'

One of our biggest hindrances to making progress, is getting caught up believing that something has to reach the point of perfection. I'll do that, when this. Instead of making meaningful progress, we can get stuck and feel overwhelmed, all of which does more harm than good. For all of us, with at least an aspect of our lives, it's inevitable.

With some areas of our lives, we know the consequences don't really matter. For example, this article will take me way longer than it should to write, I'll think about it a lot, start/restart numerous times, and I'll doublecheck it more than it needs. But there are far worse and unproductive ways to spend time. So I don't really mind.

In other areas of our lives, we know that waiting can have a drastic impact on our lives, influencing the shape our lives take for decades. For example, making a big decision, like moving, starting a family, or making a career change. Making, or not making a decision, creates a snowball effect of outcomes in either direction. A single decision can influence infinite decisions moving forward.

Then there's areas of our lives, where we think the consequences are small, but that's because we don't truly understand them. For most of us, our finances fall into this last category. It's something that we hope will just fall into place, without effort. With investing, our best friend is time. By hoping, instead of taking action, we're minimizing the effectiveness of our successes biggest influence.

I'll work with a Financial Planner, when I'm rich. If you plan on waiting until the perfect time, chances are, you'll always be waiting. The perfect time isn't something that we stumble upon. The perfect time is something that we create by putting ourselves in a position to maximize an opportunity when it arises. And that, requires us to take action.

Key Takeaways:

- A complete understanding can allow you to make better decisions more often – we want to compound good decisions while avoiding bad ones.

- Time is your best friend as an investor – it's important to get your best advice from the beginning, so you can capture the most benefit of it.

- Success fuels success – seeing the progress you're making towards your goals will keep you engaged, committed, and lead to more success.

As a Financial Planner, I believe that everyone should know most of what I know. But even if it benefits everyone, it's an impossible reality. The next best thing, is everyone having access to their best financial advice, regardless of their situation. This is not an impossible reality. It's not the reality for most people yet, but it doesn't have to be far away.

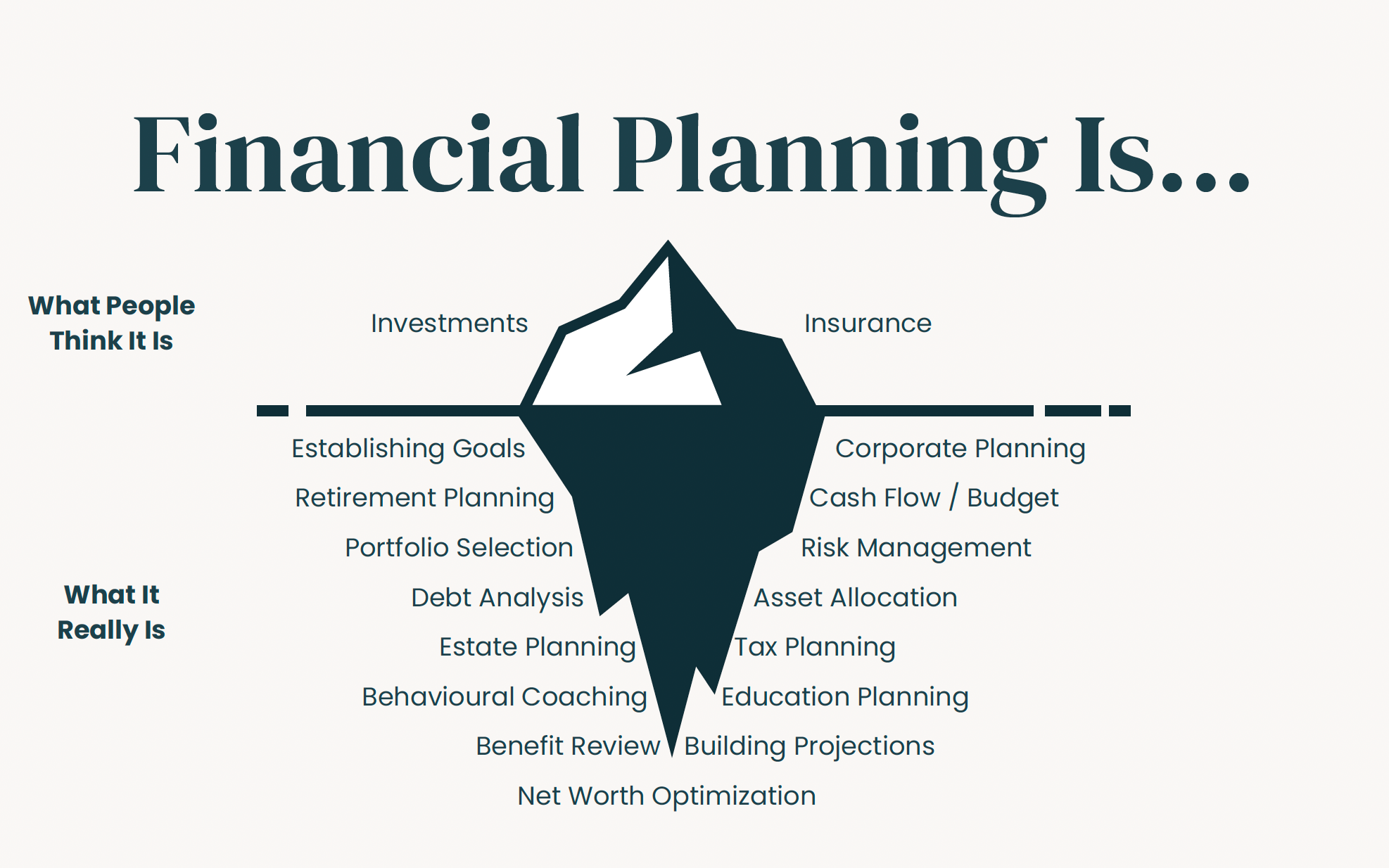

Generally, people believe financial planning is picking investments and writing insurance policies. But that's only the tip of the iceberg, financial planning is so much more than that.

Holistic financial planning, takes your entire situation into consideration. Only by looking at the big picture, and what's most important to you, can we figure out where to begin and what your priorities are.

Like anyone who believes in what they do, you could say I'm bias. There are people who will be okay without ever working with a Financial Planner. But for the majority of people, just like using other professional services, there's a lot of benefit for those that do. Here's some of the reasons why it not only makes sense to work with a Financial Planner, but that you should consider it sooner than later.

You Can't Know What You Don't Know

The financial industry is good at overcomplicating simple but powerful concepts. How the human body works is a miracle, it might be the most complex thing that we know to exist. But even with its complexity, we know and do things everyday to benefit it: eat right, exercise, rest, brush our teeth, etc. Compared to the human body, financial systems are rudimentary. Yet, our finances remain a mystery to most of us.

The problem starts with the fact that we're never taught about investing or personal finance in school. Despite the reality that no matter where our interests or career takes us, we need to make good financial decisions along the way. Whether you're a teacher, engineer, or chef, we all have financial goals and need to invest for retirement.

The financial landscape is constantly changing. For Canadians, our main sources of retirement income are still relatively new:

- Old Age Security (OAS): 72 Years Old

- Canadian Pension Plan (CPP): 58 Years Old

- Registered Retirement Savings Plan (RRSP): 67 Years Old

- Tax-Free Savings Account (TFSA): 15 Years Old

And there's new incentive plans coming and going all of the time, like the First Home Savings Account (FHSA). On top of that, there's been incredible change in how we invest. Not to mention all of the change outside of that. Technology over the last decade has essentially made carrying cash obsolete. What worked for the people we trust the most, like our parents or grandparents, is completely different than what's even available today.

Like trying to self-diagnose an ailment on Web MD, guessing with our finances can lead us astray. Whether you're contemplating investing or paying off debt, how to build a down payment, how to start investing, or if your investments are right for you. It's impossible to know what you don't know, and make informed decisions that you know are in your best interest. A Financial Planner can ensure that you're making the best decisions every step of the way.

Good and Bad Decisions Compound, Just In Different Directions

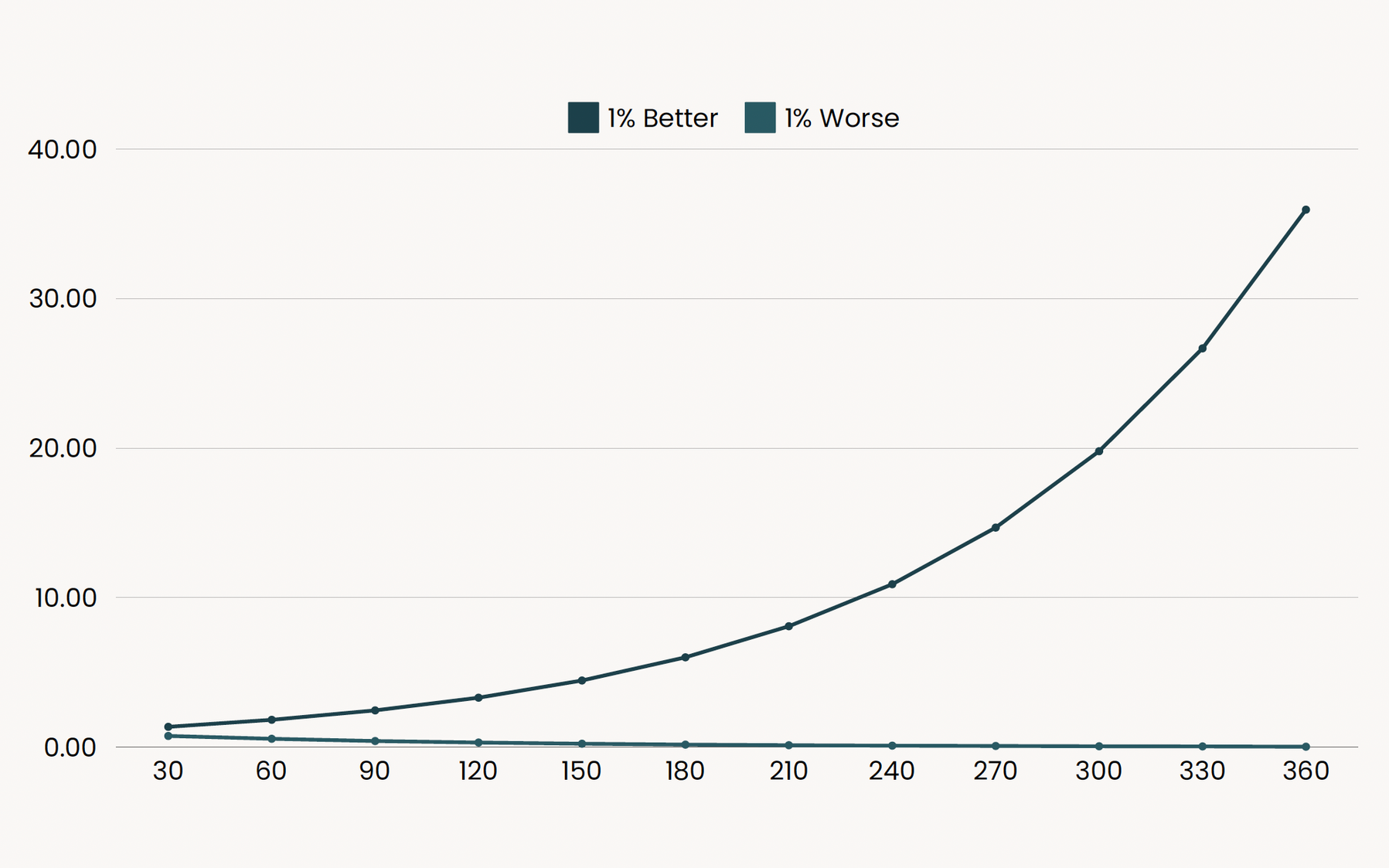

Compounding works by building on what we put in, and in the future, the growth (or loss) that it produces. As good decisions stack up, the benefit from each good decision increases. The same is true in the other direction. Bad decisions, compound negatively. Bad decisions are obviously bad, but what's less obvious, is they can require the same, if not more, effort as good decisions. Not only are you getting further from your goal, you're spending effort doing so.

Bad decision making is rarely intentional. We can only evaluate a decision after the main outcomes have played out. Even if you make the right decision, you don't always get the outcome you hoped for. That's why two things are really important:

- Having a good sense of expectations.

- Understanding the variables that will influence your outcome the most.

When we understand what to expect, we can have a good benchmark to measure to. On a one day timeline, the chance of investments being up is a little better than them being down. The longer we expand our timeline, the better the odds are of us looking at a gain, until they historically become 100%. Good decisions can produce a bad looking outcome, but when we know what to expect, we can make that call.

It's critical to make decisions based on the important information you have at the time. If it ends up being a good decision, you can double down on your process. If not, you can figure out what went wrong. We can get distracted and make decisions based on unimportant information. An undervalued life ability, is being able to differentiate between the things that matter and the things that don't.

Time can either work for, or against you. Waiting shortens the available time compounding can work for you. Bad decisions not only shorten your potential for good compounding, it also reduces your funds that can compound. With investing, our goal is to allow time to work for us for as long as possible. The earlier you can begin to compound good decisions, the longer you'll have to reap the rewards they produce. A Financial Planner can help you make better decisions more often.

The First $X is Harder Than the Next $X

It's important for every investor to get the best advice from the very beginning. Instead of guessing or doing things inefficiently, it just makes sense to do things correctly, right from the start. It's also important, because the first $X is harder than the next $x. This is the case for a few reasons:

- Establishing a new habit is hard.

- Compounding takes time for significant results.*

- *Assuming that you're investing properly.

We've already seen how a deeper understanding allows us to more easily compound good decisions, which works in our favour. The hardest part of any new action, is establishing it as a habit. We want to take anything that benefits us, and make it as easy as possible to accomplish, to the point where we do it automatically. At the same time, we can put friction in between us and our negative habits.

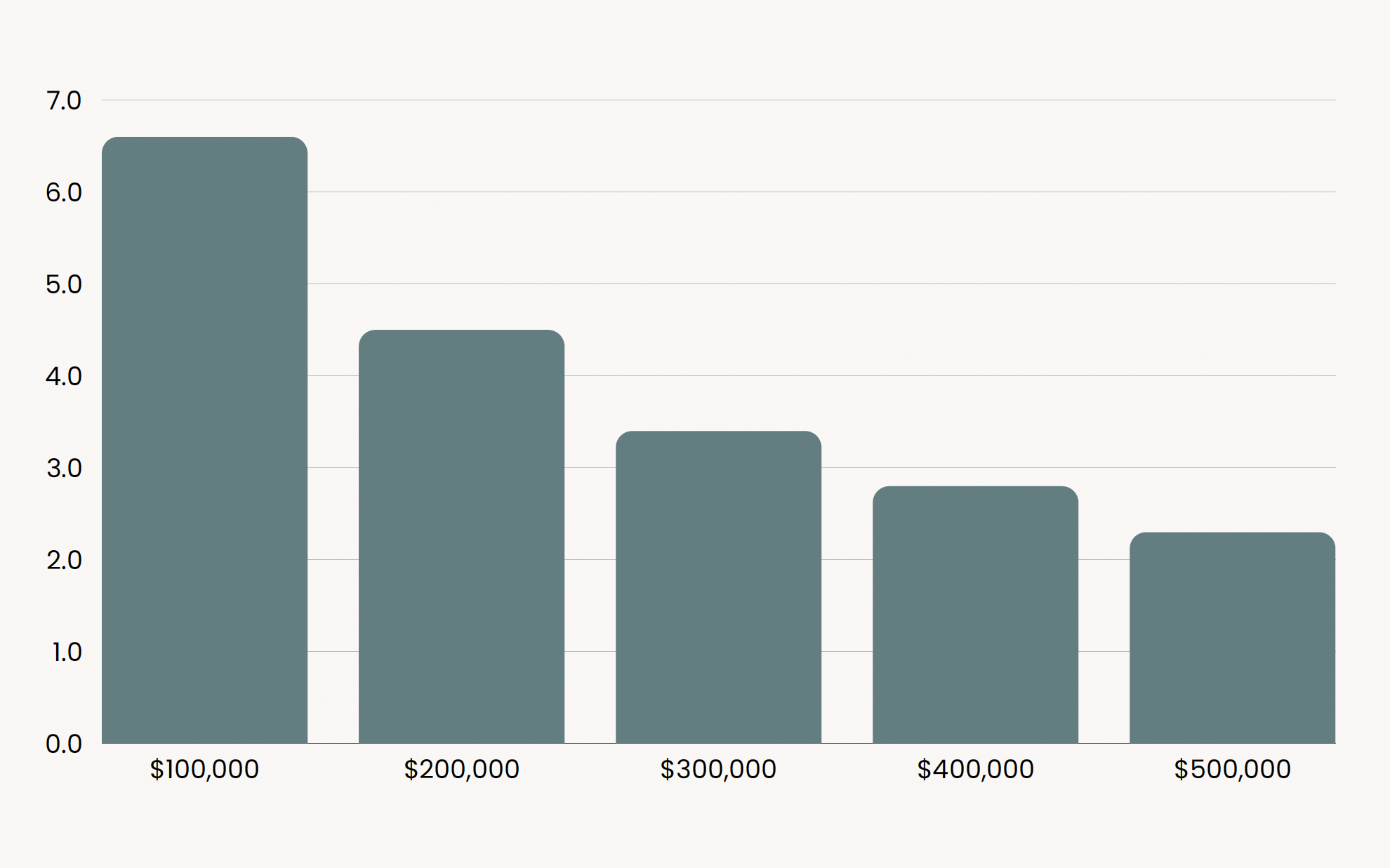

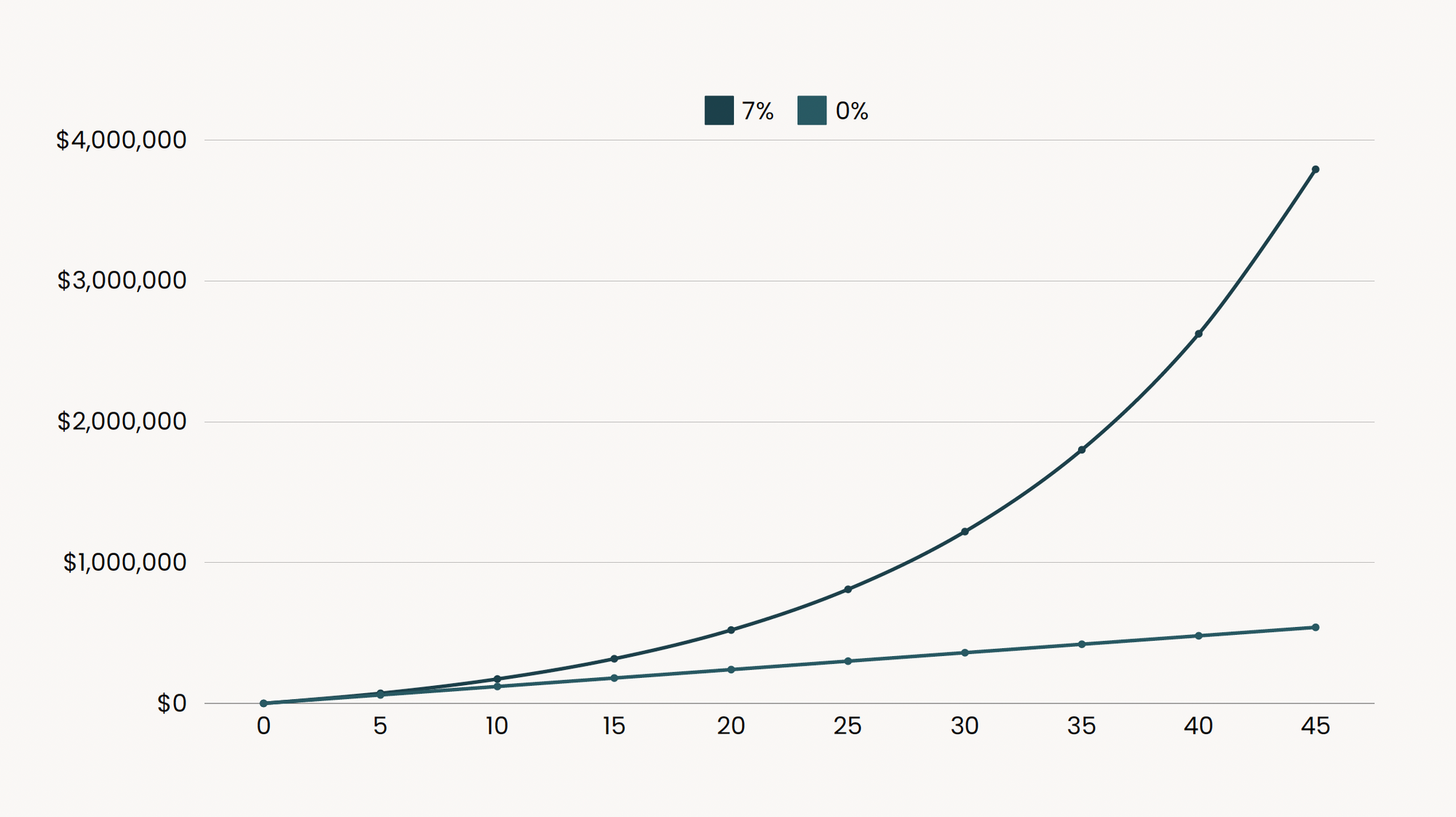

When we're first starting out, our accounts are primarily made up of contributions, not growth. That's why your contribution rate is so much more important than your growth rate. As our portfolio builds, and our investments can work for us, our returns help our portfolios grow. Contributing $1,000/month, earring 7% annually, it takes about 6.5 years to accumulate $100,000. From $100,000 to $200,000 only takes about 4.5 years. The time to reach the next $100,000 is shorter and shorter, even though we're still putting in the same effort.

That's all assuming the best case scenario, that you're properly invested and earning a good return. If you're not, it becomes an almost impossible challenge. Accumulating $100,000 without earning any interest will take almost 8.5 years. To accumulate $500,000 while earning 7% annually takes 19.5 years, doing it while earning nothing takes almost 42 years.

We can see that a bad decision, earning 0% annually, requires the same effort as the good decision, earning 7% annually, which is contributing $1,000/month. But the outcomes are wildly different. It's the difference between a life of just trying to get by, and easily becoming wealthier than you ever imagined.

In the beginning, every investor has an uphill battle. It requires an understanding to make good decisions, establishing those good decisions as automatic habits, and relying on our contributions rather than our growth to make our progress. As time goes on: our habits take care of themselves; automatically repeating, and our returns carry our progress to incredible levels. The tough part is getting started in the right direction, a direction that sets your future self up for success. A Financial Planner can get you heading in the direction of success.

Success Fuels Success

One of the easiest ways to stick with something, is to see the progress that it creates, and let that momentum carry you forward towards more progress. It's a self-reinforcing cycle that keeps you engaged and committed to the process itself. The progress you see leads to future progress.

This is one of the most important reasons why it's not only important to start early, but it's important to start the right way early. Starting early lacks benefit if it results in you either: giving up, or not putting in the effort needed to see its full potential. The right way, should not only help you reach your goals, but keep you motivated throughout the process. It should help you overachieve your goals.

8% of $1,000 is $80. In the beginning, compounding can feel slow. 8% of $10,000 is $800. But as you accumulate more funds, compound growth starts to feel exciting. 8% of $100,000 is $8,000. Eventually, your investments can make more for you than your full-time job. 8% of $1,000,000 is $80,000. The trick is seeing the progress you're making, and allowing it to continue to work for you. The worst thing that we can do to compounding, is to interrupt it unnecessarily.

Working with a Financial Planner can provide you with the expertise to fill in the gaps of what you don't know, which helps you make better decisions, resulting in more success from the beginning. That progress created leads to more progress. If you can see the fruits of your labour, especially early, it can allow you to get excited about it. Focusing more energy and effort towards it, which can expedite the process between where you are today, and where you want to be.

It Isn't Just About Growing Your Money, It's About Keeping It

We tend to think that bad things won't happen to us, that they only happen to others. And that good times will continue indefinitely. At the same time, we know that life is unpredictable. When we plan, the only thing we can count on, is our plan not going according to plan.

When markets are continuously going up, being an investor is easy. It likely doesn't matter if you're invested properly or not, everyone is making money. But if we look back throughout history, we know that bubbles, bear markets, and recessions happen with regular occurrence. They act as a wildfire over a forest, there's a period of destruction and disbelief, but it can lead to incredible new growth. Having an established plan is really helpful in three specific situations:

- When you're first starting out.

- When you come into money.

- When you become rich.

When we first start investing, the amount of money we invest can be a lot of money compared to the entirety that we have at the time. But it won't be much compared to what we will have in the future. That's why no amount of money is small, it's all relative. Making bad decisions early can wipe out what you have to move forward with, and also establish a false impression that investing is a losing game. In order to be successful, we need to avoid situations where we can lose everything.

It's common for athletes, musicians, celebrities, and lottery winners, to blow through millions of dollars and end up broke. It comes down to not understanding the power of money or having a plan to make it work for you. It's estimated that Baby Boomers will transfer $84 trillion to younger generations over the next 20 years. Money that could look really tempting to spend on things you don't want or need, if you don't understand what it could do for you instead. Things like: allow you to live life on your own terms, pursue what matters most, give others every opportunity, or whatever you'd do if money were no object.

At a point in time, the main goal of your investments will turn from growth to preservation. When we're working, earning, and contributing to our investments, we have safety nets in place and want it to grow as much as possible (while still being safe). When we retire, or begin to rely on those funds, ensuring that they're there, is more important than an extra percent or two of growth. Your investments should always be aligned with what matters most to you, and what stage you're at in pursuing those things.

Building a plan that protects your funds, while still considering the primary goal (growth or preservation), is essential to good financial planning. Taking on too much risk, or not putting your funds in a position of growth, can be equally devastating to your success as an investor. Our goal as an investor is to invest for as long as possible, through the good times and the bad. That requires a portfolio that's constructed to endure and survive.

Final Thoughts

We tend to think that we have to already be rich to work with a financial planner. In my experience, working with a good financial planner is a key ingredient in becoming rich. Just like how a Personal Trainer gets you in shape. Waiting until you're rich to work with a Financial Planner, is like waiting until you're in your ideal physical shape to work with a Personal Trainer. Imagine if only already peak athletes went to the gym.

Far too often, we hope that things will work out the way we want them to, without taking action to ensure that they do. If you think working with a Financial Planner will help you reach your goals, I'd encourage you to start that journey sooner than later. There's a lot of advice to give outside of investments. If you don't feel like you're in an ideal spot yet, a Financial Planner can help you get there quicker.

Most people should start working with a Financial Planner as soon as possible. I believe this because what we want most is too valuable to leave up to chance. Instead of hoping things work out, take the first step towards ensuring that they do.

This article was originally inspired by an Allie Volpe article for Vox, You don’t need to be rich to work with a financial planner.

Keep doing things your future self will thank you for.

Member discussion