Buffer and Buffett — A Better Way To Budget

Warren Buffett is the most recognizable investor ever. Even if you know nothing about investing, you still know who The Oracle of Omaha is. He started investing at the age of 11, sometimes joking that he started too late, and has been investing ever since, for over eight decades now.

When you hear "Warren Buffett", you almost immediately start thinking of some of the world's other richest people. A list he’s been near or at the top of, for quite some time. But there’s a big difference between him and many others on that list.

Unlike the Bezos’, Musk’s, and Zuckerberg’s of the world, Buffett didn’t earn his wealth by creating innovative companies. He didn’t invent the iPod, a global e-commerce giant, or the possibility of life on Mars. Buffett’s success, has been in part due to his ability to identify the people and the companies that will. The bottom line is that Warren Buffett is a great investor.

Being able to find the right companies to invest in has definitely helped Buffett along the way. Of course, not every company he’s ever invested in has worked out the way that he had hoped. That’s just the way life goes. But picking companies, hasn’t been Buffett’s key to success.

Over everything else, the key to Warren Buffett’s success, is time.

Key Takeaways:

- Warren Buffett built his wealth by investing for such a long time. If we follow his model, we can have Buffett-like results.

- Rethink of idea of a budget to encourage ourselves to become investors sooner rather than later, the traditional idea of a budget, just doesn’t work.

- By paying ourself first, we can ensure we are prioritizing our future self, while giving our present self guilt free spending.

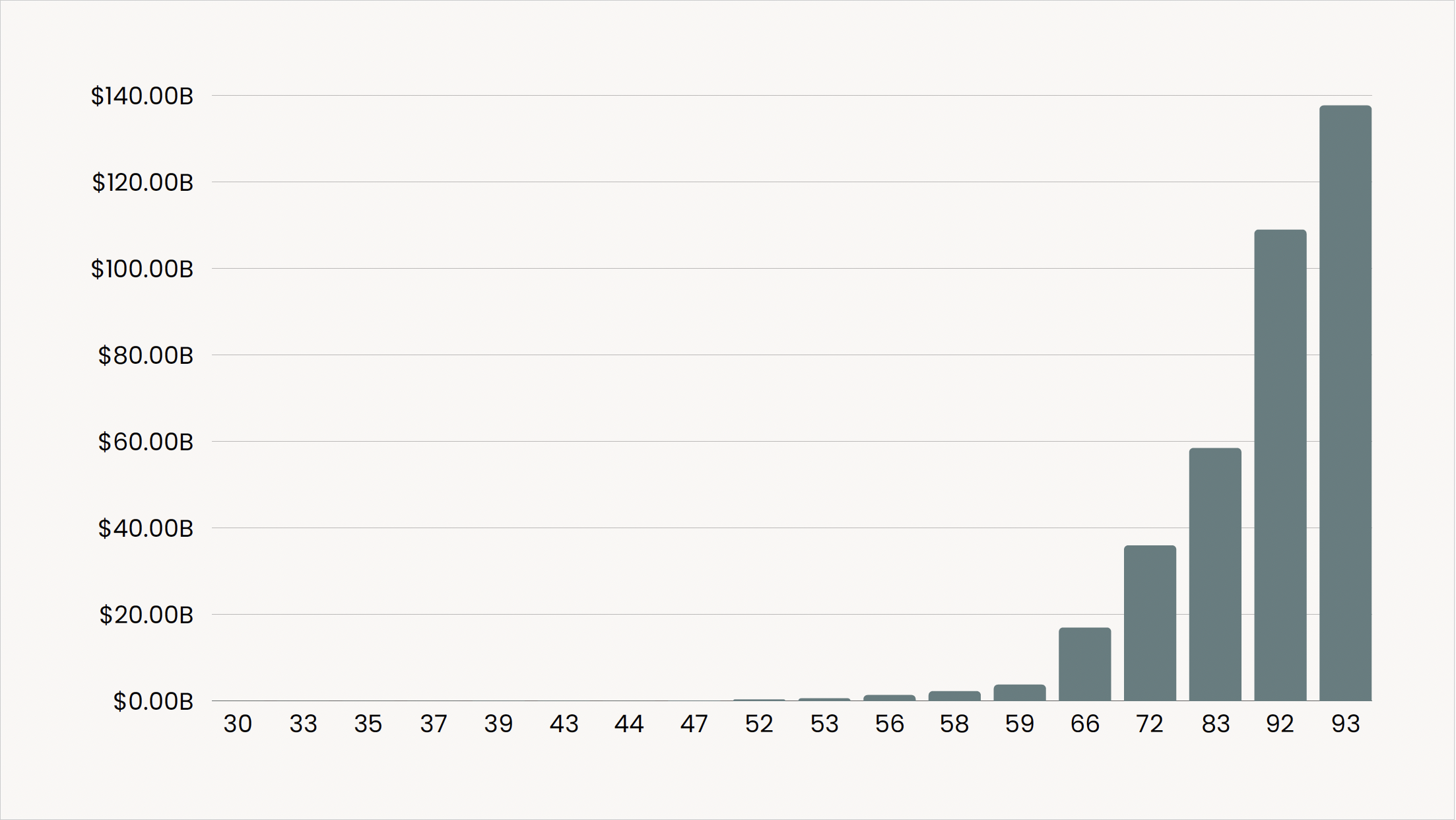

The chart below starts at age 30, when Buffett had a net worth of around $1,000,000. As you can see, there’s basically no visual change at all until almost 25 years later. Even the change that we can see, a change in net worth from $1 million to $1.4 billion (an increase of 1,400x), seems microscopic to the net worth of $137 billion at age 93.

This chart spans over six decades, and in that period of time, more than 99% of Buffett’s wealth was created after his 50th birthday.

You might be thinking, ‘He’s Warren Buffett, that’s an unrealistic comparison!’. Sure, it’s tough to compare anyone to the greatest investor of all time. But anyone can apply Buffett’s approach, and invest for a long period of time.

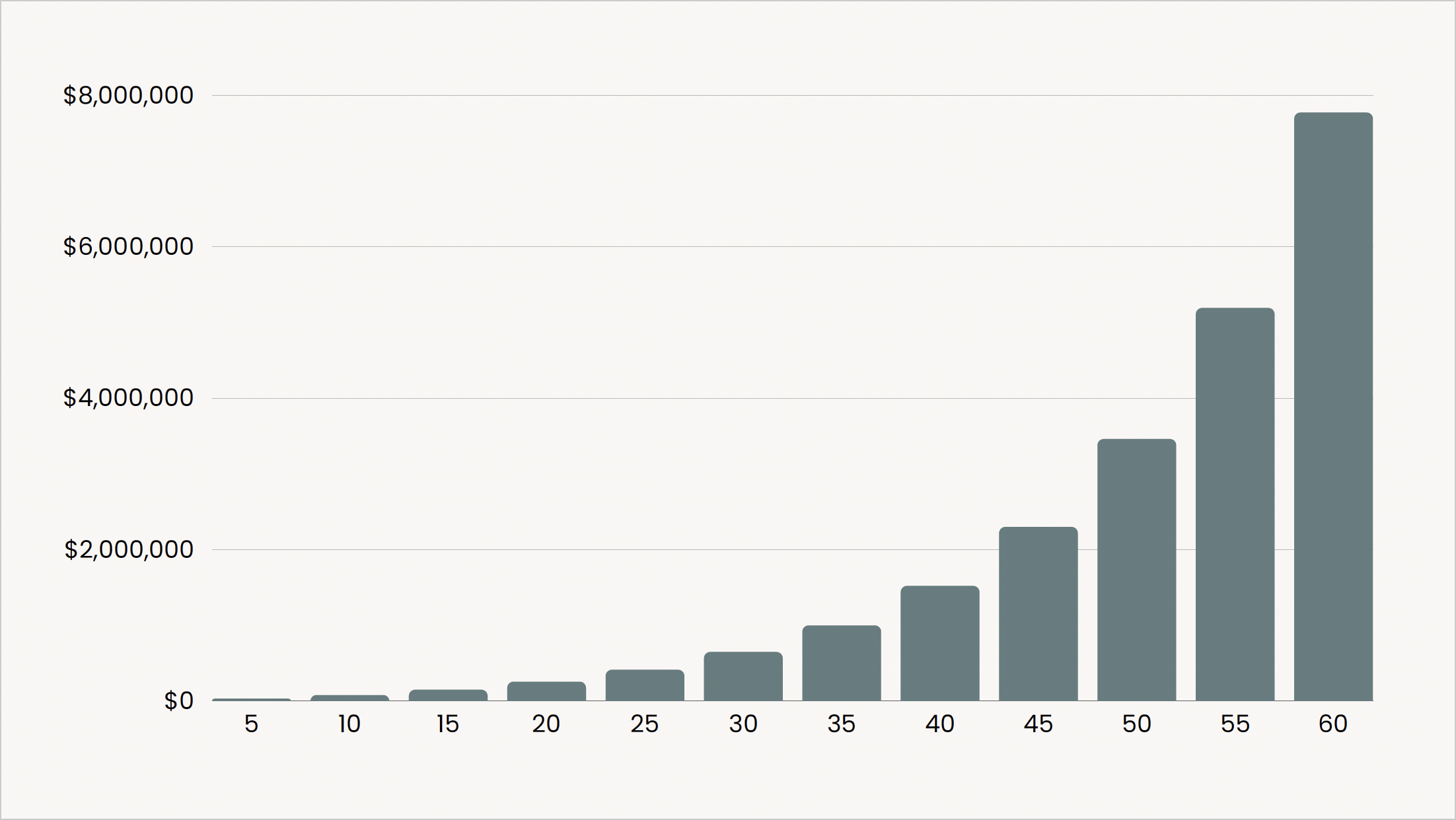

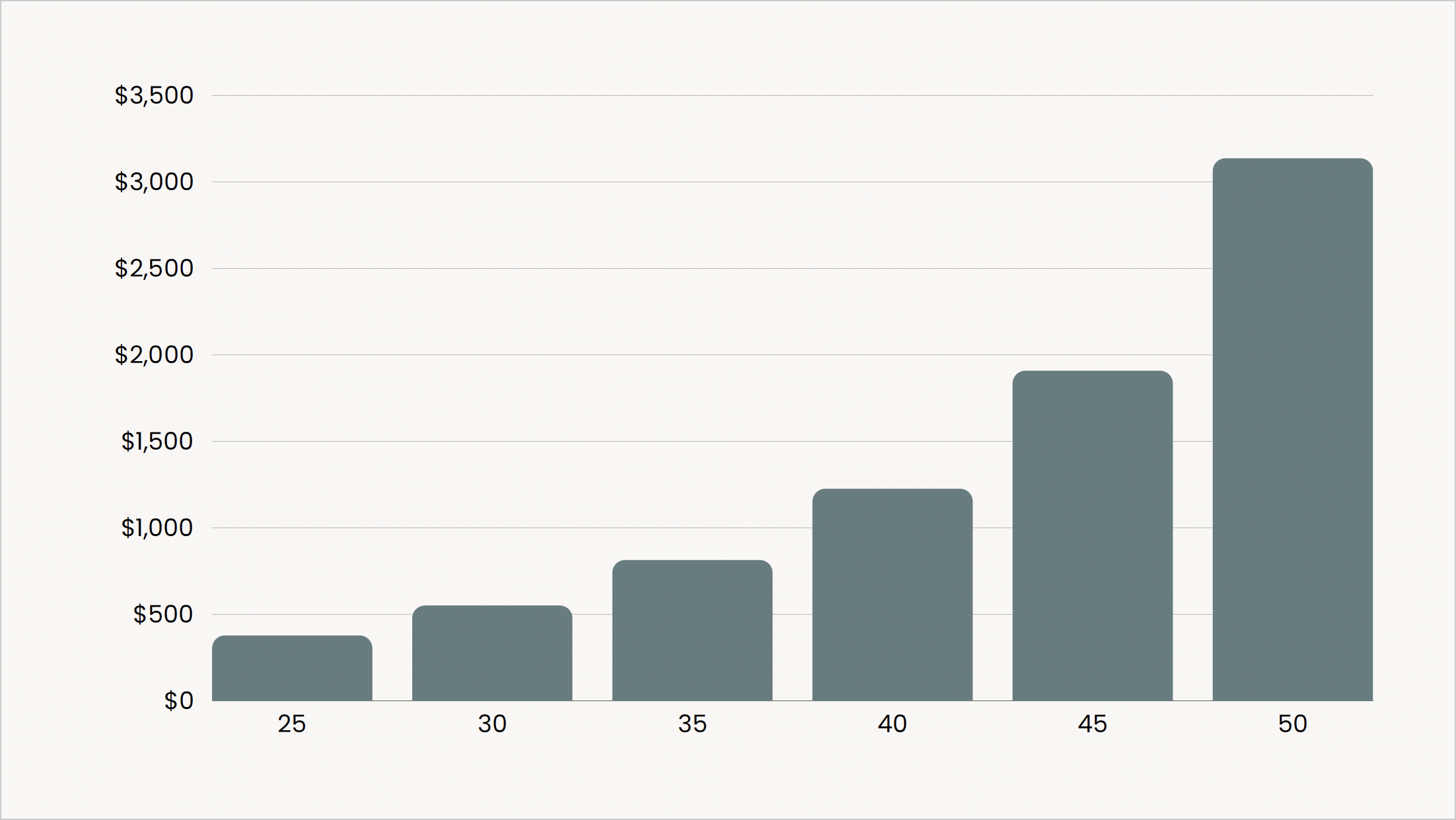

In the chart below, someone invests $200 biweekly and earns 8% annually. We see very similar results to Buffett’s chart. 92% of the total wealth was created in the last 30 years. In Buffett’s case, 97% of his wealth was created over the past 30 years.

Both charts have a similar pattern, with growth starting small but becoming exponential in later years. These results aren’t due to picking the right companies, timing the market, or taking on unreasonable risk. These results are due to the same thing as Buffett’s results. Time.

We don’t have to be Buffett, to get Buffett-like results. We just have to put our money in a position where it can work for us, for as long as possible. Simple as that.

How long we’ll actually invest for

Both charts above run for 60 years, and you might be thinking, ‘I’ll never invest for that long, I plan to retire in 30 years! Buffet is only investing still because he’s rich!’

There’s a big misconception that we invest until we retire, and then stop. From that point on, we only have the amount we initially retired with to withdraw from, until our money is gone. But that’s not the case. Or at least, it doesn’t have to be.

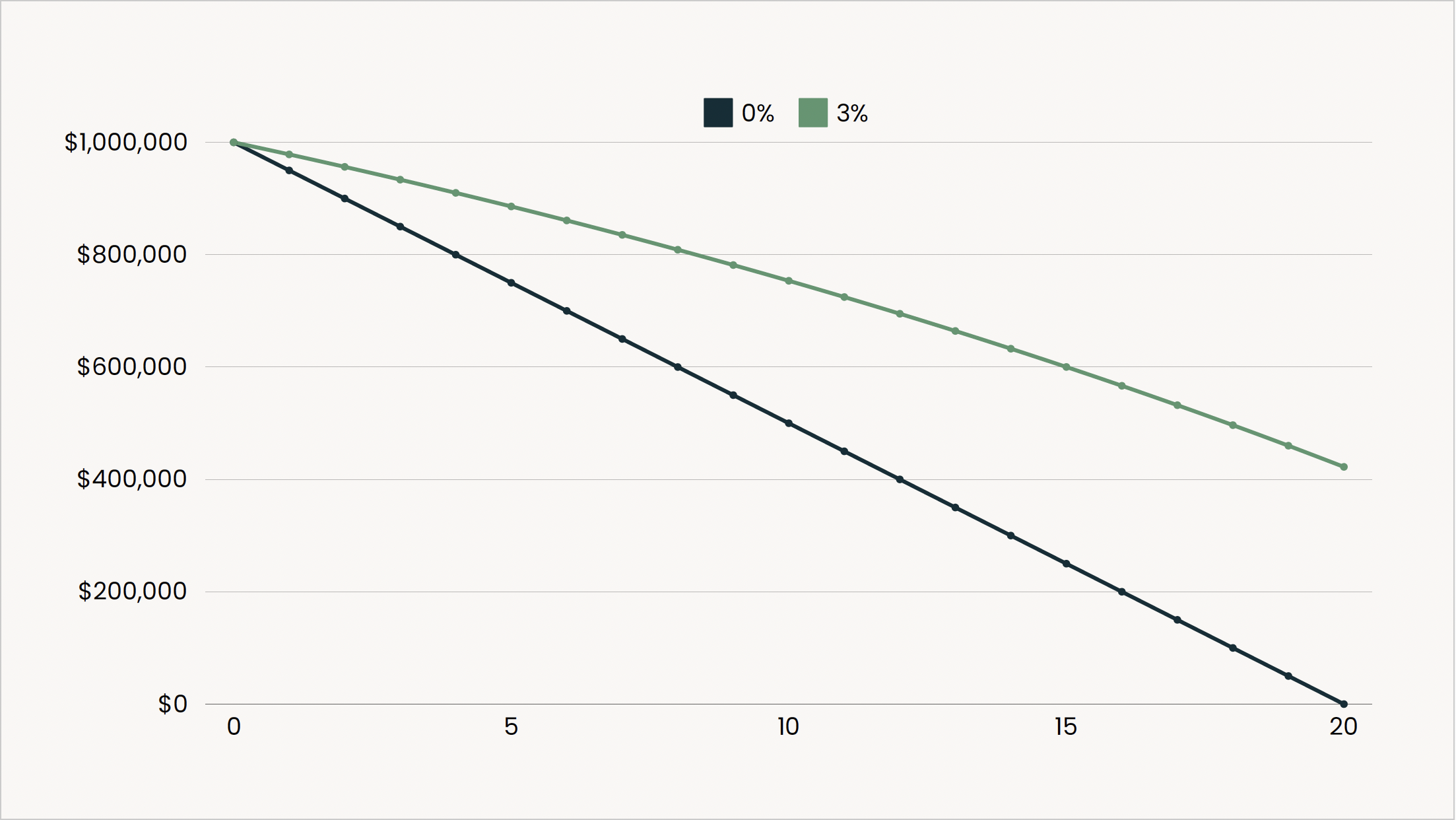

Let’s say someone is about to retire with $1,000,000, and over their retirement they will need to withdraw $50,000 annually to afford their ideal retirement. They have a choice, they can choose to not invest any of their funds, or invest their funds to earn, let’s say, 3% annually.

If they choose not to invest their money, they run out of funds in 20 years. After that same 20 years, the choice to earn 3% annually would still leave them with a balance of $422,287, and they wouldn’t run out of funds until the 30th year — increasing the lifespan of their funds by 50%. If they were to earn an annual return of 4%, that would increase the lifespan of their funds to nearly 38 years.

With life expectancy and the cost of living continuing to increase, making the most of our retirement funds is more important than ever. When we think about how long we have until our ideal retirement age, plus the length of our retirement, investing for 60 years looks pretty realistic. In some cases, 60 years might not be long enough.

The reality many Canadians face

So far things seem pretty simple, right? In order to grow our money and retire comfortably, all we need to do is invest for a very long period of time. But there’s a big problem: this is far from what most Canadians actually do.

Most people don’t start investing early. They wait too long, resulting in a shorter period of time that their funds are invested for. That means their money isn’t in a position to work as hard for them as it could have. Instead of a timeline of 60 years, they might be looking at 30, or 40 years. We now know, that without a long timeline, we are removing the hardest working years for our money.

Below is a graphic of statistics from Manulife’s 2022 Spring Debt Survey.

It shows us some startling, but common, statistics. No matter what survey is conducted about the state of Canadian finances, it paints the same picture. One that tells us that Canadians are generally underprepared for their financial future.

This lack is preparedness stems from a lack of financial education taught at any level. If you’ve made it this far in this article, you’re doing something about it. But at a real world, practical level, our financial health depends largely on the way that we manage our money. That management, usually takes the form of a budget.

Why traditional budgeting falls short

There’s multiple ways to budget. Unfortunately, the traditional thinking of a budget, falls short. When you think of a budget, you likely think of a spreadsheet, reviewing your bank account and credit card statements and filling in columns of information to track where your money goes. It’s cumbersome and time consuming.

Traditional budgeting doesn’t prioritize our future selves. Putting money aside for our future, is often the last thing we look at with our budgets. We prioritize our now money: non-discretionary things like bills and living expenses, and discretionary things like shopping and services. If we spend all of our money in the present, we shrug it off and tell ourselves that we’ll save some money next month — but we won’t.

Our finances are tied to us on an emotional level. Especially when we first start out, it’s likely that we will make mistakes and not meet our goals. Like building a habit, it takes time and commitment. If our goal is to save money for our future, but it’s the least prioritized item on our budget, the thing we get to last, it’s unlikely we’ll meet that goal. In that sense a budget can become very discouraging, and something we don’t want to do at all. So we usually don’t.

A lot of people have a hard time with budgets, because the idea of a budget that we think of, isn’t the best that it can be. It’s like someone trying to communicate today, by only using a fax machine. It's impossible. You’d give up, I know I would. We have to learn to combine our best intentions, with the best practice.

That’s why it’s beneficial to rethink what a budget is, what it’s supposed to do, and lay it out in a way that sets ourselves up for the most success.

What a budget should do

A budget shouldn’t be an exhausting tool to track our every day spending. We all have different priorities when it comes to our spending. We could read one hundred articles on how to exactly structure our budget, and it’s likely that none of them will truly reflect our exact situation.

A budget should be the balancing factor between our present and future selves. It’s the way we allocate our income between what we want now, and what we want most. It should be effortless and fit into our routine with ease. Ideally it wouldn’t take up any time at all. It should be manageable, realistic, and achievable — all to keep us committed to it.

With any budget, there’s going to be sacrifice. Prioritizing spending now means future sacrifice. While sacrifices today can ensure the financial future you dream of. It’s a balancing act. The statistics we continue to see in surveys show a lack of discipline and planning, resulting in unknowing future sacrifices. Given the choices and results in an easy to understand way, many people would adjust their spending habits to put more priority towards their future self.

Simply keeping track of our spending doesn’t make us better financially. Someone could document every transaction into a spreadsheet, but that doesn’t mean they’re going to save and invest towards their future. It doesn’t mean they’ll have confidence in their financial future.

If that’s all understood and agreed on, our income (after taxes) can be allocated towards three categories: now money, buffer money, and Buffett money.

Now Money

Our now money is the money we need on a day to day basis. It accounts for things like our mortgage or rent, monthly bills, groceries, fuel, unique priorities, and our fun money. Financial obligations that we can’t afford to miss because we count on them.

We all have different priorities for what we spend our money on. Understanding this is important. Amongst your now money obligations, you might spend a considerable amount more in certain areas than someone else, but that doesn’t mean it’s a poor decision. If set up properly, your now money should be able to be spent freely, within reason that you still maintain your lifestyle, but in a way that you don’t have to fuss about how you spend it. It should be aligned with your priorities and interests.

Buffer Money

We started this article by taking a look at how Warren Buffett built his wealth. Not by being the greatest stock picker to ever live, but by ensuring the investments he makes, can work for him uninterrupted, for a very long time. That time, is Buffett’s biggest key to success with building his wealth.

Buffer money is the money that sits between your now money, and your investments. It’s the money that helps you work towards your goals, while protecting your investments and allowing it to do what it does.

Your buffer money could take the form of an emergency fund, ideally three to six months of living expenses, or even more if your income fluctuates significantly. It can also be your short term goal account. Accumulating for trips, upgrades around the house, or a future big purchase like a car. It can account for purchases or expenses that fall outside of our day to day spending, but don’t have the long time horizon needed for investments.

Because of the shorter time horizon, buffer money shouldn’t be invested aggressively and won’t earn us the big returns over decades. But its value is that it allows us to have money that we can invest aggressively over the long term, earning us those big returns.

Buffett Money

Our Buffett money is our long term investments. If Buffett’s key to success is time, then we want our Buffett money to stay invested for as long as possible. That’s one of the reasons why having buffer money is so important. We want our Buffett money to be in, and stay in, a position to earn as much as possible, for as long as possible.

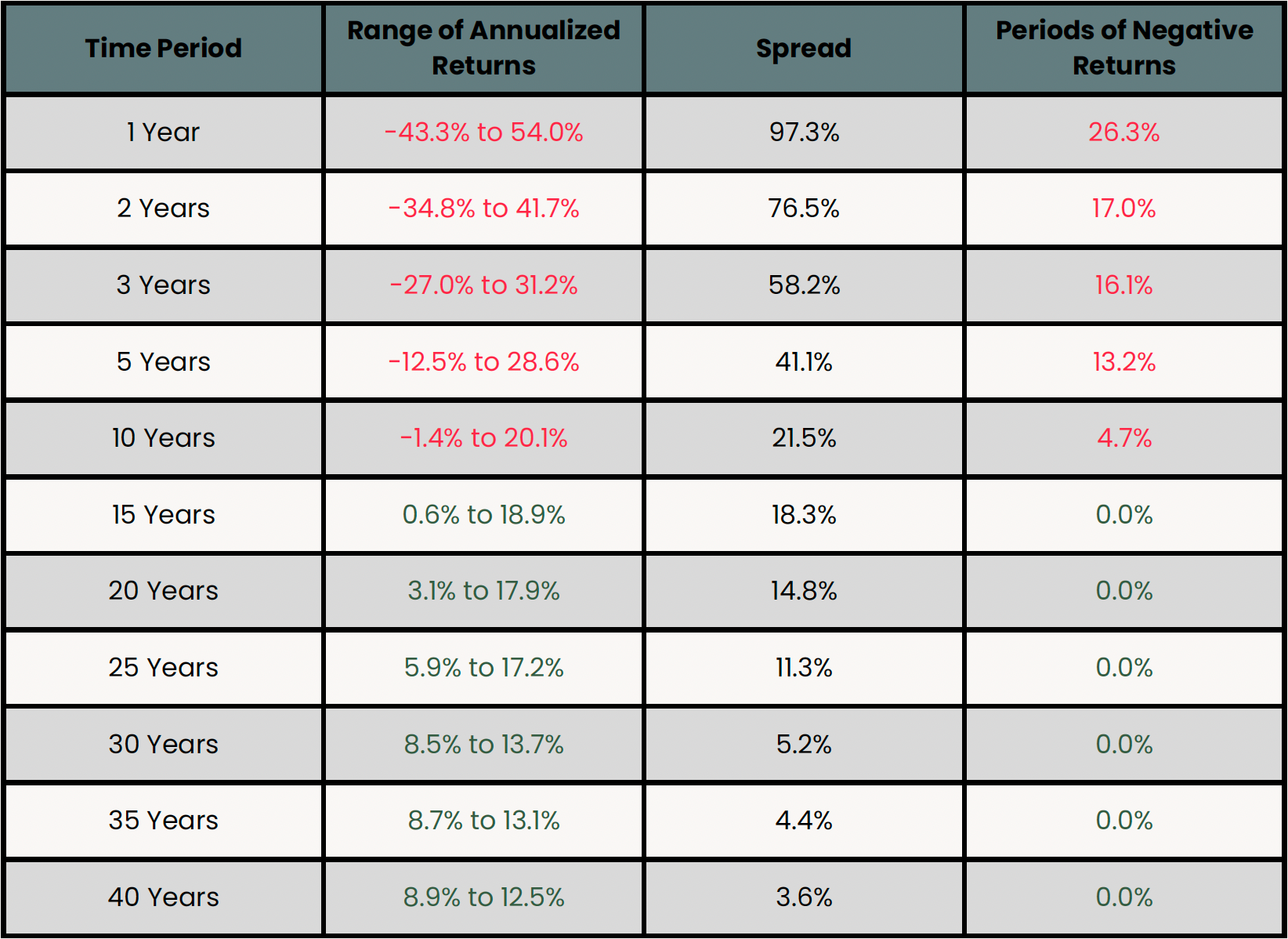

When we talk about financial planning and goal setting, long term goals are things we look at in terms of decades, not single years. Because of that, it gives us more opportunity to take on volatility and risk. The chart below shows how the S&P 500 has performed in annualized returns over time.

In any given year, the range of outcomes is significant. That’s when investing too aggressively, or for too short of a time, can burn investors. But the longer the period of time, the more focused that spread becomes. Although past performance doesn’t guarantee future results, it can help set our expectations, and give us a guideline for planning purposes.

The another great thing about long term investing, is the worst gets better and better with each passing year. After a 15 year period, historically there’s been a 0% chance of our money being down, with a worst annual return of 0.6%, still outperforming a savings account. From there, it only continues to get better.

By having a long term mindset, not only are we putting our money in a position to work for us, we are also increasing its chance for success, and at the same time, reducing risk and volatility. It’s a win across the board.

Your budget allocation

If the idea is to divide our income between now, buffer and Buffett money, the next step is to determine how much to each.

Financial planning isn't a one size fits all solution. That’s because we all have different situations, priorities, and goals. People in a similar professional occupation might seem financially similar, but it’s never that simple.

There can be benchmarks that we want to strive towards for contributions, either a specific amount or percentage of an income. But these ideas can vary a lot. Someone who is young and beginning to invest should need to contribute a lot less to get the same result than someone who is starting when they are older. That’s because the person who is younger, with assumably the longer time horizon, should earn more from their money working for them.

The allocation between now, buffer, and Buffett will depend on your own goals, and present financial situation.

Especially in the beginning, accumulating an emergency fund might be a higher priority than long term investments. Since when we are making long term investments, we want to ensure they stay put. After we have a system in place, we should always expect things to adjust at least a little moving forward. Shorter term goals come and go, job situations change and may need to be reevaluated, and life always happens to find ways to influence how we thought things would go. Even just take a second to think about yourself now compared to five years ago, and imagine that change over the next 60 years. It’ll be a rollercoaster.

You can say I’m bias, and sure I am. But everyone benefits from working with the right financial planner. Someone who works with you to help identify and reach your goals. Someone you can turn to in times of uncertainty or to answer a question. When it comes to financial planning, there’s no one better qualified to help you.

How we should budget: Paying yourself first

Traditional budgeting often leaves us with the scraps from our income to build our future with, and that’s just not enough.

Reverse budgeting is an approach where you identify your goals and the financial requirement to reach them. You prioritize those goals through a method referred to as paying yourself first, essentially treating your future goals as a bill you cannot miss. From there you pay your bills, and the money that’s left over can be spent however you see fit.

This simple reordering of your priorities is such an effective way to manage your finances while always looking out for your future self. You can set up automatic contributions towards your goals that align with your pay day. You can’t spend money you don’t have. By putting it towards your goals instantly, you never have the temptation, or the chance to spend your money for something else.

Think of it like a pension plan. Everyone loves a pension plan, and if you have one, it’s something you contribute to. Yet, people don’t complain that they can’t afford to do something because they had to contribute to their pension plan on their last paycheque. They know it’s beneficially and something they should do.

At first it will seem tough, so it’s a good idea to start small. After identifying your goals contribution amount, maybe you’ll start at 50% of that, or whatever is comfortable, and build up to the 100% level over a set amount of time. Over time, studies show that people get used to it, so much so that they forget they are even contributing, or find they have extra room in their budgets to contribute more.

Sort of like with fitness, todays workout becomes tomorrows warmup. The small steps we take, accumulate over time into a giant leap of progress, we just need to get started.

A better way to budget

In order to correct the surveys that we see, we need to collectively get better with our finances. Luckily, the solution isn’t a complicated one.

We need to rethink what we are doing, and shift from an ineffective model, towards something that isn’t only more effective, but easier while being less time consuming. It can be a tough thing to envision, but prioritizing our future as early as possible, puts the benefit in a position to compound and grow over time. The earlier we start, the more benefit we see.

By prioritizing our future self, and acting as though our future self is an obligation like a bill we need to pay, we can put ourselves in a position where we can freely spend our now money. We can’t spend money that we don’t have, and by setting up a system to regularly take money from a spending to a saving position, we are doing just that. The best part, once it’s set up, it doesn’t need to require any of our time at all.

Keep doing things your future self will thank you for.

Member discussion